The Return Characteristics of Diamonds

- Kenneth Small, Jeffrey Smith, and Erika Engel Small

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

We outline the ethical considerations surrounding the trading of diamonds, the metrics used to value diamonds, the history of diamond trading, and the current market structure. We provide an analysis of the underlying risk and return characteristics of several individual diamond types. We show that diamonds exhibit low CAPM and Fama-French betas and exhibit low correlations with gold, the S&P 500, long-term U.S. bond prices, and U.S. inflation.

Data Sources:

Diamond price index from Datastream (polishedprices.com). 2002-2011.

Alpha Highlight:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Strategy Summary:

- Identify the 6 diamond price series listed in the paper

- Diamond Index (includes both commercial and fine diamonds)

- One-Carat Fine Index

- One-Carat G-VS

- One-Carat H-VS

- One-Carat I-VS

- One-Carat D Flawless

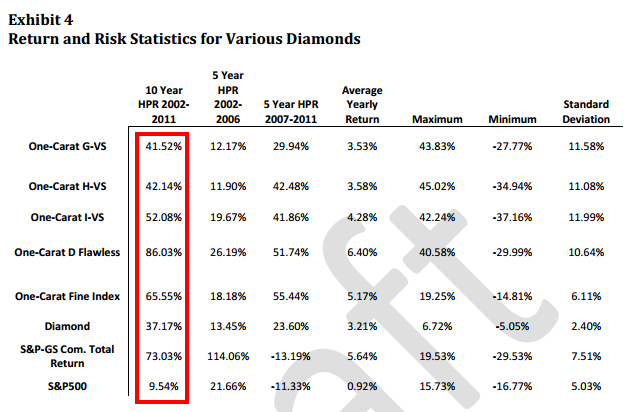

- The diamond returns are much higher than the market from 2002-2011 with the highest return being the One-Carat D Flawless series.

- The diamond returns exhibit low correlations with the SP500, inflation, gold, and U.S. long-term bond returns.

- The diamond returns are not explained by the CAPM or 3-factor models.

Commentary:

- Although there are low correlations between diamonds and the SP500 between 2002-2006, and negative correlations between 2007-2009, the correlation in 2010-2011 become significantly higher (around 30%).

- Will this trend continue?

- The four one-carat price series (G-VS, H-VS, I-VS, and D Flawless) have higher returns than the market, but much higher standard deviations.

- The One-Carat Fine Index has lower returns than the One-Carat D Flawless series, but has a much lower standard deviation.

- An interesting finding is that the diamond returns are in general negatively correlated with gold returns.

- Only a 10 year period of study, so results must be interpreted accordingly.

- What are the true transaction costs and liquidity constraints on diamonds?

- Personally, the only $ I’d waste on diamonds is the one you have to put on your wife’s finger…but that’s just me.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.