The “anchoring bias” is firmly established in psychology circles, but a more recent area of focus within the field–social anchoring–is opening up some intriguing new possibilities for how anchoring affects us as investors, especially with respect to the public’s relationship with Wall Street.

The “social dimension” of anchoring, examines the extent to which an individual’s decisions are influenced by group judgments, as they can be in financial markets.

Why should we be influenced by the crowd to begin with?

Consider conformity, driven by the human desire to “fit in,” and the evidence on the wisdom of crowds. Perhaps, conforming behavior confers a survival advantage? For example, say we identify a beautiful swimming hole on a hot summer day. There is a wonderful opportunity to swan dive off the cliff and into the water, but the problem is we don’t know if the swimming area is 20 inches deep or 20 feet deep. Prior to finding the relaxing pool, we notice 50 people running in the opposite direction. Perhaps, “following the herd” is a wise approach, on average.

Certainly, humans benefit by cooperating with others, and an individual can be ostracized if he has a divergent view. If many different individuals independently arrive at a conclusion, then that conclusion is likely to be robust. Additionally, when an individual is under a heavy cognitive load, going with the crowd is often the right strategy, and an efficient strategy, requiring no extra thinking, which preserves scarce brain resources.

In short, there could be a strong evolutionary basis for such socially influenced behavior.

In “An Experimental Study on Social Anchoring,” (which can be found here: http://wwwuser.gwdg.de/~cege/Diskussionspapiere/DP196) Lukas Meub and Till Proeger explore the influence of “socially derived” anchors, that is, anchors provided by groups.

The authors collected a number of subjects for the experiment, and individuals were shown a formula and asked to make prediction estimates.

They had 2 versions of the task:

- A simple version, with a simple formula to review.

- A complex version with a longer formula, thus increasing the subject’s cognitive load.

They added 2 types of anchors:

- A “neutral,” non-social anchor.

- A “social” anchor, which were estimates made by the other participants. There’s a trick here though. The group estimates contained a randomly generated variable that eliminated all informational value of the group “consensus forecast” to the individual. The group estimates were, by design, useless.

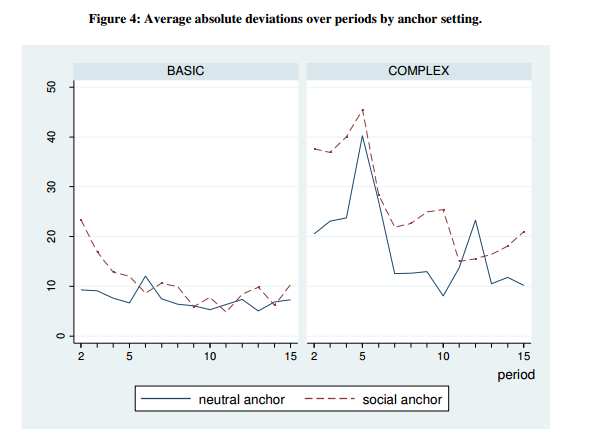

Below is graphical output from the study:

The blue line marked “neutral anchor” represents individuals subject to a non-social; the dotted red line reflects outcomes for individuals treated with the “social anchor.”

As you can see, when individuals were faced with the more complex estimating task, the anchoring effect was stronger for both neutral as well as social anchors.

Under heavy cognitive loads, when we are faced with a more complex tasks, we tend to anchor more strongly on information, which may be useless.

More interestingly, note that the effects of the social anchor are stronger than the neutral, non-social anchor, in both simple and in more complex tasks. Moreover, it appears that when we are faced with complexity, the social anchoring effect becomes even stronger when compared with effects of a neutral anchor. That is, when complexity and cognitive load increases, anchoring effects are magnified when the anchor is social – based on the judgments of the crowd. Social context has a clear influence on anchoring.

How might this apply in an investing context?

This has important implications for Wall Street. For example, Wall Street’s sell-side analysts provide high-profile, publicly available estimates, which in the aggregate form a group consensus forecast for corporate earnings.

In light of the study above, it seems clear that Wall Street consensus estimates provide powerful anchors for investors, especially when investors are under duress, and suffering from a high cognitive load. The evidence from this study suggests that social anchoring effects will be more pronounced: What Goldman Sachs has to say about XYZ’s earnings really influences our independent estimates for XYZ’s earnings.

Knowing that investors are likely to anchor on Wall Street sell-side analyst opinions, it would be interesting if we could systematically identify when Wall Street consensus forecasts were wrong.

That would be a powerful strategy. Luckily, there are tantalizing hints buried in academic research that such strategies are out there. It just requires a little curiosity to uncover them…more to come in the future…

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.