The current market volatility is justifiably causing people stress. Nobody wants to see their hard-earned wealth get vaporized.

But how does increased stress affect decision-making?

A recent paper published in the Proceedings of the National Academy of Sciences highlights an interesting finding:

- Humans don’t have stable risk preferences–stress makes us more risk-averse.

In, “Cortisol Shifts Financial Risk Preferences,” the authors question a core assumption in economic models that “agents” (i.e., human beings) have stable risk preferences. They find via experiments that this assumption may not be empirically valid. Humans are more afraid of risk when they get stressed–especially sustained stress.

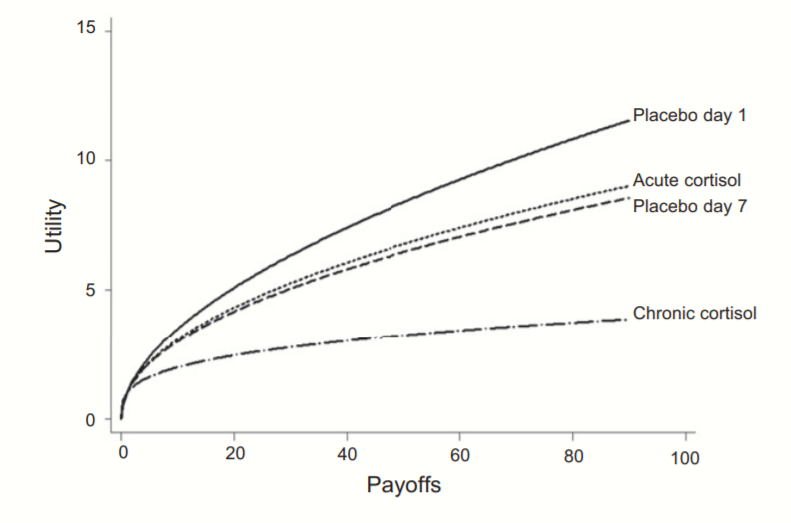

In the figure below, the authors highlight the average utility of their subjects under different conditions. If subjects are more risk-averse, their marginal utility for increased expected payoffs will increase at a decreasing rate. In summary, a flatter curve means more risk aversion.

Why is this relevant?

We think this research ties into the historical effectiveness of trend-following-based risk management systems. We talk about downside protection via trend-following rules and highlight a behavioral hypothesis for why these rules work.

Consider the concept of dynamic risk aversion, which is the idea that human beings don’t stick to a set risk/reward behavior—their appetite for risk can change depending on their recent experience… As market prices drop below the twenty percent threshold, an economist assumes that the new price is a bargain. Expected returns have gone up after prices have moved down, while volatility and risk aversion are assumed to be relatively constant…

But this doesn’t happen. Stocks can—and have—gone down over fifty percent, and these movements are much more volatile than the underlying dividends and cash flows of the stocks they represent! Remember 2008/2009? How many investors swooped in to buy value versus threw the baby out with the bathwater and kept selling? …

One approach to understanding this puzzle is by challenging the assumption that investors maintain a constant aversion to risk. Consider the possibility that investors change their view on risk after a steep drawdown (i.e., they just lived through an earthquake). Even though expected returns go up dramatically, risk aversion shoots up dramatically as well.

This paper’s evidence supports our behavioral hypothesis that trend rules work because humans get more risk-averse when markets start dropping and volatility gets wild. The research also highlights that one-off stress events won’t drive dynamic risk aversion–we need a sustained period of stress and chaos to change hearts and minds. The recent turmoil in August–and now into September–may not be enough sustained stress to change minds, but if the drama continues…watch out!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.