Will My Risk Parity Strategy Outperform?

- Robert M. Anderson, Stephen W. Bianchi, Lisa R. Goldberg

- A version of the paper can be found here.

Abstract:

“We gauge the return-generating potential of four investment strategies: value weighted, 60/40 fixed mix, unlevered and levered risk parity. We have three main findings. First, even over periods lasting decades, the start and end dates of a back-test can have a material effect on results; second, transaction costs can reverse ranking, especially when leverage is employed; third, a statistically significant return premium does not guarantee out performance over reasonable investment horizons.”

Data Sources:

The results presented in this paper are based on CRSP stock and bond data from January of 1926 through December of 2010. The aggregate stock return is the CRSP value weighted market return (including dividends) from the table Monthly Stock – Market Indices (NYSE/AMEX/NASDAQ). The aggregate bond return is the face value outstanding (cross-sectionally) weighted average of the unadjusted return for each bond in the CRSP Monthly Treasury (Master) table. The proxy for the risk-free rate is the USA Government 90-day T-Bills Secondary Market rate, provided by Global Financial Data.

Discussion:

In this article, the authors evaluate four strategies based on two asset classes: US Equity and US Treasury Bonds.

The authors analyze the returns over the following intervals:

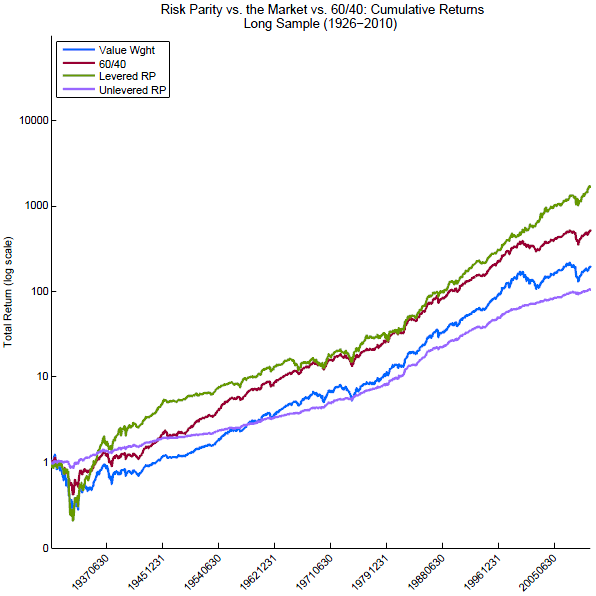

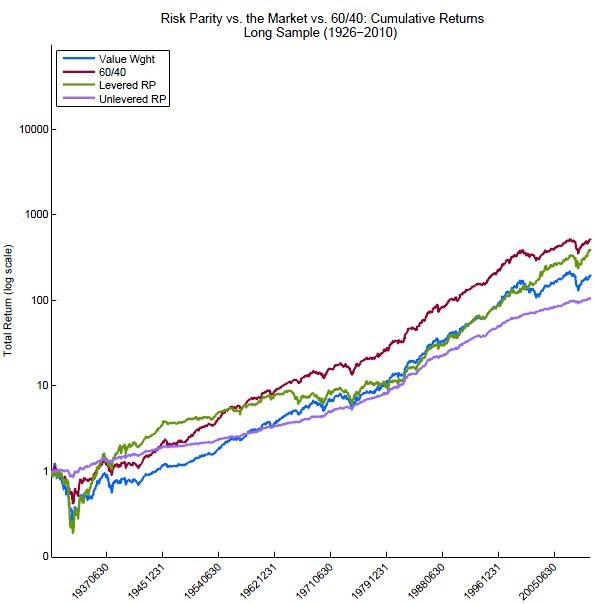

- The entire 85 year sample, 1926-2010

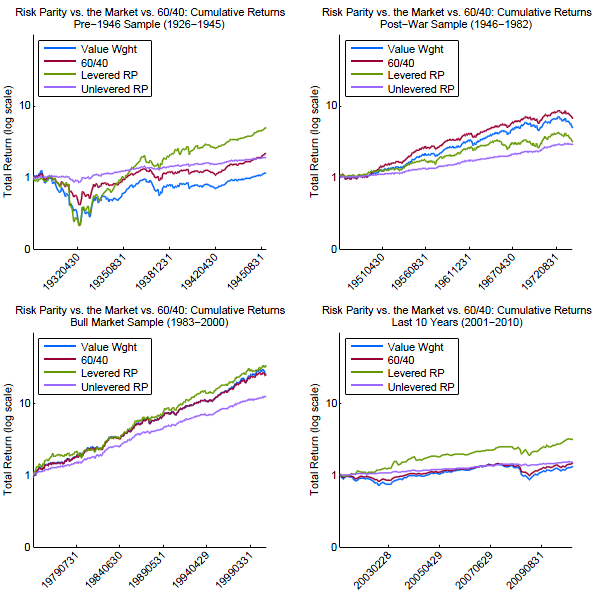

- The 20-year Pre-1946 sample, 1926-1945

- Post-war, 1946-1982

- Bull market, 1983-2000

- The last 10 years, 2000-2010

Here is an outline of the different strategies:

- Value Weighted: a fully invested strategy that value weights US Equity and US Treasury Bonds.

- 60/40: a fully invested strategy with capital allocations of 60% US Equity and 40% US Treasury Bonds.

- Unlevered Risk Parity: a fully invested strategy that equalizes ex ante asset class volatilities.

- Levered Risk Parity: a levered strategy that equalizes ex ante volatilities across asset classes.

The conclusions from the analysis are as follows:

- Results are dependent on the time period analysed–suggesting robustness issues.

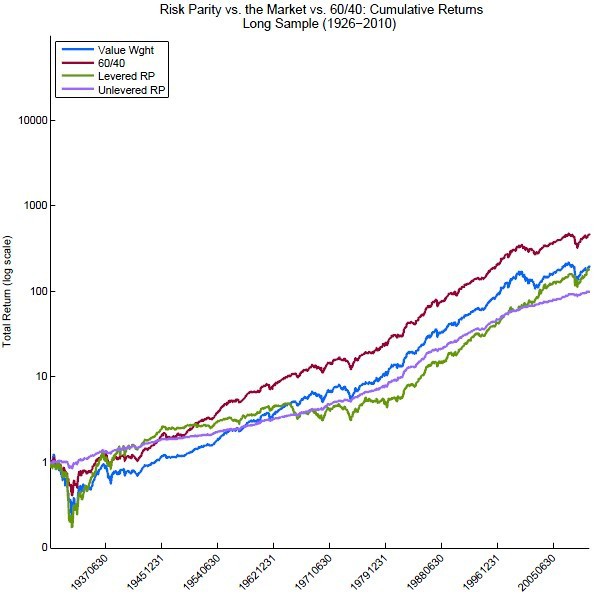

- Over the long period 1926-2010, levered risk parity had the highest cumulative return by a factor of three.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

- In four sub-periods, levered risk parity prevailed during the Pre-1946 Sample and the last 10 years.

- Despite its relatively low volatility, unlevered risk parity beat the value weighted and 60/40 strategies in the most recent period.

- During the post-war period from 1946 to 1982, both the 60/40 and value weighted strategies outperformed risk parity.

