Transactional Sex as a Response to Risk in Western Kenya

- Jonathan Robinson and Ethan Yeh

- A free, unpublished version of the paper can be found here.

- The published version can be found here (you have to be a member of the AEA).

Abstract:

Though formal and informal sex work has long been identified as crucial for the spread of HIV/AIDS, the nature of the sex-for-money market remains poorly understood. Using a unique panel dataset constructed from 192 self-reported diaries, we find that women who engage in transactional sex substantially increase their supply of risky, better compensated sex to cope with unexpected health shocks, particularly the illness of another household member. These behavioral responses entail significant health risks for these women and their partners, and suggest that these women are unable to cope with risk through other consumption smoothing mechanisms.

Data Sources:

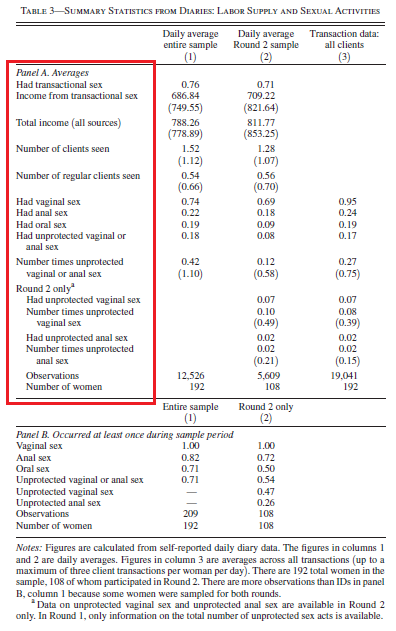

Data for this study were collected over two 3-month intervals. The researchers had 192 prostitutes keep diaries of their income, expenditures, transfer payments, and the “shocks” she encountered each day. In addition to income information, the subjects were asked to keep detailed records of client interactions, to include: activity performed (sex, blowjob, anal, massage, etc.), whether a condom was used, price that was paid, client profile, and so forth. Talk about a unique dataset!

Discussion:

The first question you may be asking is “What the heck does economic analysis of prostitutes in Kenya have to do with investing?” My answer is simple, “Trust me, and read to the end.” And while this is a bit off the beaten path, I couldn’t resist an opportunity to once again Turn Academic Insight Into Investment Performance™.

Your second question may be, “How did you find this?” Well, I came across this paper while riding the Amtrak from Baltimore to Philadelphia. I often pull out a copy of the Journal of Finance, the Journal of Financial Economics, or the The Review of Financial Studies–ya know, respectable finance journals. For a change in pace, I pulled out the latest copy of a very respectable economics journal–The American Economic Journal of Applied Economics.

Flipping through the dense economic journal, a table immediately caught my eye:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

What in the world??? Is this Penthouse, or the Journal of Applied Economics? Unable to combat my primal male instinct, I immediately flipped to the beginning of the article.

The authors of this paper investigate an interesting economic question: How do individuals change the supply of their labor in the face of short-term unexpected income shocks? Rational theorists suggest that short-term shocks to income or lifestyle shouldn’t have large effects on how much labor supply one brings to market. Moreover, following a short-term income shock, a rational framework would suggest that the individual supplying labor would not engage in any risky transactions that would have potential long-term effects on their ability to supply labor in the future. In other words, the short-term benefits of a few extra bucks, will not be worth the fact the individual will earn a lot less in the future.

Here is an example: Let’s say I’m a circus performer. If I wreck my car, I’ll probably increase my hours a bit to help compensate for the short-term shock. Perhaps I sign up to do a show for a kid’s birthday after hours–who knows. Regardless, it is very unlikely that I will sign up to have a tiger eat me alive on stage: 1) my long-term productivity will be severely diminished, and 2) I’d be dead.

So how do the authors examine this economic question about labor supply and short-term shocks in the context of Kenyan prostitutes?

