The search for configural relationships in personality assessment: The diagnosis of psychosis vs. neurosis from the MMPI

- Goldberg, L. R.

- Multivariate Behavioral Research, 4, 523-536

- An online version of the paper can be found here

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

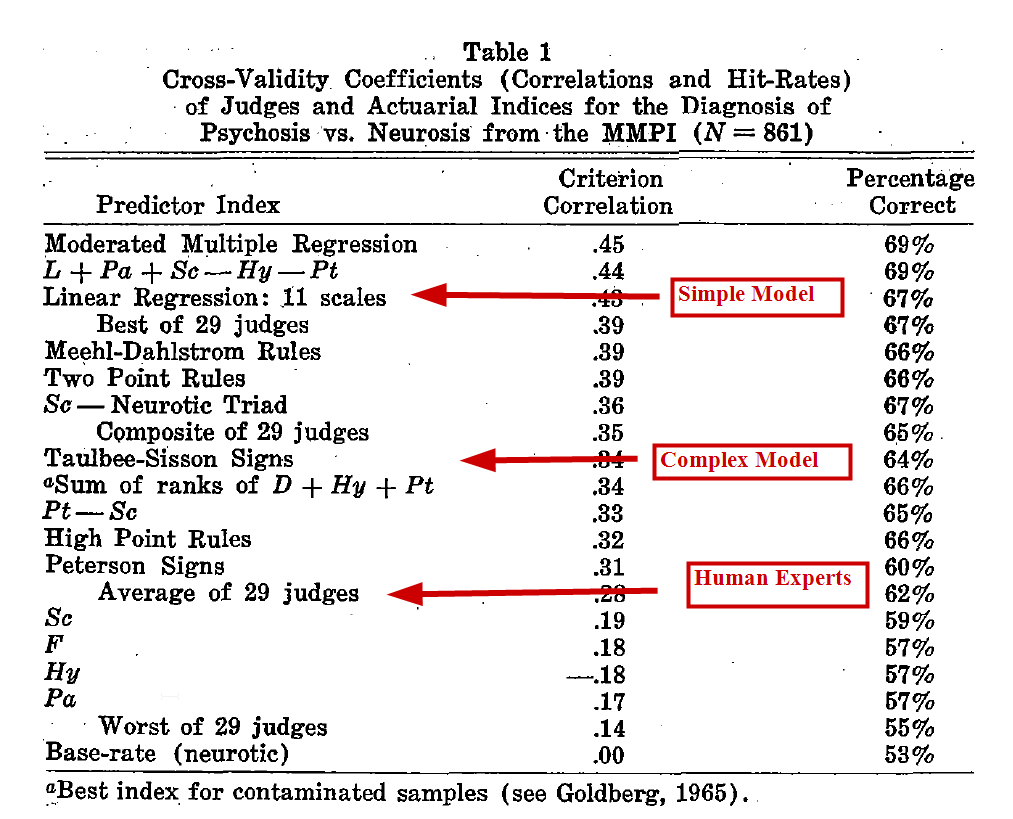

In 1956 Meehl predicted that the relationships between MMPI scores and the psychosis-neurosis diagnostic classification should be highly configural in character, and therefore that no linear combination of MMPI scores should be able to differentiate neurotic from psychotic patients as accurately as either experienced clinical psychologists or configural actuarial techniques. The present paper summarizes the findings from ten years of research on this question. While the research for configural actuarial procedures has led to a moderator variable, neither clinical experts, moderated regression analyses, profile typologies, the Perceptron algorithm, density estimation procedures, Bayesian techniques, nor sequential analyses-when cross-validated-have been-able to improve on a simple linear function. The implications of these negative findings for investigations of configural relationships with other problems are discussed.

Prediction:

The authors compare the diagnosis results for psychosis or neurosis across experts, complex models, and simple models.

Here are the results from the test with a few highlights for examples of the 1) human experts, 2) complex model, and 3) simple model.

Anyone else catching on to a pattern here? Simple beats complex and machines beat humans.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.