We’ve seen a few cool posts comparing different moving average rules.

Here is a recent example from Systemtradersuccess.com: http://systemtradersuccess.com/golden-cross-which-is-the-best/

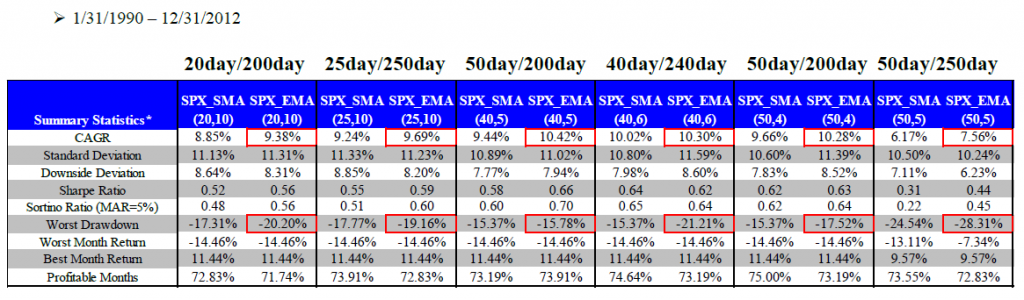

Below are the results of different moving average trading rules on the S&P 500.

SMA=Simple Moving Average

EMA=Exponential Moving Average

[Click to enlarge] The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

EMA performs a bit better on a CAGR basis, but comes with higher MAXDD.

Overall, very similar.

Should we keep it simple stupid–or do you think fancier moving average rules are warranted?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.