Now that the tide is leaving the shore, it’s a great time to reflect on manager performance and the most elaborate casino on earth–the stock market.

Bill Miller is best known for his fall from investing grace during the 2008 market explosion. Below is a sampling of the media piling on poor Mr. Miller:

“Is Bill Miller Toast?” (Kiplinger)

“Is Bill Miller Losing His Touch?” (Seeking Alpha)

“Bill Miller’s New Streak” (CNN Money)

“Was Bill Miller Just Lucky” (Fool)

Most of these articles talk about Bill Miller’s star-studded 15-year ‘beat the market’ performance from 1991-2006 and subsequent fall from grace.

It appears that Bill Miller (and many other value managers) were caught “swimming naked” when the sh&$ hit the fan in 2008.

Before we start, I want to reiterate that this isn’t a “bash on Bill Miller” post; rather, it is a bash on “stock-pickers” in general. Bill Miller gets all the headlines, but all of us remember getting our quarterly reports from our supposed all-star performance market-neutral “Long/Short Equity” and “fancy hedge funds” that showed drawdowns of 50-60%+. Blah!

Now let me be clear: There ARE definitely some good stock pickers out in the market, but on average, it seems that “good stock pickers” are few and far between when you really analyze their performance over good AND bad cycles. Or as Buffett’s says, “There are a lot of people swimming naked [when things go wrong].” As a benchmark to assess true “value-add,” I personally like to look at how a manager stacks up against very plain-vanilla (and tradeable) quantitative value models.

First, let’s break down the the theoretical cost and benefits of a stock-picker versus a computer stock-picker (“quant-picker”):

- Stock-picker Benefit: a concentrated portfolio of names where the manager has high conviction and potentially high alpha.

- Stock-picker Cost: The downside of this stock-picker is limited diversification.

- Quant-picker Benefit: Decent alpha and diversification.

- Quant-picker Cost: A “shotgun” research approach versus the very precise “sniper” fire research done by stock-pickers.

In the end, theorizing about whether a stock-picker (“they overcome diversification because they are so good at picking stocks”) is better or a quant-picker (“they overcome mediocre alpha by keeping costs low and being systematic”) is better, makes for a great cocktail discussion, but to get the actual answer, we can simply look at data.

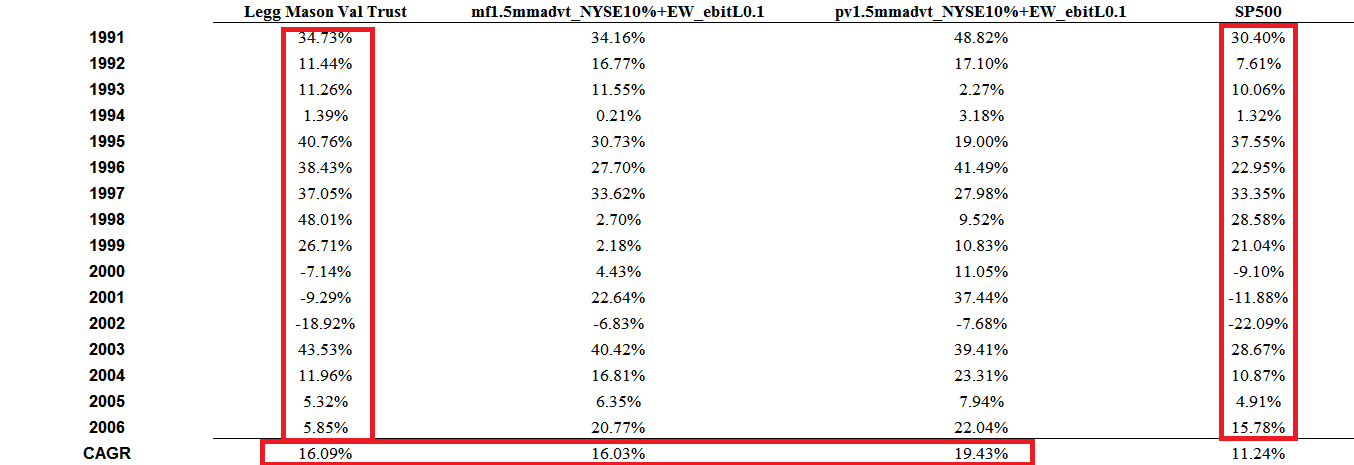

First, a comparison of Bill Miller (and the many other ‘stock-pickers’ like him) vs the SP 500 and two very simple ‘quant-picker’ models: the Magic Formula and a Profit and Value approach.

A few notes:

The backtested MF and PV strats only include stocks that are above the 10% NYSE cutoff for market cap AND must have an average daily value traded of 1.5mm (adjusted for CPI). The idea here is to ensure these strats are tradeable for a decent size book.

