A while ago we highlighted a very interesting paper by Alex Edmans:

http://alphaarchitect.com/2011/04/satisfying-employees-a-satisfying-investment-strategy/

Alex has published a version of the paper that looks at the 1984 -2009 paper in the Journal of Financial Economics:

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=985735

He has another version which looks at the 1984-2005 period:

http://finance.wharton.upenn.edu/~rlwctr/papers/0716.pdf

Recently, a group of my highly motivated Drexel students did an independent backtest of the returns for the employee satisfaction strategy from February 2006 through February 2012. An “out of sample” independent verification study, if you will.

As a reminder, the strategy works as follows:

- Identify the 100 best companies to work for at http://money.cnn.com/magazines/fortune/bestcompanies/2011/index.html

- Go long firms with high employee satisfaction.

- Outperform.

There are four ways of investing in the strategy:

- p1. Rebalance the portfolio across the list of the best companies to work for.

- p2. Hold the original best companies to work for on 2006 throughout the period.

- p3. Add new companies on updated list, but don’t drop companies that appeared on previous lists.

- p4. Include only companies that were once on the list, but were dropped in subsequent periods.

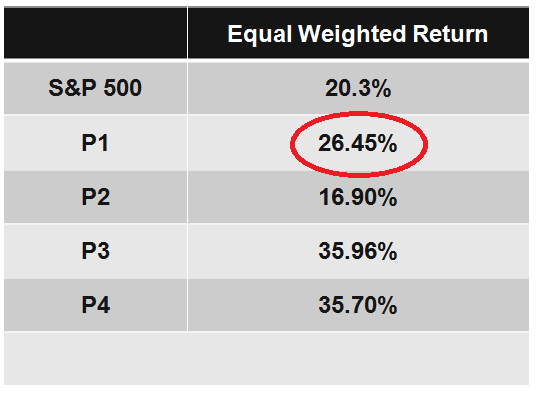

Here are the results for the total return from Feb 2006 to Feb 2012:

Wow, not too bad. The baseline portfolio of high employee satisfaction firms outperformed the S&P 500.

Here are the list of tickers for the 2011 portfolio to give you a flavor for the type of names in the book.

| ADBE | AFL | AMZN | ARO | AXP | BBW | BRCD | CHK | CPT | CRM |

| CSCO | DRI | DVN | DWA | EOG | FDS | GIS | GOOG | GS | HAS |

| INTC | INTU | JWN | KMX | MAR | MAT | MORN | MSFT | MW | NATI |

| NS | NTAP | NVO | QCOM | RAX | SBUX | SJM | SYK | UMPQ | WFM |

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.