The ETF structure is often regarded as being “tax-efficient.” However, many investors — even sophisticated professionals — often blow off the benefits of the ETF wrapper as “marginal.” However, the reality is that the tax-efficiency benefits offered by the ETF wrapper are potentially way more powerful than many investors realize.

Tax-efficiency of ETFs

Perhaps the most compelling write-up on the tax-efficiency of ETFs is one written by a law professor who compels the public to change the taxation of ETFs because he views ETFs as essentially a “tax swindle.”(1)

The professor states the power of the ETF wrapper in the context of better understood retirements vehicles:

Many ETFs have morphed into investment vehicles that offer better after-tax returns than IRAs funded with after-tax contributions…

The professor goes on in the conclusion to make the point clear in the context of HNW investors:

…[ETF taxation] unfairly benefits high-net-worth owners of ETFs.

One would think that statements like these would perk up the ears of investors allocating taxable wealth. However, various media outlets and mutual fund sponsors don’t make the information acquisition efforts any easier. For example, even the WSJ is confusing the public. An article on “The Myth of Cheaper ETFs” states the following related to ETF tax-efficiency:

But that advantage shouldn’t be exaggerated, according to David Blanchett, head of retirement research at Morningstar Investment Management, the advisory arm of Morningstar. “In most cases, the difference in after-tax returns between an open-end index fund and a comparable ETF is not going to be that material,” he says.

The claim above speaks to market-cap weighted index etfs or the equivalent mutual funds–funds that rarely trade. And of course, things that rarely trade rarely generate tax liability. It is therefore true that there are marginal tax benefits for ETFs relative to mutual funds when talking about market-cap weighted index funds.

But this misses the point of the ETF tax-efficiency debate.

What the debate is really about

The real debate here is with respect to funds that actually have trading activity. For example, active mutual funds versus ETFs that require rebalancing, e.g. factor ETFs or so-called smart beta strategies.

We’ve talked to hedge fund managers, mutual fund managers, and C-level executives at multiple billion-dollar financial service companies — many don’t really understand the tax benefits of ETFs. (By the way, if you want to really get in the weeds on this stuff, contact us directly and we’ll chat).

ETF folks get it, obviously–it’s their business!

And the tax-advantages of ETFs are not some secret squirrel financial-ninjas-only type of knowledge; it’s spammed all over the web.

Some examples:

A PDF version of this is available here.

Taxation of ETFs – let’s break this down Barney Style

Some assumptions:

- Assume we have ABC active mutual fund that follows a strategy that turns over 100% a year and generates a guaranteed 10% a year (they have a magical stock-picking formula).

- Assume we have XYZ active ETF that follows a strategy that turns over 100% a year and generates a guaranteed 10% a year (they also have a magical stock-picking formula).

- Assume that ABC mutual fund and XYZ active ETF are doing the EXACT SAME THING.

- Assume no dividend or income distributions (there is no ETF tax advantage for income/dividend distributions).

Note: “Active” refers to the fact the portfolio is changing and is not a buy and hold market-cap weighted index.

We buy $1,000,000 ABC and $1,000,000 XYZ on Jan 1 and plan on holding forever.

We’ll get the following situation at year end:

- ABC mutual fund will post a gain of $100,000, but also distributes a short-term capital gain of $100,000. The after-tax return will be around $60,000 (assuming marginal of 40%), or 6%.

- XYZ active ETF will post a gain of $100,000 and distribute ~$0 capital gains (more on this later). The after-tax return will be around $100,000, or 10%.(2)

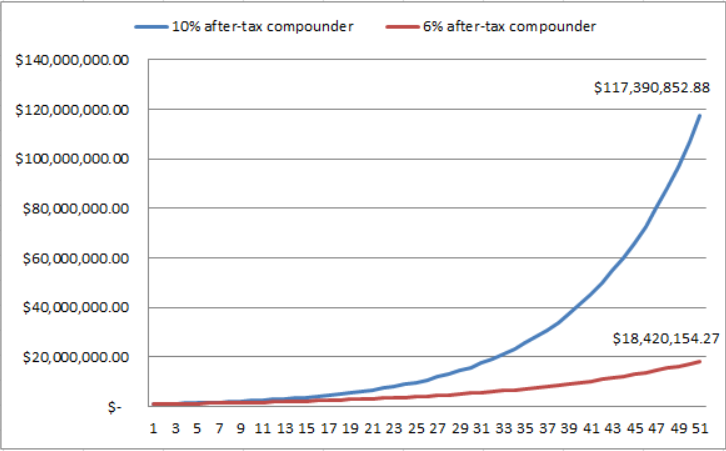

Compound $1,000,000 6% for 50 years and compound 10% for 50 years. Some will be amazed, whereas others will simply be reminded of the power of compounding.

