The term “Black Friday” has been used for many years to describe the day after Thanksgiving, which for retailers marks the beginning of the holiday shopping season. Retailers were traditionally thought to operate in the “red,” or at a loss, until this point in the year, when they began to recognize profits, and were thereafter in the “black.” Others attribute the name to the shopping mayhem and herd mentality surrounding one of the biggest shopping days of the year.

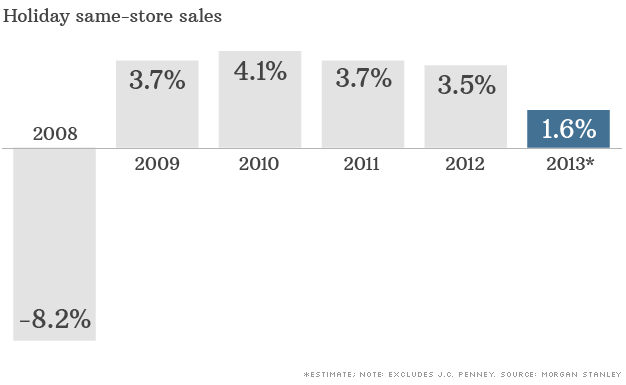

Always ready to rain on your holiday equity parade, Morgan Stanley announced that 4th quarter retailer same-store sales growth for 2013 (excluding hard-luck JC Penney) are expected to be less than half of that for 2012, and the lowest since 2008:

Here at Turnkey Analyst, we are always on the lookout for extra helpings of holiday cheer, and so when we noticed that a number of retail names passed our quantitative screening measure for price, quality, and financial strength, we decided to share the holiday spirit.

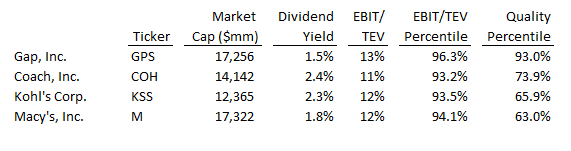

Here are four retailers that meet our systematic value/quality criteria:

We have a good idea, from herd leaders such as Morgan Stanley, about why these retailers are cheap: anemic sales expectations. And these stocks are all very cheap indeed, residing comfortably within the top market decile for cheapness within our screening universe (consisting of equities with >$1.5bn market cap). Yet these shunned names also exhibit statistical signs of being high quality, financially strong businesses.

Daniel Kahneman discusses the availability heuristic, in his book “Thinking Fast and Slow.” The availability heuristic describes how people often form their assessment of conditions or events by drawing from examples that are most easily available to their memory.

Divorces among Hollywood celebrities and scandals among politicians attract much attention, and instances will come easily to mind. You are therefore likely to exaggerate the frequency of both Hollywood divorces and political sex scandals…A plane crash that attracts media coverage will temporarily alter your feelings about the safety of flying.

Likewise, is it possible that extensive press coverage of the slow retail season has an influence on the likelihood that investors will purchase retailer names? We think it is possible.

As Kahneman further points out, “The proof that you truly understand a pattern of behavior is that you know how to reverse it.”

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.