- Between 1982 and 2000, levered risk parity, 60/40 and value weighted strategies tied for first place.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

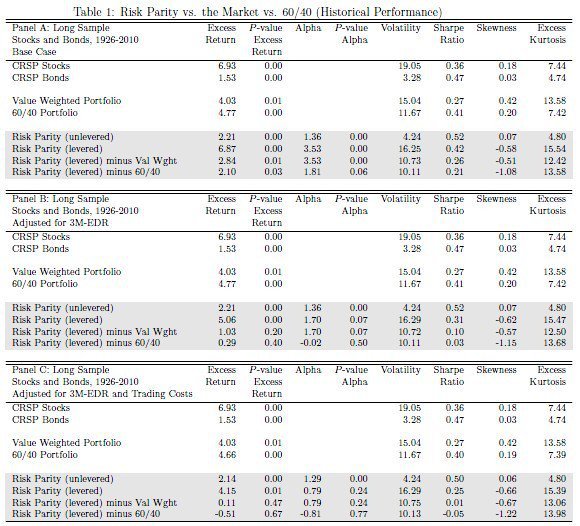

Borrowing costs matter

To make the analysis more realistic, the authors replace the 90-Day T-Bill Rate with the 3-Month Euro-Dollar Deposit Rate starting in 1971, and use 90-Day T-Bill Rate plus 60 basis points in the 1926-1970 period. Under these assumptions, the 60/40 strategy had a slightly higher return than levered risk parity over the long horizon.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

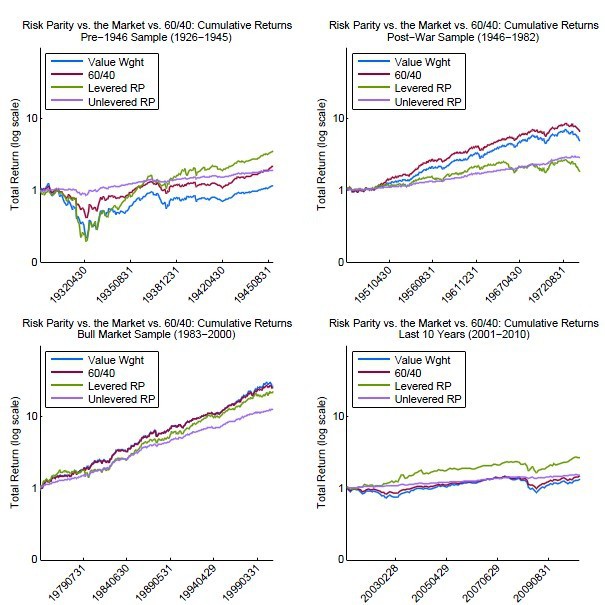

When applied to subperiods, there are three sets of assumptions about transaction costs:

- The base case assumes borrowing was at the risk-free rate and turnover-induced trading incurred no penalty.

- The middle case assumes borrowing was at the 3-Month Euro-Dollar Deposit Rate starting in 1971, and was at the risk-free rate plus sixty basis points before 1971.

- The final case retains borrowing assumptions from the middle case, and adds turnover induced trading costs of 1% during the period 1926-1955, .5% during the period 1956-1970 and .1% during the period 1971-2010.

Over the entire period, 60/40 is the dominant strategy in terms of after-cost returns. However, levered risk parity outperforms in turbulent periods.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Turnover-induced trading costs

Due to difference in frequency of rebalancing, the trading costs for the levered risk parity are much higher than they are for the unlevered risk parity and 60/40 strategies.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Unlevered risk parity has the highest realized Sharpe ratio, with 60/40 coming second.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

In conclusion, 60/40 has a substantial probability of beating levered risk parity over the next 20 years and the next 50 years after accounting for borrowing cost and transaction cost.

Investment Strategy:

- For defensive investors, focus on unlevered risk parity to maximize peace of mind and risk-adjusted return.

- For aggressive investors, contemplate levered risk parity, but find a way to minimize trading and borrowing costs.

- If the aggressive investor can not achieve low cost implementation, flip a coin and choose either 60/40 or levered risk parity.

- Hope for the best.

Commentary:

Strategy evaluation is an important part of the investment process. It is essential to consider market frictions, the assumptions underlying extrapolations, and statistical significance. The strategy must be evaluated over periods of different length and in different market environments.

About the Author: Tian Yao

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.