David Dreman is a personal hero of mine. Years ago, I stumbled on his book, “Psychology and the Stock Market: Investment Strategy Beyond Random Walk,” which was originally published in 1977. It had a huge impact on me. It’s timeless, with lessons that still apply to value investing today. It was among the first books I read that explained clearly how investor psychology affected the stock market.

Mr. Dreman has been busy over the years. He’s written a number of follow-on books, and founded a successful value investing firm.

I wanted to highlight today a great paper he co-wrote with Eric Lufkin back in 2000, “Investor Overreaction: Evidence That Its Basis Is Psychological.” In it, the authors show how large changes in stock prices for value and glamour stocks cannot be explained by changes in fundamentals, which suggests that it is investor psychology that drives them.

Most value investing studies follow a similar approach: rank stocks by some value metric, and then sort them into buckets, such as quintiles. Then take a look at how the cheapest quintile performs going forward versus the most expensive quintile. In the past, we have tried our own variations on this approach to explore evidence that value investing tends to work over time, such as in our post, “Value Investing: Never Buy Expensive Stocks. Period.”

This paper also adds a new wrinkle to the usual analytical methods. It began by looking at how the cheapest quintiles performed subsequent to formation, but also considered another angle: what were the returns of these stocks prior to portfolio formation? In other words, assuming we are ranking stocks at time t=0, what were the returns the cheap quintile exhibited in the years leading up to time t=0?

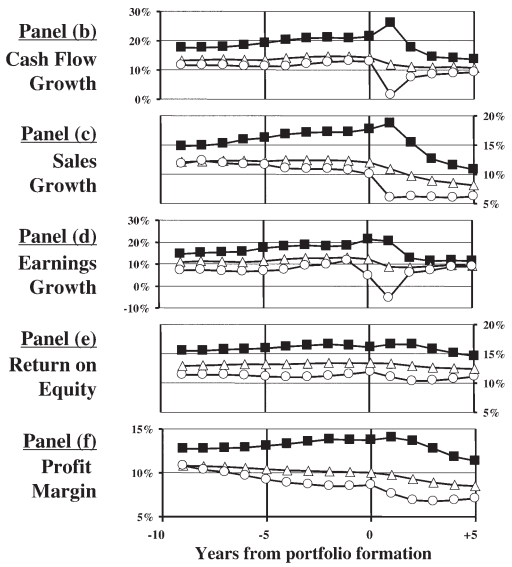

Below is a graph from the paper showing the 1973-1998 returns of high and low P/CF quintiles leading up to, and subsequent to portfolio formation at time t=0.

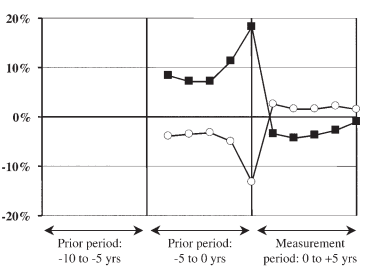

After time t=0, consistent with most value investing studies, value stocks outperformed, and the glamour stocks underperformed. But what happened before time t=0? How did these high and low quintiles act?

Before portfolio formation, the glamour stocks grew much faster than their value stock counterparts, and grew at an increasing rate as they approach time t=0. They had high cumulative outperformance.

Meanwhile the value stocks actually had negative relative returns, and returns were increasingly negative as they approached time t=0. They had high cumulative underperformance.

That’s odd. Why should this be?

One possible explanation is that something is going on that explains price performance during these pre- and post-formation periods. For example, consider fundamentals, such as growth in cash flow, growth in sales, growth in earnings, return on equity (ROE), and profit margin.

If fundamentals were dramatically improving for the glamour stocks pre-formation, then they may have driven prices sharply higher. Likewise, if fundamentals sharply deteriorated after portfolio formation, then that could explain the poor returns for glamour. So is that what was happening?

In a word? No. Consider the below figures, which show what happened to fundamentals pre- and post-formation:

Incredible. The fundamentals actually seem to improve for glamour in the year subsequent to formation. Similarly, in year t+1, the fundamentals seem to deteriorate for value.

This is wildly inconsistent with the huge stock prices changes we saw one year after formation. The change in fundamentals do not support the changes in the stock prices.

What on earth is going on?

Enter: the overreaction hypothesis

Investors overreact to “event triggers,” which are essentially surprises, like for example an earnings surprise. Such event triggers are unanticipated and have huge effects on investor perceptions.

Expectations for glamour stock returns may be sky high at time t=0, due to years of steady performance of fundamentals, yet if a piece of news calls the company’s prospects into question, the overreaction is so severe that a dramatic price reversal occurs.

From the paper:

An example would be the 35% drop in the stock price of Dell Computer in the spring of 1999, despite the company’s years of flawless market performance. Dell’s sales and earnings growth of over 50% a year rocketed the stock to a P/E multiple of over 100 in early 1999…When Dell announced in its 1999 first quarter that earnings were in line with analysts’ forecasts, but revenues fell slightly short of expectations, the price suddenly dropped sharply.

Consider the mirror image of this outcome, i.e., a value stock that has suffered years of poor fundamentals and a declining stock price. Last year was especially terrible, even worse than the years before it. The stock is priced for bankruptcy. No one would touch this stock with a 10-foot pole. Then, at time t=0, there is a glimmer of hope – an event trigger.

Some piece of news comes out that indicates things aren’t quite as horrific as they seem. Hugely pessimistic views suddenly aren’t quite so extremely pessimistic. Investors overreact to this news, sending prices skyrocketing for our beaten down value stock.

Overreaction.

Take it from Dreman, a guy who’s been writing about market psychology since the 70s. This may be the fundamental psychological factor that explains why value investing has worked over time. The stock market can be said to be a game of expectations. When value stocks get too cheap, it only takes a modest surprise to change rock bottom expectations.

It’s probably a good bet human psychology will continue provide active investors with opportunities to profit in the stock market. Overreaction is why value works. Seems simple, right? Unfortunately, it’s not easy, since that’s only half the battle. In order to successfully realize those profits, investors must also understand how limits to arbitrage can provide them with a sustainable edge, as discussed in our post, “The Sustainable Active Investing Framework: Simple, But Not Easy.”

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.