Are Stocks Cheap? A Review of the Evidence

- Fernando Duarte and Carlo Rosa

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

- h/t A. Seager @ Arbor Hill

Abstract:

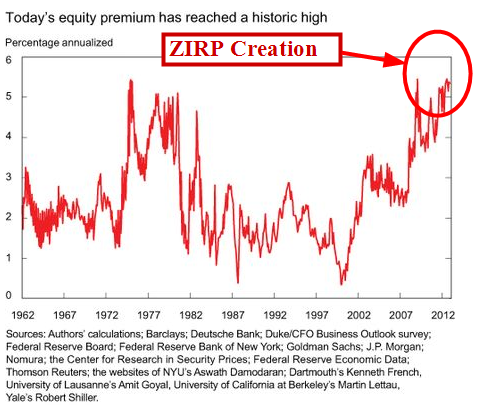

Let’s now take a look at the facts. The chart below shows the weighted average of the twenty-nine models for the one-month-ahead equity risk premium, with the weights selected so that this single measure explains as much of the variability across models as possible (for the geeks: it is the first principal component). The value of 5.4 percent for December 2012 is about as high as it’s ever been. The previous two peaks correspond to November 1974 and January 2009. Those were dicey times. By the end of 1974, we had just experienced the collapse of the Bretton Woods system and had a terrible case of stagflation. January 2009 is fresher in our memory. Following the collapse of Lehman Brothers and the upheaval in financial markets, the economy had just shed almost 600,000 jobs in one month and was in its deepest recession since the 1930s. It is difficult to argue that we’re living in rosy times, but we are surely in better shape now than then.

Data Sources:

Multiple

Alpha Highlight:

All the models suggest equities aren’t that expensive on a historical basis.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

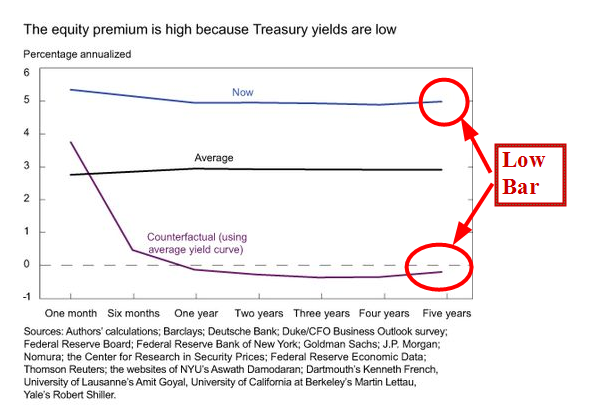

Why?

The opportunity costs of capital (the bond alternative) is lower than it has ever been.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Strategy Summary:

- Rule #1: Never listen to the Feds.

- Rule #2: Refer to Rule #1

Example: Bernanke pontificating on housing…

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.