Do Short Sellers Trade on Private Information or False Information?

- Amiyatosh Purnanandam and H. Nejat Seyhun

- Journal of Financial and Quantitative Analysis

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

- Is there a relationship between short selling activity and insider selling?

- What is the impact of short selling trading strategies that are conditioned on insider trading signals?

- Does the price impact of short selling subsume that of insider trading?

- Is the price impact of short selling trades permanent or are do they eventually reverse?

What are the Academic Insights?

- YES. Especially in smaller, below median market cap, stocks—apparently short sellers have valuable inside information in that universe. There is weak correlation with respect to short selling and insider trading in larger stocks. However, when short-selling trades are conditioned on insider trading, the results indicate short sellers do predict future returns.

- CONSIDERABLE, especially when forecasting the following one month return. A long only strategy that is high Short Interest (SI) produced a risk-adjusted return of -.06% (not sig) per month (equal weight). This increases to -.44% (sig), when the high SI portfolio is predicated on negative signals from insiders and is -.42% (sig) when value weighted. The low SI portfolio returned 1.41% when equally weighted, and 1.02% when value weighted, both significant at 1%. When converted to a long/short trading strategy, the risk-adjusted return was 1.85% when equally weighted, and 1.44% when value weighted, both significant at 1%.

- NO. Insiders trade profitably regardless of the activities of short sellers. The evidence presented in this study does indicate that insiders trade on information that is either not exploitable by, or not available to short sellers.

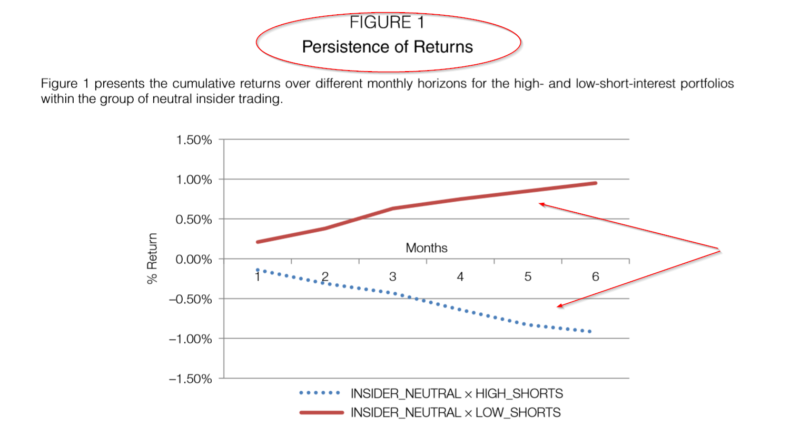

- IT’S PERMANENT. The graph presented in Figure 1 below shows the cumulative return over 1- to 6-month holding periods. No turnaround in prices is evident. The impact on prices is not a temporary event that reverses itself over the following 6 months. The authors conclude support in favor of the “additional information hypothesis” as distinct from the “manipulative trading hypothesis”.

Why does it matter?

This is the first study that differentiates and separates the information possessed and utilized by two important participants in markets: short sellers and insiders. A consistent pattern emerges for high and low SI portfolios, conditioned on a lack of insider trading: a permanent price impact is observed consistent with short interest positioning. Short selling strategies work because short sellers are trading profitably on private information. These results and interpretations presented are further buttressed by a number of robustness tests and are unlikely diminished significantly by transactions costs.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We investigate whether short sellers contribute towards informational efficiency of market prices by trading on their private information or destabilize market prices by trading on rumors and false information. We do so by projecting a firm’s short-selling activities on contemporaneous trading activities of its insiders – our proxy for the potential availability of private information. We find that short-selling activities are considerably informative about future stock returns when there is a higher likelihood of private information in stocks. Short-sellers also bring considerable additional information to the market, especially for smaller stocks, that is not fully captured by contemporaneous insider trading. Overall, these results suggest that on average short sellers bring informational efficiency to the market rather than destabilize them.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.