Are stocks expensive? On an absolute basis, yes. As Greenbackd.com and Mebanefaber.com have recently pointed out, the Shiller P/E, or cyclically-adjusted P/E (CAPE), is at a historical high. We have the last reading at 22.65.

To keep tabs on CAPE and related measures, we built a new module in Turnkey to help investors quickly understand where returns might be heading. https://alpha.turnkeyanalyst.com/macroviews

First, we like to look at all returns on all assets in terms of yields. A P/E type ratio isn’t comparable to a bond yield or a dividend yield. However, the inverted P/E, or E/P, does mean something–it is essentially an “earnings” yield. The earnings yield is more comparable to other yields in the market place.

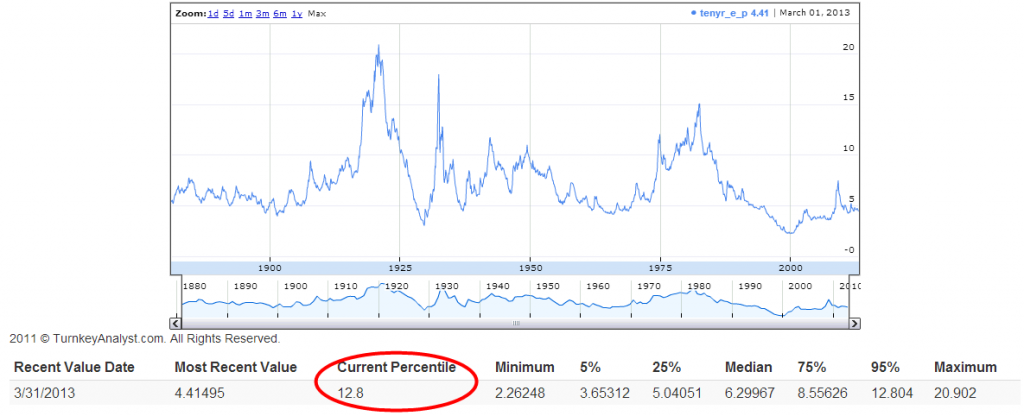

A simple question: How does the current real earnings yield (1/CAPE) stack up relative to historical real earnings yields?

At it stands as of 3/31/2013, the current real earnings yield is 4.4%, which sits at the ~13th percentile, historically.

In other words, stocks are very rich!

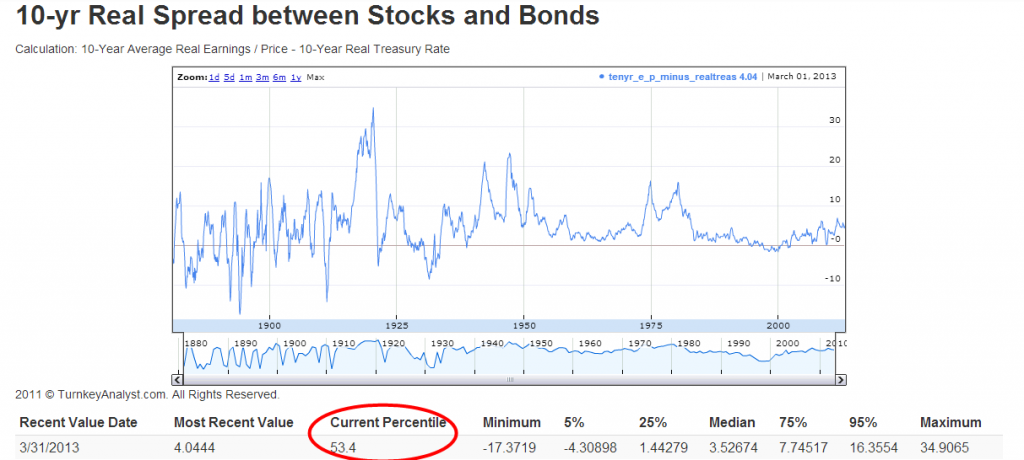

A simple question: How does the current real earnings yield (1/CAPE) stack up relative to the real yield on 10-year government bonds?

As of 3/31/2013, the current real spread between stocks and bonds is ~4%, which sits at the ~53rd percentile, historically.

In other words, stock prices are not that expensive relative to bonds.

So what are investors to do? Bonds don’t offer much; stocks offer more; but no asset looks attractive.

“Solution:”

Cry in your pillow, wipe your tears with the cash you have lying under your bed, and hope for a market crash in the future.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.