Informed Trading through the Accounts of Children

- Henk Berkman, Paul D. Koch and P. Joakim Westerholm

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

This study argues that a high proportion of trading through underaged accounts is likely to be controlled by informed guardians seeking to share the benefits of their information advantage with young children, or camouflaging their potentially illegal trades. Consistent with this conjecture, we find that the guardians behind underaged accounts are very successful at picking stocks. Moreover, they tend to channel their best trades through the accounts of children, especially when they trade just before major earnings announcements, large price changes, and takeover announcements. Building on these results, we argue that the proportion of total trading activity through underaged accounts (labeled BABYPIN) should serve as an effective proxy for the probability of information trading in a stock. Consistent with this claim, we show that investors demand a higher return for holding stocks with a greater likelihood of private information, as proxied by BABYPIN.

Data Sources:

1995-2010, Finland Trading data Nasdaq OMX Helsinkin exchange

Alpha Highlight:

Finland has some SMART kids!

Strategy Summary:

-

- Examines accounts who are aged 0-10 years and have guardians behind the accounts.

-

- Data focuses on Finland trading data (Nasdaq OMX Helsinkin exchange).

- 183 Finnish stocks from Jan 1, 1995 to May 31, 2010.

- Investors are divided into six age groups (from 0-10, 11-20, 21-40, 41-60, 61-80, >80).

- Use screens to match the brokerage accounts of minors (0-10, 11-20) to the guardian accounts.

- Data focuses on Finland trading data (Nasdaq OMX Helsinkin exchange).

-

- Fama-MacBeth tests find that stocks bought and sold by young investors (0-10) outperform all other accounts by 9 bps per day (>20% annually).

- Guardians have similar outper-formance on the stocks they buy, but not on the stocks they sell.

- Fama-MacBeth tests find that stocks bought and sold by young investors (0-10) outperform all other accounts by 9 bps per day (>20% annually).

-

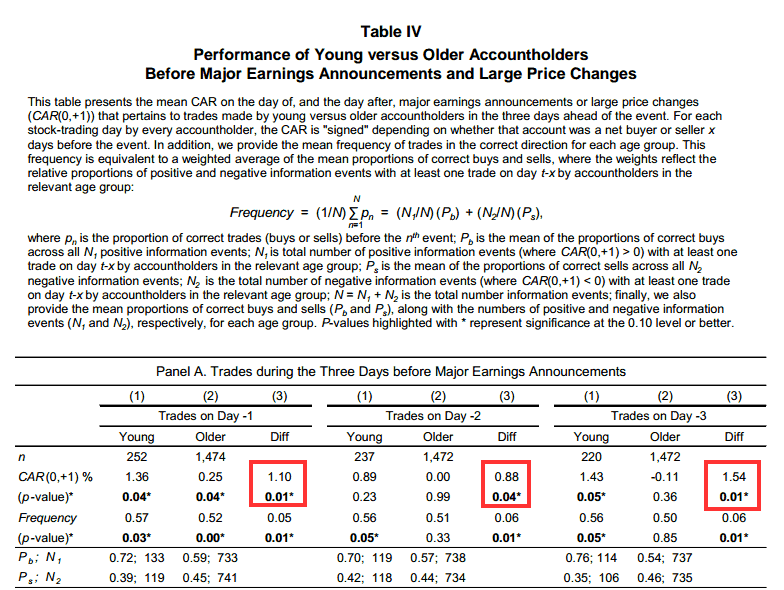

- Find that young investors outperform when trading before major earnings announcements, large absolute price changes, and takeover announcements (Tables 4 and 5).

- Guardians’ accounts also outperform when trading before earnings announcements and large price changes (but not before mergers).

- Find larger outperformance in younger accounts when focusing on those who trade before major event in only one stock or industry.

-

- This evidence indicates that access to inside information is one of the sources of superior performance.

- Find that young investors outperform when trading before major earnings announcements, large absolute price changes, and takeover announcements (Tables 4 and 5).

- Create a variable BABYPIN as a proxy for stocks with more information-based trading.

- BABYPIN is defined as the proportion of total trading activity through accounts of children aged 0-10 years old measured over the current and previous two months.

- Find that higher BABYPIN firms have higher future stock returns (alpha between 0.9% and 1.4% as shown in Table 10).

- This indicates that BABYPIN serves as a useful measure of the probability of information-based trading in a stock.

Strategy Commentary:

- Would be difficult to implement a trading strategy based on the measure in the U.S., as this information is private.

- However, the majority of the alpha generated by the BABYPIN portfolios is located in the long book (Table 10), indicating that given the account information, this would be a tradeable strategy.

Using your kids to trade privileged information? C’MON MAN!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.