Psychiatric diagnoses: A study of how they are made

- Kendell, R. E.

- British Journal of Psychiatry, 122, 437-445

- An online version of the paper can be found here

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

A series of videotapes of brief diagnostic interviews, lasting only five minutes each, were held with a series of 28 patients at the time of their admission to hospital and then presented to groups of experienced psychiatrists who were required to make a diagnosis and a number of other ratings for each….

Test Design:

The content of each interview was presented in 3 alternatives ways—as a videotape, as an audiotape, or as a written transcript. All the author’s test are targeted towards understanding how different aspects of the information set affect judgement accuracy and reliability.

The null hypothesis is that behavioral cues from audio and video will help a psychiatrist diagnosis behavioral problems–Seems reasonable.

Here are the core results from the test.

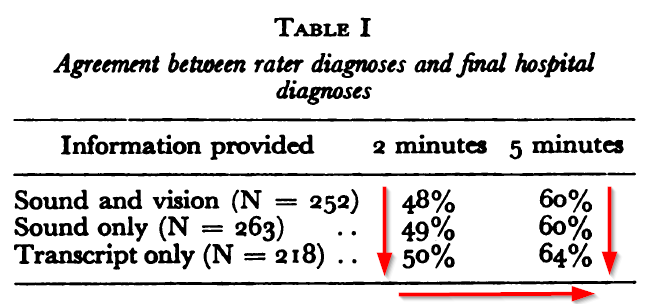

- The rater’s diagnoses were the same as the final hospital diagnosis in 48-50% after only 2 minutes of interview, and 60-64% at 5 minutes.

- Inner-rater agreement was over 75% under all 3 rating conditions.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The most fascinating result is that the transcript only information is the best information set to facilitate accurate and reliable forecasts. Behavioral cues had no ability to help predict behavioral issues.

Counterintuitive?

Less is more. In the words of Kendell (p. 443):

…it is actually an advantage for the total quantity of information to be restricted.”

Thoughts on the paper?

About the Author: Tian Yao

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.