Value Around the World

- Nilufer Caliskan and Thorsten Hens

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

Over the last decades the value premium has well been documented for various time spans and countries. It is proven to be a consistent asset pricing anomaly. This study presents the largest international study on portfolio returns formed according to the book-to-market ratio and examines how cultural differences affect the magnitude of value returns. The cultural differences are measured in two dimensions: patience and risk aversion based on the data collected by the International Test on Risk Attitudes (INTRA). In accordance with a consumption based Gordon model we find that risk aversion is positively and patience negatively related to the magnitude of value profits. Similar results hold for the average stock volatility. Although patience is positively related with the degree of economic development, its relation to value returns does not disappear after controlling for general economic and financial development measures. Furthermore, we find that the value premiums are also positively associated with the country price earnings ratio and negatively related to firm size.

Data Sources:

Data stream

Alpha Highlight:

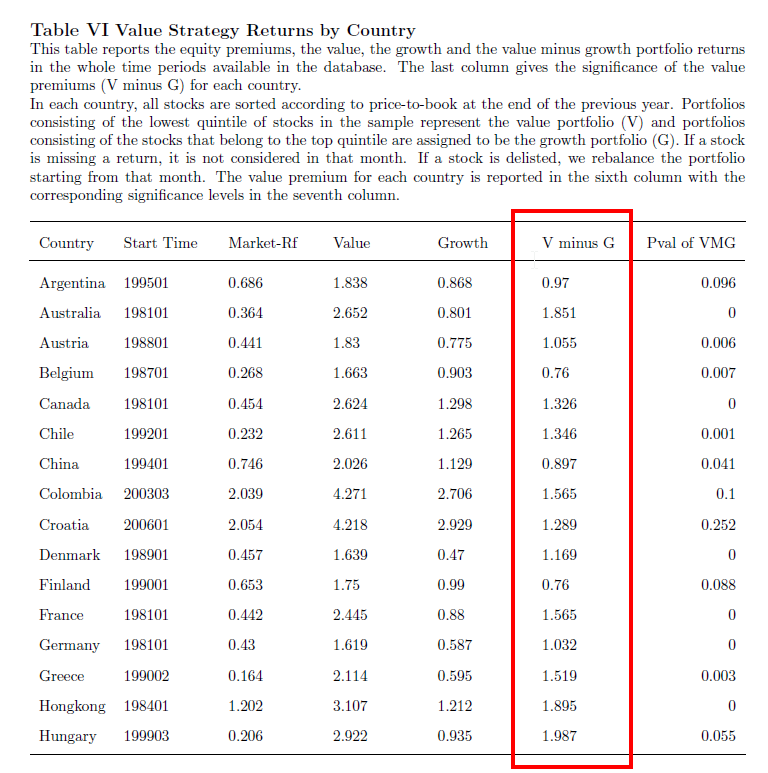

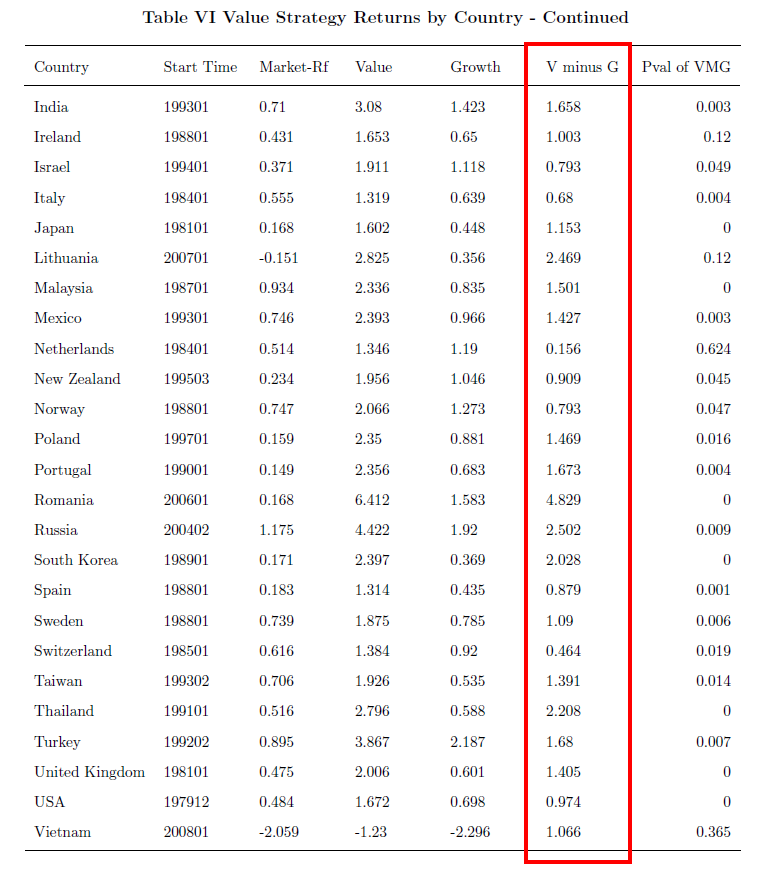

The table below outlines the monthly premium (in $ terms) for 41 different countries.

Value: 41/41 wins.

Growth: 0/41 wins.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Strategy Summary:

- Buy cheap stuff

Commentary:

- Let me reiterate: Buy cheap stuff

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.