Media and Google: The Impact of Information Supply and Demand on Stock Returns

by Yanbo Wang

Yanbo identifies information into two buckets: News releases (supply) and Google search traffic (demand). A very rough synthesis of how the supply and demand are predicted to affect stock returns works as follows:

- Increased supply, with increase in demand ==> No effect

- Increase in demand, no increase in supply ==> No effect

- Increase in supply AND increase in demand ==> Strap on your alpha rockets

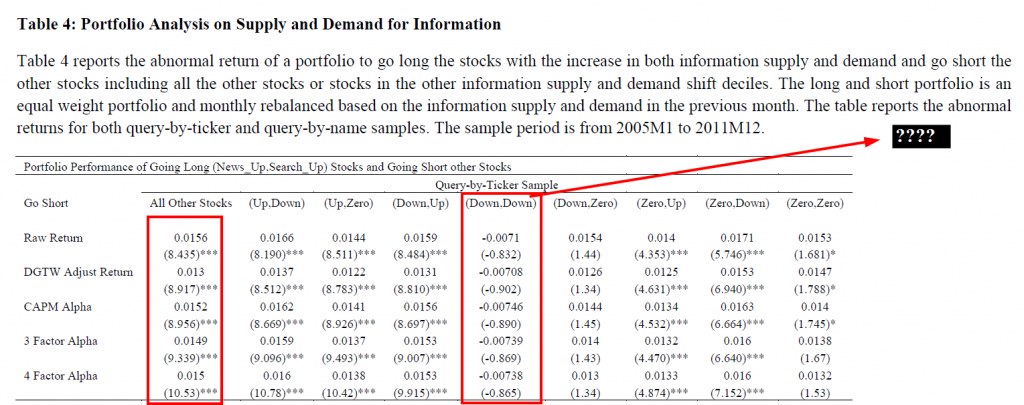

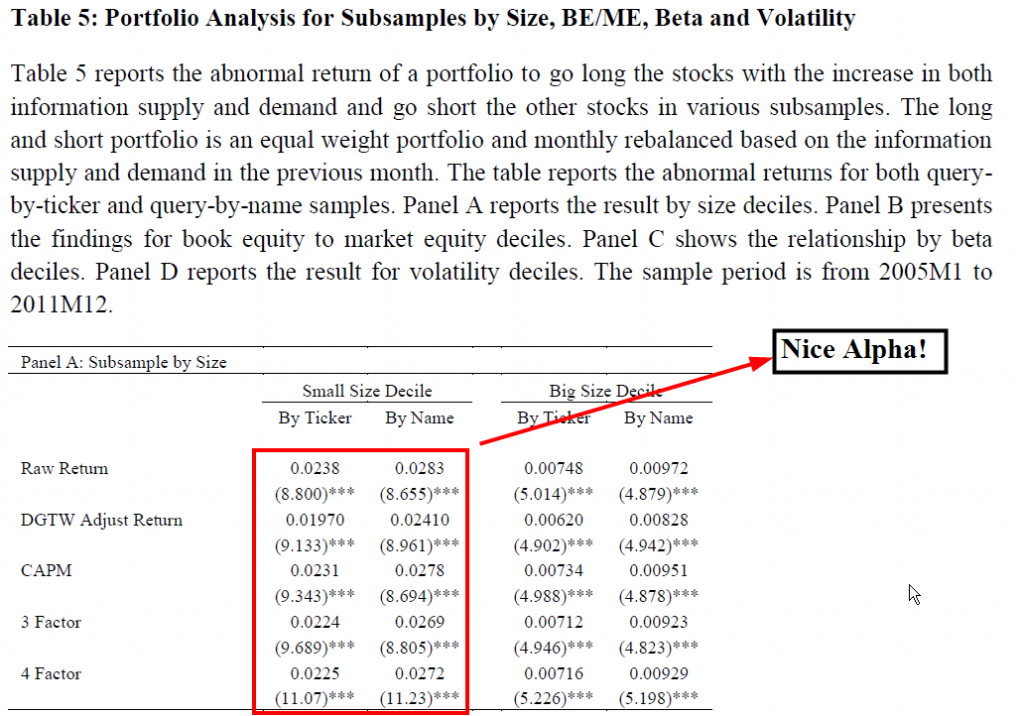

I use the number of news articles and Google search volume about a company as proxies for the information supply and demand respectively. I examine the relationship between the cross sectional stock return and the “pairs” of information supply and demand shifts. I show that only the upward shift in both information supply and demand is an economically and statistically significant predictor of future returns among shift “pairs”. A monthly rebalanced portfolio to buy stocks with this shift “pair” and short sell the other stocks delivers an abnormal return between 16% and 22% per year with a sharp ratio between 0.85 and 0.9 (S&P500 sharp ratio is 0.049 in the same period). The abnormal return increases to 23%-34% per year in the small stocks subsample. This finding shows that the supply of information affects stock return only when there is a demand for information. The result is consistent with attention hypothesis and supports the approach to tackle both information supply and demand jointly. To my knowledge, this is the first empirical paper to study the joint effect of both information supply and demand on stock returns.

Finance porn:

First, the overall results.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Next, some results specific to smaller stocks. 2.25% per month 4-factor alpha?

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.