Do Hedge Funds Trade on Private Information? Evidence from Upcoming Changes in Analysts’ Stock Recommendations

- Klein, Saunders and Wong

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

Two large financial institutions recently settled allegations of selective disclosure of private information from supply-side analysts to hedge fund clients. These allegations lead us to explore two research questions: How widespread is this transfer of private information between analysts and hedge funds? Is there evidence that hedge funds trade advantageously on this private information? Using quarterly hedge funds holdings, we find evidence consistent with the view that large hedge funds traded profitably on upcoming analysts’ recommendation changes. First, we find a positive correlation between hedge fund trades and future changes in analysts’ stock recommendations (issued up to 2 days ahead of trades). However, we do not find a similar trading pattern for other institutions, such as banks, insurances companies and growth-oriented mutual funds. Second, individual hedge funds tend to trade prior to recommendation changes issued by a small number of brokers only, suggesting a favored hedge fund-brokerage house relationship. Third, hedge funds act as transient investors on trades made prior to recommendation changes, but act as longer-term investors for their other trades. Lastly, we provide evidence that hedge fund trades are profitable only when they are accompanied by a recommendation change. When hedge funds trade in equity with recommendation changes, they earn an annualized abnormal return of 9.96% for upgrades and avoid an annualized abnormal loss of 11.28% for downgrades. In contrast, abnormal returns on other stocks are not significantly different from zero.

Alpha Highlight:

This paper empirically addresses something that everyone in the hedge fund business already knows–the biggest fee payers on the street basically “own” the sell-side analysts. If you didn’t know about this sweetheart relationship, well, you do now.

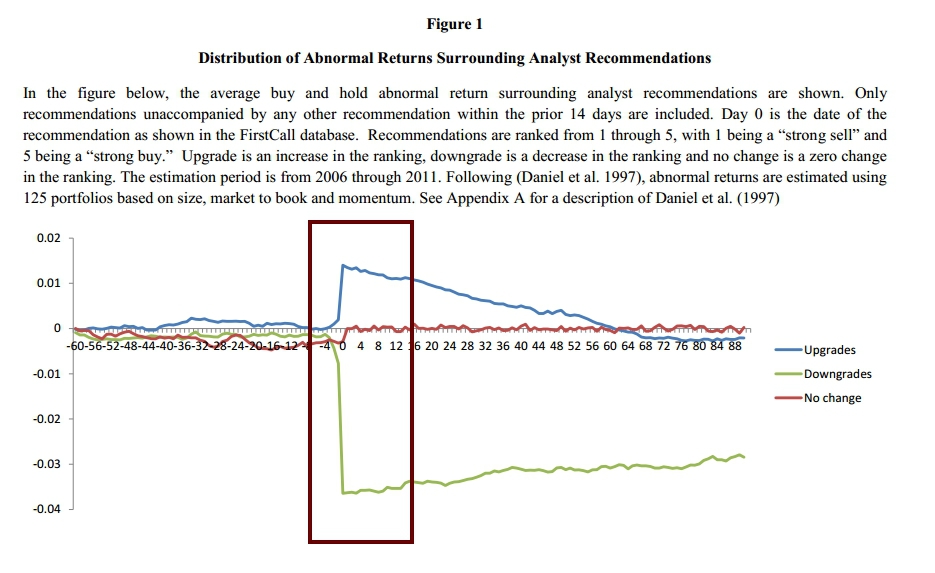

First, there is clear evidence that trading ahead of analyst upgrades and downgrades would provide some great returns:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

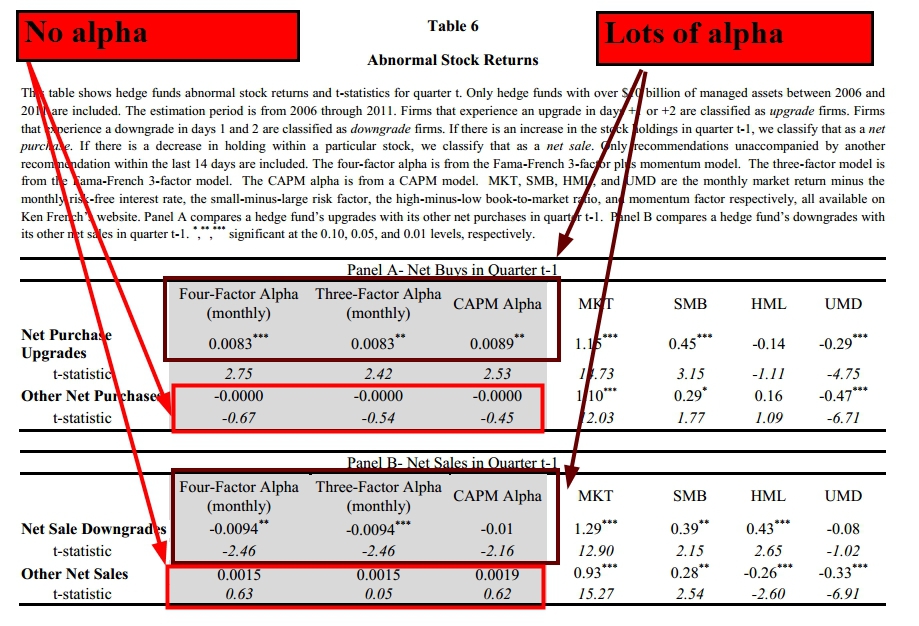

When the authors look at the performance of hedge fund stock holdings that are associated with analyst reports and those that are not, they find a clear pattern: all the alpha is in the stocks they are trading that have upgrades/downgrades attached to them.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Pay more fees to the banks, get more front-running opportunities…and we wonder why nobody trusts Wall Street…

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.