How can one optimize performance and decision-making when one is affected by scarcity? This is the subject of Part 2 of our 2-part scarcity series.

In Part 1 (http://alphaarchitect.com/2014/01/02/the-psychology-of-scarcity-part-1-of-2/), we discussed the framework for thinking about scarcity found in the book, “Scarcity: Why Having Too Little Means So Much,” by Sendhil Mullainathan and Eldar Shafir.

We start Part 2 with some observations supplied by the authors that can be applied to everyday life, and then we try to use the framework to assess a critical investing question that concerns asset managers: asset allocation.

As always, it is instructive to look to the past for insights into the present. Mullainathan and Shafir discuss how Henry Ford recognized the effects of scarcity about a century ago:

When Henry Ford famously adopted a 40-hour workweek in 1926, he was bitterly criticized by members of the National Association of Manufacturers. But his experiments, which he’d been conducting for at least 12 years, showed him clearly that cutting the workday from ten hours to eight hours – and the workweek from six days to five days – increased total worker output and reduced production cost. Ford spoke glowingly of the social benefits of a shorter workweek, couched firmly in the terms of how increased time for consumption was good for everyone. But the core of his argument was that reduced shift length meant more output.

Henry Ford’s genius was to recognize the importance of reducing bandwidth constraints among his workers – thus counteracting scarcity – by reducing working hours, and shortening shift lengths that promoted tunneling; this, perhaps paradoxically, made them more productive. We might all benefit from managing our own bandwidth issues, rather than focusing on the simplistic paradigm of hours worked.

Google seems aware of Ford’s insight and how it relates to the bandwidth of today’s technology employees. If you currently work for Google, you can take a quick nap in a sleep station, which is based on NASA technology:

This is an attempt to create slack, as a buffer against sleep deprivation, and is a tool allowing employees to avoid the sleep scarcity trap. This article discusses how effects from a 10 minute nap can last for up to 2.5 hours (http://online.wsj.com/news/articles/SB10001424127887323932604579050990895301888)

Creating White Space

The usefulness of slack extends far beyond sleep. By creating slack, or “white space,” we eliminate any number of constraints that drive scarcity. Time is a common constraint for today’s harried worker. To combat this, you might create space in your calendar by not scheduling meetings and calls too densely. Then, when, say, you get stuck in traffic, you don’t suffer cascading effects on your schedule.

Vigilance

The authors observe that a single, one-time choice is easier to make than a series of consistently repeated choices, which might be described as effectively imposing a “vigilance tax.” Therefore, when possible, convert choices requiring ongoing, bandwidth-intensive vigilance to one-time choices. Sign up for automatic 401(k) contributions. Enroll in automatic bill pay. Sign up for EZ Pass. Put those gym runs, or weekly activities with your kids on your calendar once, instead of waiting to assess your availability, when you are vulnerable to scarcity effects. Be thoughtful about health consequences of food once a week, while shopping, instead of every time you go to the refrigerator. These small changes can reduce tunneling and neglect resulting from getting hit with repeated bandwidth taxes.

Asset Allocation

Scarcity arguably significantly affects the asset allocation question, as decisions about asset management naturally tax bandwidth in various ways, especially given the broad range of issues and tradeoffs to consider.

A quick look at the iShares website highlights 298 options to choose from–talk about some bandwidth tax!

Allocation Plan

First, what are your objectives, and tolerance for risk? Which markets should you invest in, and how should you allocate across those markets? What are the returns, standard deviations and correlations between asset classes?

People crave specific domain knowledge about and within each market to help them make informed choices. The scarcity of knowledge and clarity may drive tunneling behavior, driving narrow framing, and impeding efficient portfolio-level decision-making. We suffer a bandwidth tax on our executive function, which leaves us vulnerable to impulsive decision-making.

Complexity consumes bandwidth and may delay our decision-making, as we become distracted or overwhelmed. Attempting to sort through the dense information flow, we may fall back on our need for coherence by relying on news and “experts” who further tax bandwidth and distract you from efficient decision making (see our blog post about this: http://alphaarchitect.com/2013/12/12/financial-news-satisfying-your-need-for-coherence/).

