The famous (perhaps infamous to some folks) John Maynard Keynes has a great quote related to technological unemployment from his essay, “Economic Possibilities for our Grandchildren:”

[Technological unemployment] means unemployment due to our discovery of means of economising the use of labour outrunning the pace at which we can find new uses for labour.

Source: http://www.aspeninstitute.org/sites/default/files/content/upload/Intro_Session1.pdf see pg. 4

For those interested, here is an interesting discussion of Keynes piece:

http://www.tellus.org/documents/stutz.pdf

h.t. Ron C.

What does Keynes mean by technological unemployment?

Well, there is a simplistic, but convincing, story that technology is bad for unemployment because machines/robots/automation displace humans. The concept is intuitive: I’m a textile working making a decent living and all the sudden someone invents a machine that can do my job 10x cheaper.

Here is a video of a pretty sweet robot riding a bike like a champ!

Unfortunately, the empirical evidence over the past 100 years hasn’t backed the technological unemployment position. Productivity has gone up a lot, but unemployment has stayed relatively stable and world economic output has grown.

So why aren’t we all unemployed?

The story goes something like this…some technology enters the system–let’s say agriculture technology. Now everyone pays half as much for vegetables as they did before the technology. All else equal, people has more disposable income to spend on other goods, or put another way, there is increased demand for other products. This increased demand will spawn new industries who will then rehire those workers displaced from outdated businesses. Overall GDP is higher and unemployment is unchanged. There is a short-run adjustment period, but the long-run equilibrium is good to go.

But what happens if the technological change is dramatic and workers from outdated businesses can’t “retrain” themselves? One hypothesis is that the economy might end up with a growing group of unskilled unemployed workers with no ability (or incentive?) to adapt to the new economy. The economy as a whole will be richer, but the wealth between those who can adapt and those who cannot will widen. In some sense, the economy reflects predictions from Darwin’s Theory of Natural Selection. Adapt or die. Yikes!

If you’d like to learn more, here is a great link: http://www.economicshelp.org/blog/6717/economics/the-luddite-fallacy/

Just how many jobs are subject to technological unemployment?

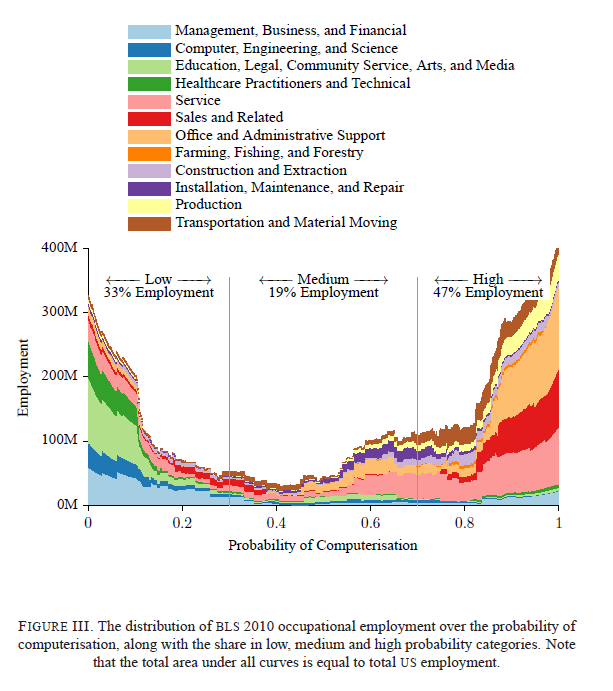

Carl Frey and Michael Osborne have an interesting paper on the subject, “THE FUTURE OF EMPLOYMENT: HOW SUSCEPTIBLE ARE JOBS TO COMPUTERISATION?”

We examine how susceptible jobs are to computerisation. To assess this, we begin by implementing a novel methodology to estimate the probability of computerisation for 702 detailed occupations, using a Gaussian process classifier. Based on these estimates, we examine expected impacts of future computerisation on US labour market outcomes, with the primary objective of analysing the number of jobs at risk and the relationship between an occupation’s probability of computerisation, wages and educational attainment. According to our estimates, about 47 percent of total US employment is at risk. We further provide evidence that wages and educational attainment exhibit a strong negative relationship with an occupation’s probability of computerisation.

Speed of change and ability to adapt–are we prepared as an economy?

For those of you following the robot revolution and the wave of information technology entering the world of commerce, you can vouch that there is no doubt that “the world is a changing.” We are all going to be replaced by a robot at some point. The real question is if people getting displaced are willing and able to adapt to the new economy?

If these authors are correct, we better all put our “semper gumby” hats on and prepare to learn new skills in the future. And if you don’t feel like changing, you’ll likely be collecting a welfare check in the near future.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.