Financial advisers are ubiquitous in the US, where many investors hire them to assist with investing, financial planning and other types of financial decision-making. Advisers can be helpful when people lack the expertise or the time to devote to managing esoteric or complex financial questions.

If you seek advice in areas where information is ambiguous, however, and it’s hard to judge the quality of the advice based on your own knowledge, you can get stuck with a second order problem:

What is your basis for relying on the adviser in the first place?

Especially under conditions of uncertainty, what gives you confidence that the advice is good? When it comes right down to it, why should you believe what the adviser is telling you?

Periodically, it comes time to review these relationships. So how do people assess the quality of advice they get from their advisors?

How to Assess an Advisor?

Certainly, you can consider an adviser’s decision-making track record. How good has the advice been in the past? Has following the advice led to good outcomes? But this hindsight approach has its challenges.

Some decisions are rare. A home mortgage, for instance, a change in marital status, a windfall, or selection of a fund for a retirement account, may be one-time events, where it may take many years to see whether the advice was good. Additionally, adverse economic shocks, like the financial crisis, or idiosyncratic risks, like a huge drawdown in, say, a gold position, may also cloud your ability to judge the quality of the advice. So you may have to fall back on other means to draw firm conclusions.

Perhaps the adviser has similar values to yours. They exhibit a lot of professionalism. These presumably have something to do with their ability to provide advice, don’t they?

More generally, the most fundamental question one must answer is do you trust the adviser?

The best way to find out if you can trust somebody is to trust them. – Ernest Hemingway

We’re not sure we agree with Mr. Hemingway, at least in this context. As we move from observing tangible, performance-related outcomes, to more subjective approaches like “trust,” we can get into trouble. The problem is that we sometimes trust advisers based on criteria that have nothing to do with their competence. Our trust can be misplaced. That is, we may consider an adviser to be trustworthy, and thereby view them with approval, when in fact they are giving us bad advice. As it turns out, this happens all the time.

In “Individual Judgment and Trust Formation: An Experimental Investigation of Online Financial Advice,” by Agnew et al., the authors explore how trust is related to the assessment of advisor performance. The research highlights some surprising factors that influence our evaluations of an advisors quality, perhaps not surprisingly, many individuals evaluation metrics are entirely unrelated to the quality of advice given.

As a side note, while the research was conducted in Australia, we have few doubts that it reflects realities here in the U.S.

What Does the Paper Find?

The paper documents that people prefer younger advisers. They also prefer people who have professional certifications. Given the blizzard of existing certifications in the US, however, a certification may be misleading. People also are “sticky” with their advisers, perhaps exhibiting a form of endowment effect or familiarity bias, in which we underestimate the riskiness of something simply because we are familiar with it. Just because you’ve been with an adviser for 20 years does not mean you are getting good advice.

These factors may have nothing to do with providing good financial advice, and yet we rely on them.

Ambiguous situations give rise to additional opportunities for the clever adviser to game the system, and manipulate and exploit clients. For instance, the paper describes the psychological ploy of “catering,” where an adviser may agree with an investors suggested approach to gain trust. Once trust is established, they can then disagree with the approach and offer bad advice.

A particularly interesting finding was that people were heavily affected by advice related to easy financial topics, offered early on in an advisory relationship.

The paper describes an experiment in which advisers gave advice on “easy” topics, as well as on “hard” topics.

The researchers found that:

Put simply, if an adviser gives correct advice on an “easy” topic, the respondent can judge the quality easily, allowing them to form a firm opinion of the adviser. If this same adviser then follows with advice on a topic the respondent considers “hard,” judging the advice quality is difficult. Because the respondent can’t tell if this new advice is correct or incorrect, they interpret it in line with their prior view on whether the adviser is good or bad. As a result, a pre-existing good opinion of the adviser will be reinforced by “ambiguous” advice on a hard topic, regardless of whether the advice is really correct or not…advisers who can establish their trustworthiness early on an easy topic are still trusted after giving wrong advice on hard topics…

People can naively trust people in fancy suits bearing advice on financial matters. In many ways, it’s easy to gain an investor’s trust, which can then be increased with bad advice. As the research shows, all you need to do is show some familiarity with the simple stuff. If the investor trusts you based on the simple advice, you can say whatever you want about the hard stuff!

An example:

Easy Scenario. Adviser: “You have credit card debt and a large cash position. The interest you’re earning on the cash is less than the interest expense on the credit card debt. You should pay off your credit card debt.”

Hard Scenario. Adviser: “So you want to invest in an index fund. All these funds will match the index returns, but some have stood the test of time and have managers who are better known in the industry, and that kind of quality is really important for investors. You should avoid funds with low management fees, since these are going to be funds you’ve never heard of, with managers who aren’t well established.”

What’s that you say? This example is unrealistic?

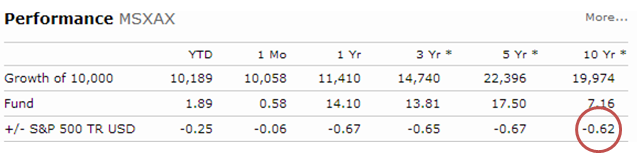

Consider the MainStay S&P 500 Index Fund Class A mutual fund (ticker: MSXAX), for which the expense ratio is 60 bps. Let’s look at Morningstar’s analysis of the past 10 years of its performance versus its index, the S&P 500:

As you would expect, the MSXAX trails its benchmark by the margin of its expense ratio. Now why would you invest in this fund, when you can invest in a tax-efficient ETF index for 5 bps?! We can’t really think of a good reason. In fact, we can’t think of a reason why this fund should even exist. Yet it manages $2 billion! It stands to reason that some financial adviser, somewhere, somehow, must be recommending it. And if so, this strikes us as objectively bad advice.

An index fund is a fairly straightforward example for many, but it illustrates the point that there are investors out there who are not thinking about index investing in the right way.

And so what happens when we move on to additional “hard” areas in finance? Questions about diversification; asset allocation; risk management; exotic hedge fund strategies; and so on. What about our favorite complicated subject–taxes?

The same concept applies. Just because an adviser can give you good advice on “easy” topics does not mean you should necessarily rely on advice in other areas. Studies show that we systematically overestimate the quality of advice we receive. The paper referenced above describes how the financial services regulator in Australia undertook a study of how consumers perceived the quality of advice they were getting:

They evaluated the quality of advice given to a small sample of Australians seeking retirement advice. They found only 3% of the advice could be considered good quality while the majority of the advice (58%) was adequate and the remaining advice was poor. Despite these low evaluations, most participants (86%) ranked the quality of advice as high. In addition, 81% trusted the advice they received from their adviser “a lot.” This suggests that people can have difficulty objectively assessing the quality of advice given.

At the end of the day, it’s very difficult to assess the quality of advisers and their financial advice. As a consumer of financial advice, you can at least be aware of common behavioral pitfalls to which you may be vulnerable.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.