Turnkey Analyst showed me a very interesting article from ZeroHedge this morning:

http://www.zerohedge.com/news/some-fun-analogies-rhyming-history-and-repeating-futures

The main point of the article? History almost repeated itself!

Oct 3, 2008: SPX=1099.23; VIX=45.14

Oct 3, 2011: SPX=1099.23; VIX=45.45

Since the stock market seems to be on track with 2008, I went ahead and used our new backtesting tool in Turnkey Analyst to assess how our screens performed.

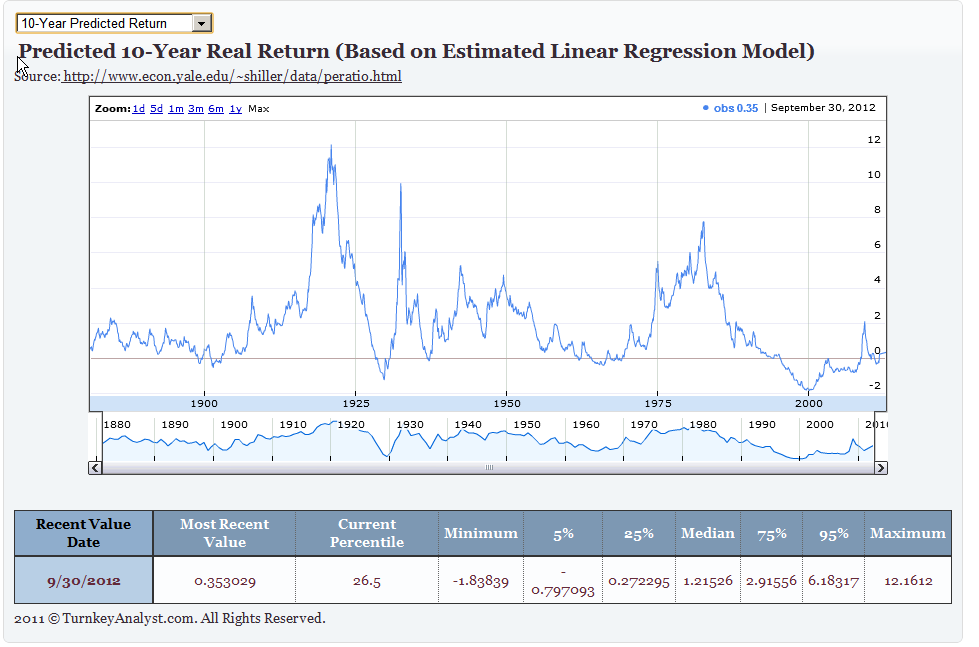

First, a screen shot of what the Shiller model predicts for the next 10 year real return on equity–a dismal 35bp/year.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