How does the ETF structure allow investors to keep Uncle Sam from getting too rich?

Answer: In-kind transaction tax rules.

The example that follows is only one of the tools in the ETF tax-management kit–there are tools such as custom baskets, but it gets complicated. Just know that ETFs are a powerful and effective way of maximizing tax deferral benefits.(3)

What is the most basic tax-magic at work?

XYZ ETF does not sell ETF shares directly to the public. Instead, Authorized Participants (chiefly big banks and broker-dealers operating under MTM 475 elections) “create” blocks of ETF shares in the “primary market” by assembling a basket of securities representing the target portfolio and delivering it to the ETF custodian in return for ETF shares representing the basket. Authorized Participants then sell these ETF shares in the “secondary market” to retail investors, such as your grandma. Similarly, Authorized Participants may “redeem” blocks of ETF shares in the primary market, by turning in a block of ETF shares to the custodian, and receiving the underlying basket of securities in return. In both the create and redeem process, the exchange of ETF shares for individual shares in the basket are “in-kind,” meaning it is a stock-for-stock transaction. Here is where the magic starts, because stock-for-stock transactions are tax-free.

XYZ ETF receives creation and redemption requests throughout the year. Creation and redemption requests occur from “market makers” in the ETF want to exchange stock shares for ETF shares, or vice versa. When a creation request comes in, the stock lots that the ETF receives have mark-to-market basis, just as with mutual funds. However, when a redemption comes in, recall that the ETF manager does not sell stock and send the Authorized Participant cash, but follows the in-kind redemption process described above, but in a very specific way: the manager carefully selects the lowest basis tax lots and delivers them to fulfill the redemption request. These stock-for-stock transactions in the primary market, being tax-free, are essentially eliminating any low basis stock from the portfolio basket without a tax effect. In this way, the tax-basis on the securities held by the ETF can be averaged up towards the mark to market value of the portfolio over time, by consistently booting out low-basis stock and taking in current market basis. This redemption process can occur in a static portfolio that is not changing. Thus, when the time comes for XYZ ETF to rebalance, the tax consequences will be minimal because the ETF has been managing its basis up throughout the year. XYZ ETF is protecting wealth by systematically eliminating or reducing the tax liability of the underlying basket. At the end of the year, XYZ ETF sends out a Form 1099 that details the overall tax due on gains within the portfolio, but magically there is a $0 in the taxes-due column, even though the portfolio has been trading throughout the year. Also, the AP, who is a securities dealer, is subject to mark to market accounting rules — so they aren’t negatively affected by receiving a low basis security — their basis is the market value upon receipt.

ABC mutual fund could theoretically minimize taxes via in-kind redemption rules, but they don’t (why they don’t is a subject for another blog post). If ABC wants to rebalance, they sell stock, incurring a distributable tax liability, and buy their new portfolio. The series of taxable gains, generated through trading activity at rebalancing times, accrues cumulatively as a tax liability for ABC and is reported on ABC’s Form 1099 at the end of the year. Wham. The investor receives this tax bill at the end of the year, and he must pay it. ABC mutual fund is destroying wealth via tax inefficient rebalancing. Sure, the investor gets a step-up in basis, but they aren’t able to compound on the capital they just sent to Uncle Sam!

What does this ETF tax-efficiency debate mean for investors?

Let’s say you’re an investor that believes in active management, but you hate turnover because it kills your tax bill. You punt on the whole idea of active management and buy the Vanguard S&P 500 ETF or mutual fund (a passive mutual fund doesn’t generate much tax liability because it hardly trades). You’re stuck on a second-best solution: You’d love to take active bets, but a 50% after-tax return haircut isn’t worth the potential benefit.

What’s the potential solution?

The ETF structure.

You buy a strategy you like and don’t touch it.

You’ll compound tax-deferred (minus net income distributions) and the underlying turnover will have little effect on your after-tax results.

Of course, even though the ETF vehicle can potentially maximize your after-tax returns, don’t disregard process over tax-efficiency. Ensure that the ETF investment strategy aligns with your investment objectives. If you can find a great process and couple it with a powerful tax-minimization vehicle, you’ll get the active management alpha (in expectation), but minimize your tax drag. A win-win for investors!

References[+]

| ↑1 | hat tip to Brian Bruggeman @ Baker Boyer for bringing this paper to our attention |

|---|---|

| ↑2 | There will be a long-term deferred gain at the end, which will lower the benefit, but this complicates the simple point of pre-tax compounding. |

| ↑3 | Here is an angle on the mechanics and tax-efficiency of ETFs that is a bit more advanced and highlights why trading activity is not a requirement to facilitate the tax-efficiency of an ETF. This solution revolves around custom baskets. |

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.