So while it is true that the Value Trust beat the SP 500 for 15 straight years, it didn’t really add much in terms of CAGR relative to very plain vanilla quantitative value strategies that also did exceptionally well. As a side note, I’m sure if I threw the DFA small-cap value fund in here it would have knocked the cover off the ball.

Conclusion: ~tie between stock-pickers and quant-pickers during a good market.

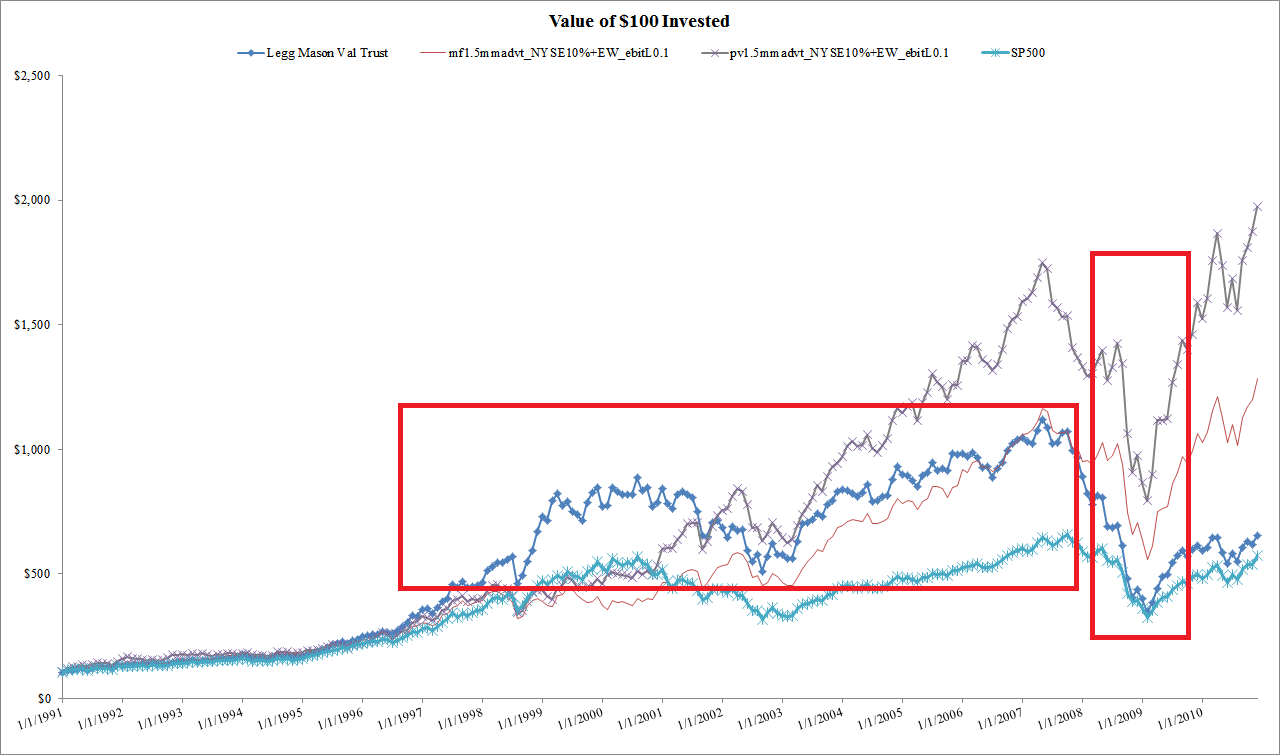

Next, let’s look at what happens when the tide goes out to sea in 2008:

When things go bust, the quant-pickers get rocked and the stock-pickers get rocked–all beta gets rocked! However, the stock-pickers are back to SP 500 levels, whereas, quant-pickers are still way above the market. Also, following the tide washing out to sea, when the surf came back in (2009-2010), the quant-pickers carried on with their winning ways against the stock-pickers.

Some more chart-porn before proceeding:

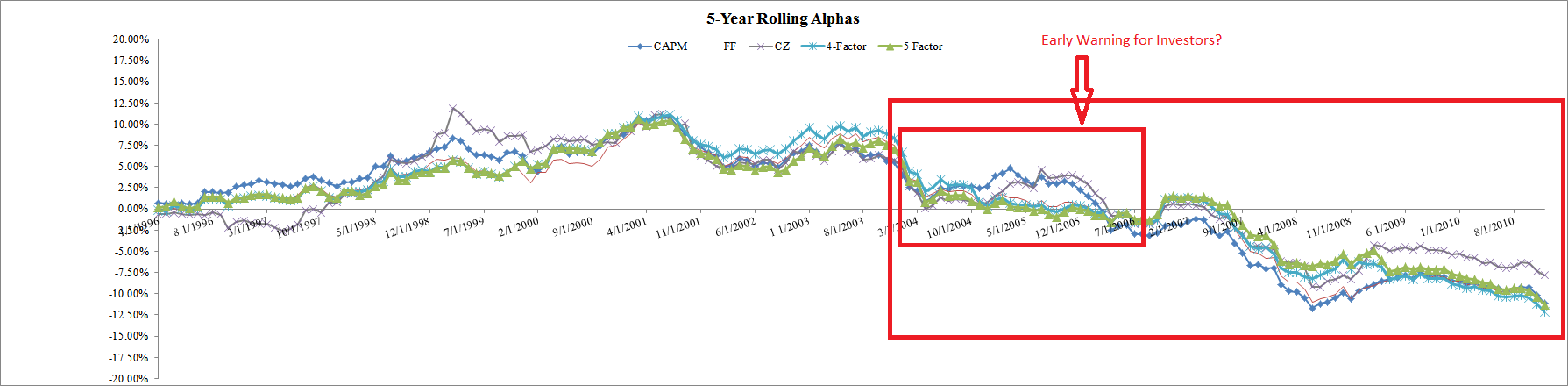

5-year rolling alpha (using a kitchen-sink of asset pricing models) for the Value Trust

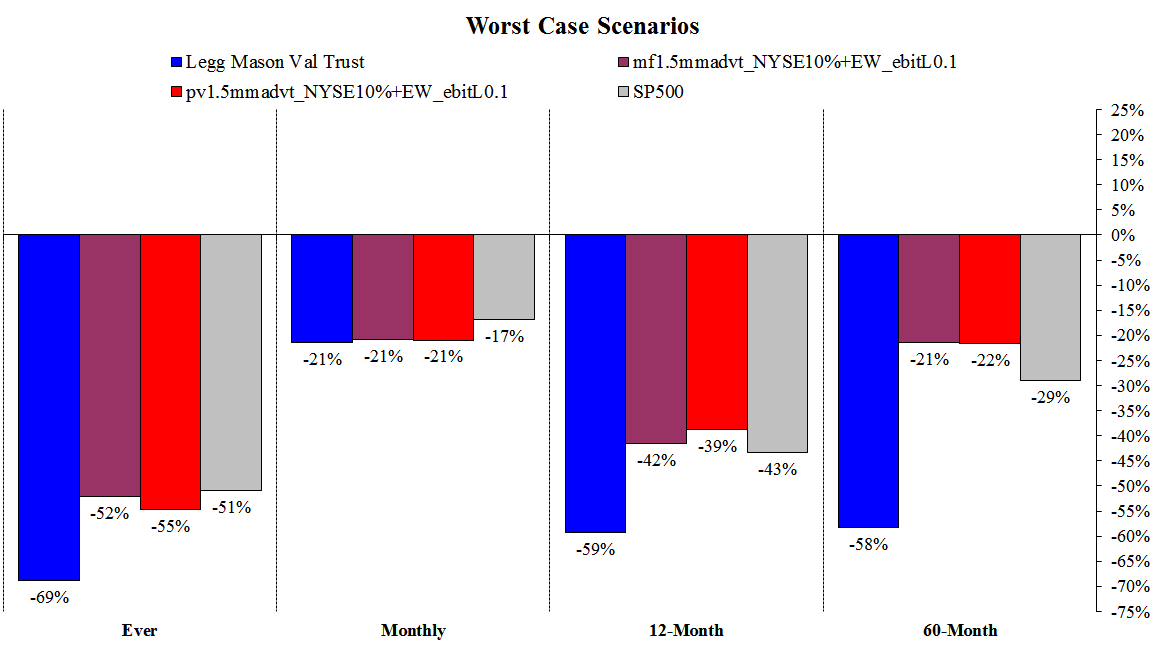

Some drawdown tables

Investments 101 chart plotting CAGR/volatility

Conclusion: UGLY. Quant-pickers beat stock-pickers on damn near every dimension I can imagine.

I’m excited to see how ‘quant-pickers’ did relative to everyone’s favorite stock-pickers over the past 30 days. When the data becomes available, we’ll let you know the results.

What’s the moral of the story here?

- When you analyze a “stock-picker”, don’t benchmark him/her against the SP 500, benchmark him against a “quant-picker” model that focuses in the same area of stock-picking (small, value, momentum, growth, high-ROA, etc).

- Never become enamored with performance against a cheesy benchmark like the SP 500, because there are hundreds of strategies that can beat the SP 500 merely adding some risk and good luck (for example, sell way out of the money options through a stable market period and you’ll have a nice Madoff-like return).

- Never pay 20% of carry without a hurdle in place that is relative to an appropriate benchmark. 20% of profits relative to a hurdle of 0%, is not appropriate for a long-only or long-biased fund. Any manager operating under this framework is being intellectually dishonest with his investors.

- Focus on 1 of 3 things (depending on your leisure/work utility function):

- Spending a LOT of time identifying TRUE stock pickers

- Spend a decent amount of time identifying a decent quant-picker

- Spend no time and invest in a broad portfolio of products with index-like fees. And if you do this approach, review the following paper:

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.