Investor PSY-chology Surrounding ‘Gangnam Style’

- Kim and Jung

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

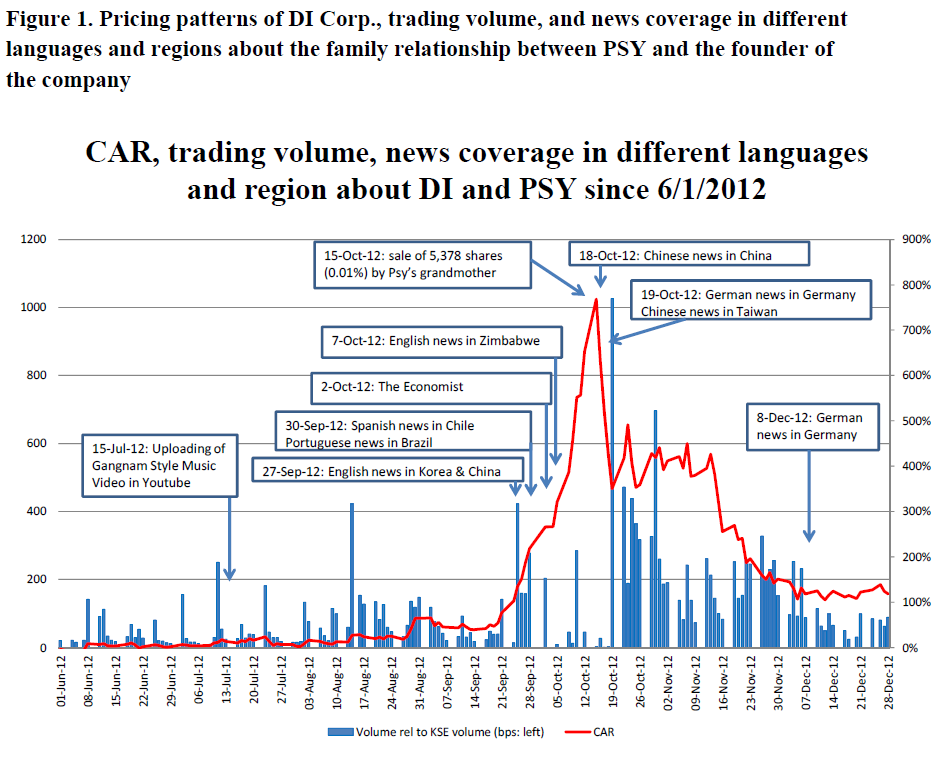

The global success of “Gangnam Style,” the 18th K-pop single by the South Korean rapper PSY in 2012, was an exogenous shock to international investor enthusiasm about DI Corp., because the company’s chairman and CEO is PSY’s father. The stock price of the semiconductor equipment company jumped by almost 800% in three months without material information. Using Korean microstructure data that identifies non-resident foreign individual (NRFInd, hereafter) investors and resident foreign individual (RFInd, hereafter) investors by nationality, we study international individual investor behavior. The count of flash mob videos and parody videos uploaded on YouTube from each country is our proxy for the enthusiasm of individual investors. We find that NRFInd (RFInd) investors in specific countries become net buyers (sellers) of DI Corp. when a flash mob or parody music video is uploaded in their country. This is because RFInd investors had already purchased the stock on the day PSY left Korea to meet Scooter Braun, the producer of Justin Bieber. Our results support a “resale option” explanation about the bubble in the asset price.

Data Sources:

[youtube url=”http://www.youtube.com/watch?v=9bZkp7q19f0″]Alpha Highlight:

From the paper:

As PSY’s “Gangnam Style” video achieved a world record of receiving more than 1.7 billion hits on YouTube from around the world since July 15th, 2012, and as his family relationship with the chairman of DI Corp. became public through news media in many languages, the stock price of DI Corp. jumped up by more than 790%. Consequently, the market cap increased from US$38 million to US$334 million…In this paper, we find that the pricing pattern was also driven by foreign individual investors placing orders for the stock from outside Korea.

Gangnam style your investment! First, some cumulative abnormal returns and press coverage of PSY:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

How about some foreign order imbalances?

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Strategy Summary:

- Identify a future mega superstar who is the son of a publicly traded company.

- Buy the public company.

- Hire a publicist and promote the association of the mega superstar and his relationship with the company.

- Make money.

Commentary:

- All research doesn’t have to be completely boring, right??

Crank up your stereo at work and dance “Gangnam Style!”[youtube url=”http://www.youtube.com/watch?v=9bZkp7q19f0″]

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.