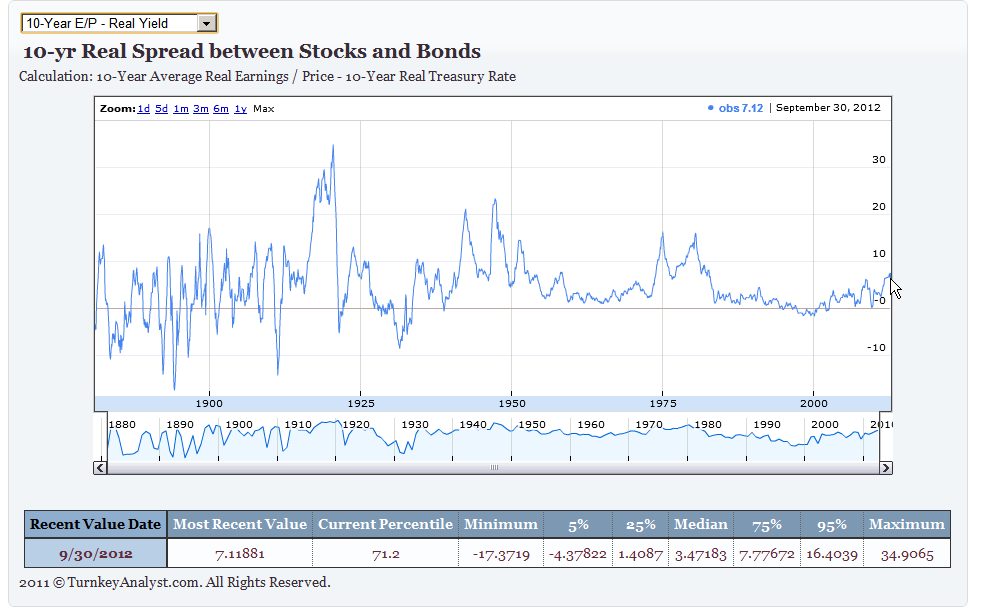

But at the same time, the real spread between stock earnings yield and bond yields is almost 7%–what’s an investor to do? Ugg, the Fed has us all in a pickle!

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

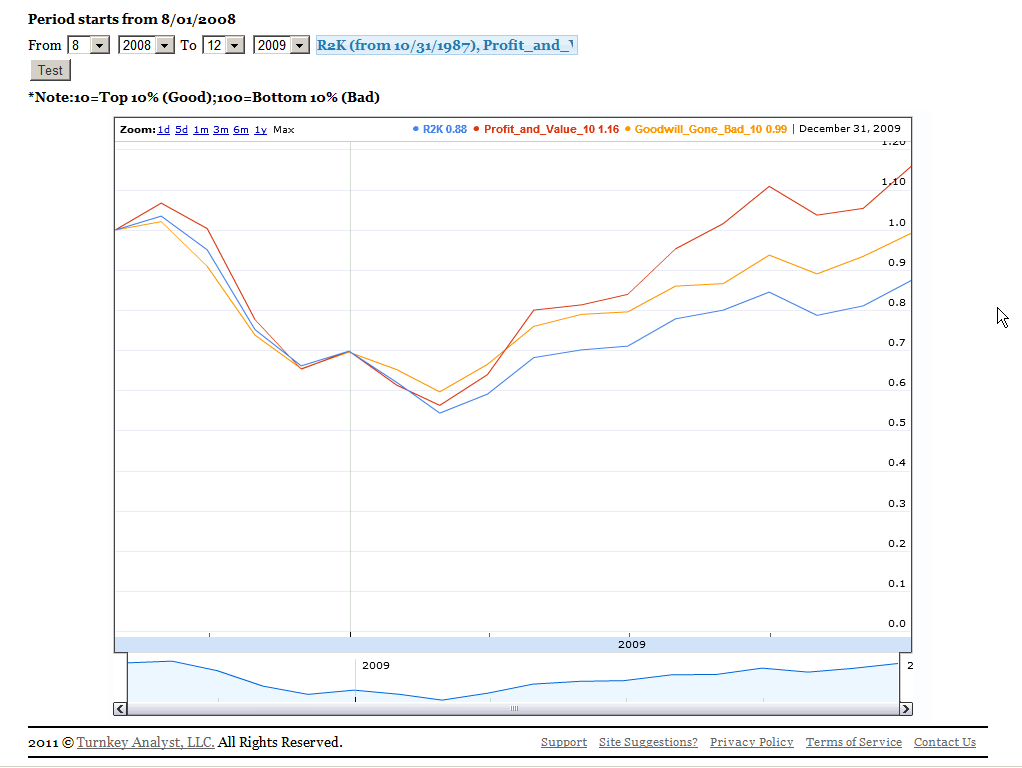

When we look at how our screens performed from August 1, 2008 through December 31, 2009, we find some interesting results:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

We find that ALL of our screens end up outperforming the broad-based Russell 2000 index, however, profit and value and goodwill gone bad stand out as the best performers (here we focus on long-only, long/short systems also did well over this chaotic time period).

Lesson: If you believe we are in the midst of another September 2008 time period, focus on the profit and value and goodwill gone bad screens to find some potential winners.

Best of luck and try out our new backtesting tool if you are interested in exploring deeper.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.