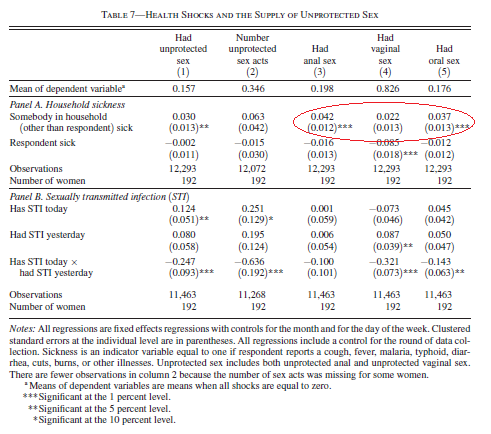

The authors identify how prostitutes react to temporary income shocks. In the case of this research study, the shock is a short-term health shock at home (e.g., kid gets the flu). The authors then test to see if the temporary shock causes the sex workers to increase their offerings of ‘risky’ sexual transactions.

Here are the results:

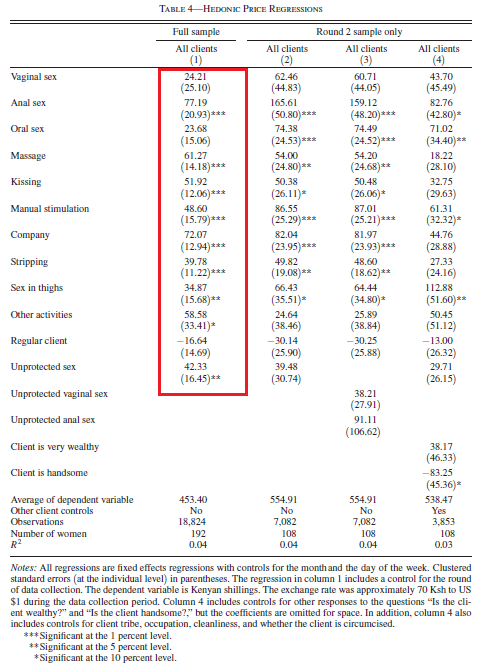

First, the authors mention that the average women earns $9.86 per day through transactional sex, and has an average of 1.52 clients a day. Some simple math suggests the average cost of a sex transaction in Kenya is around $6.50 (9.86/1.52). The authors next present the “return to sex acts” table (see below). What the table shows is that anal sex is going to cost you an extra 77 Ksh (~$1.10) and not using a condom is going to cost you an extra 42Ksh (~$0.60). For those sick individuals out there who are already booking their flights to Kenya, remember that you can get an $0.11 (-16.64*.7Ksh/$) fee break if you are a “regular” customer–“Sam’s Club economics” are in effect, even in Kenya.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Here are some stats on the relationship between risky behavior and a short-term shock (defined as someone in the household getting sick). You will notice that “riskier” activities, like anal sex and unprotected sex, increase when someone in the household is sick.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Investment Strategy:

N/A.

Commentary:

The key takeaway from this research can be summarized with a cliché: “Desperate times call for desperate measures.” But maybe this saying doesn’t make any sense: should I double my chance of getting HIV just so I can get some flu medicine for my kid? Probably not, because a prostitute with HIV loses almost all of her future revenue generating power. Nonetheless, the urge to “react” to short-term stress seems to be an innate action.

So how does this behavioral bias relate to portfolio management? Pretend you are an investment manager and you have an investment that loses 50%. Your immediate reaction may tell you to double down or buy call options, because you need to get back to even–and fast. This short-term reaction may dig you out of a hole, but if things go poorly, you’ll lose all risk management credibility, assets under management, and the prospect of ever managing money ever again. Is the risk of smoothing out a short-term loss, worth the potential costs of losing a career?

The lesson learned from all of this:

- Visit the Bill & Melinda Gates Foundation and learn about HIV/AIDS

- Don’t mess with Kenyan hookers

- Don’t let a small short-term shock cause you to engage in risky behavior that may keep your from achieving a large long-term benefit.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.