Unsuccessful differential diagnosis from the Rorschach

- Armitage, S. G., & Pearl, D.

- Journal of Consulting Psychology, 21. 479-484

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

The consistency with which individual or group diagnostic categorization can be predicted from the Rorschach was investigated in two ways; one was an objective statistical approach and the other a subjective judgmental approach. In the first, an attempt was made to relate statistically either single or patterned Rorschach determinants to previously made diagnostic judgments. The results failed to uncover any useful means of arriving at a diagnosis. The judgmental approach was found to be equally unsuccessful in achieving consistent diagnostic predictions.

Prediction:

Can Rorschach be an effective diagnostic tool?

Alpha Highlight:

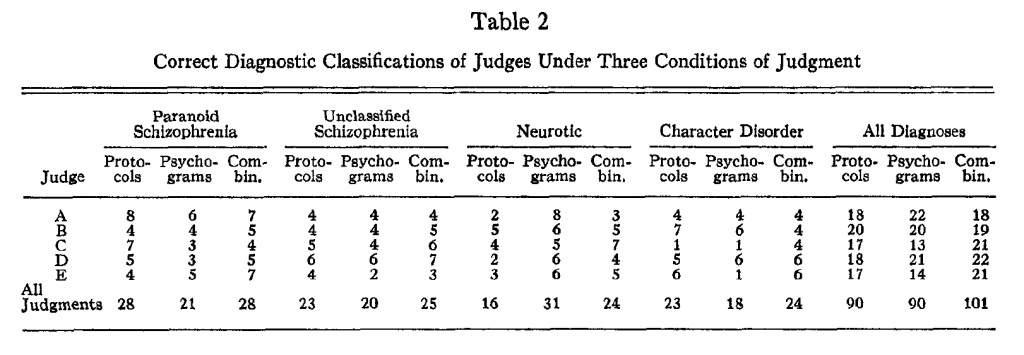

I’m not a psychologist, but my read on the paper is that protocol = judgement, psychogram = mechanical, and combined = both tools combined. Looks like for neurotic diagnosis the model wins, for paranoid schizophrenia humans win. Overall, there it seems like a bunch of noise and no machine or human can figure it out.

Strategy Summary:

Sounds like the Rorschach test is bunk…of course, this study was done in 1957.

Thoughts on the paper?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.