Tipping

- Paul Irvine, Marc Lipson, and Andy Puckett

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

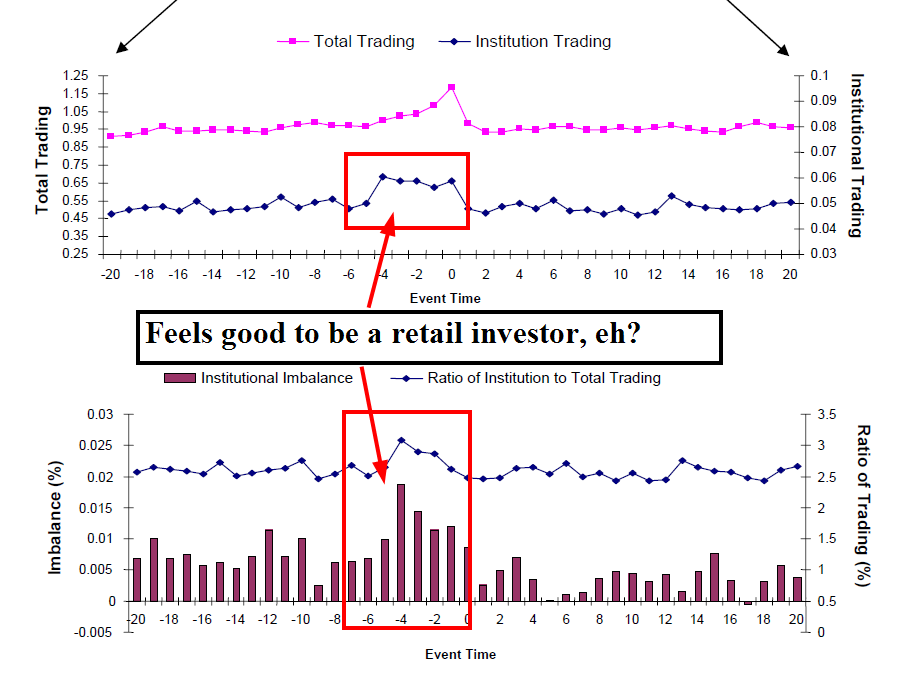

This paper investigates the trading behavior of institutional investors immediately prior to the release of analysts’ initial buy and strong buy recommendations. Using a proprietary database of institutional trading activity from the Plexus Group, we document abnormally high trading volume and abnormally large buying imbalances beginning five days before initial recommendations are publicly released. Furthermore, abnormal buying activity is positively related to initiation characteristics associated with greater abnormal price responses, including some that would require knowledge of the content of the report – such as the identity of the analyst and whether the recommendation is a strong buy. We confirm that institutions buying prior to the recommendation release earn positive abnormal trading profits. Taken together, our results suggest that some institutional traders receive tips regarding the contents of forthcoming analysts’ reports. To the extent that brokerage firm clients who benefit from these tips are more likely to direct business to the initiating brokerage firm, tipping provides economic profits to the brokerage that can help defray the cost of analyst information gathering. Thus, while tipping benefits some traders at the expense of others, the welfare consequences of tipping are unclear.

Data Sources:

Plexus Group, IBES, CRSP/Compustat.

Alpha Highlight:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Strategy Summary:

- Don’t listen to sell side research.

MakeDon’t lose money.

Commentary:

- Avoid people who own yachts and fancy cars.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.