The Value of Private Information in Investment Research: Do Company On-Site Visits Affect the Trading Patterns and Performance of Professional Investors?

- Switzer and Keushgerian

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

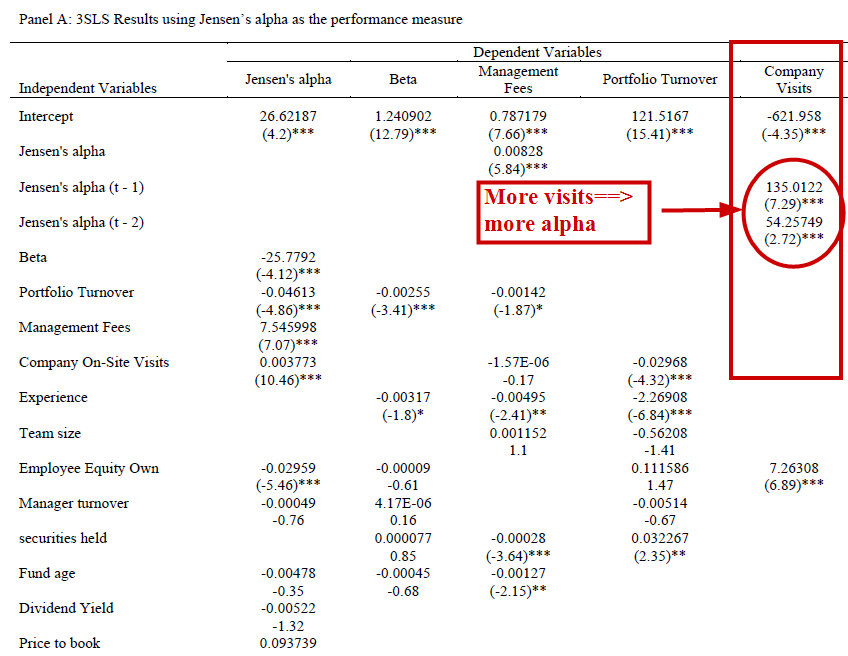

This paper looks at relationships between managerial characteristics and actions on the performance, management fees, and systematic risk of US equity investment management firms during the period 2008 through 2011, focusing on the impact of company on-site visits. Company on-site visits significantly enhance performance, management fees, and portfolio turnover. On-site visits are also positively related to employee equity ownership while the latter is inversely related to portfolio turnover. This supports the agency hypothesis that managers with greater personal stakes in their companies invest more in collecting non-public information for longer-term commitments.

Data Sources:

Brockhouse Cooper documentation of on-site visits by company analysts.

Alpha Highlight:

Company visits are associated with higher alpha…are they discussing sports in the boardroom…

Strategy Summary:

- Find ways to collect private information during company visits.

- Avoid SEC oversight and insider trading rules.

- Tell your friends how smart you are and show off your fancy car.

Commentary:

- The majority of financial analysts who conduct on-site visits are not insider trading–they are simply ensuring that managers are not wasting their capital (we hope this is what the analysts are doing!).

- The “perception” problem associated with on-site visits (the world assumes you are there to get inside scoop), is so strong one needs to think twice about conducting on-site visits. A simple visit to “kick the tires” might end up as a Wells notice from the SEC. Yikes!

Any good stories experienced during on-site company due diligence?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.