Time Horizon and Liquidity Shocks

Drawdowns represent perhaps the ultimate scarcity in investing. Therefore how much slack should you build into your portfolio to accommodate adverse market environments but still achieve long term portfolio objectives? Some liquidity buffer is prudent, but what is the appropriate allocation to more liquid investments, government bonds, or cash?

A perceived scarcity of investing time may cause us to tunnel on reducing risk, and hyperbolic discounting may cause us to overvalue current liquidity. We can become focused on the short run and neglect our interests in being fully invested. Holding excess cash can be costly in the long run.

Conversely, we may fail to build in sufficient slack or “room to fail.” We may overallocate to illiquid investments, such as small caps, stocks with low trading volume, real estate, or partnership interests. If the market declines, a scarcity of liquidity may force you to sell in order to raise cash: yet another pernicious effect driven by scarcity.

Rebalancing and Diversification

Another key asset allocation question is: how should you dynamically rebalance and reallocate across asset classes over time? This requires vigilance, which taxes bandwidth on an ongoing basis.

Perhaps you you’re invested in only a few markets, where risks are concentrated. You suffer from scarcity of diversification or exposure to appropriate markets. This consumes bandwidth, as you worry about your positions, and drawdown risk associated with an individual asset class.

Obviously, the list goes on: taxes, inflation expectations, overconfidence in managers, appropriate benchmarking. Scarcity abounds in the asset allocation process. At virtually every step, scarcity taxes our ability to make effective decisions, for exercising self-control, for problem solving and planning.

Creating Slack for the Portfolio Allocation Problem

One has to ask: What is the value of complication in the context of asset allocation? If the complexity adds a ton of value, then the bandwidth tax might be worth the cost. However, if complex asset allocation schemes add little to no value, one must ask whether the complication is worth the bandwidth tax.

So what does the evidence say?

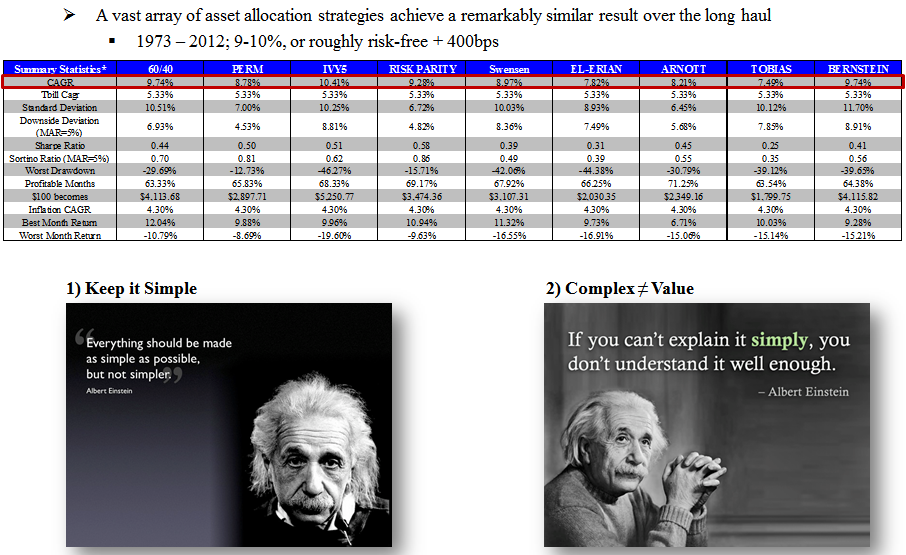

Meb Faber has mentioned a laundry list of asset allocation strategies and their corresponding results. We have done our own in-house assessment of these various asset allocation schemes.

The conclusion is surprising: Over the long-haul, all asset allocation schemes get you to approximately the same endstate…risk-free + 400bps.

What does this mean? Well, the evidence seems to suggest that a simple 60/40 or an equal-weight portfolio allocated across big-muscle movement asset classes is going to get you the 90-95% solution.

Is the extra 5% worth the complexity, fees, taxes, and bandwidth tax? Perhaps, but before we assume that we need all 298 iShares ETFs, we should at least make a calculated cost-benefit analysis as to the benefits of over complicating asset allocation.

A beginning solution to the asset allocation problem is wealthfront.com . We’ve got our own ideas on how to crack the nut, but for now, WealthFront is a great tool to lower bandwidth tax.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.