Momentum Has Not Been ‘Overgrazed’: A Visual Overview in 10 Slides

- Claude B. Erb

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

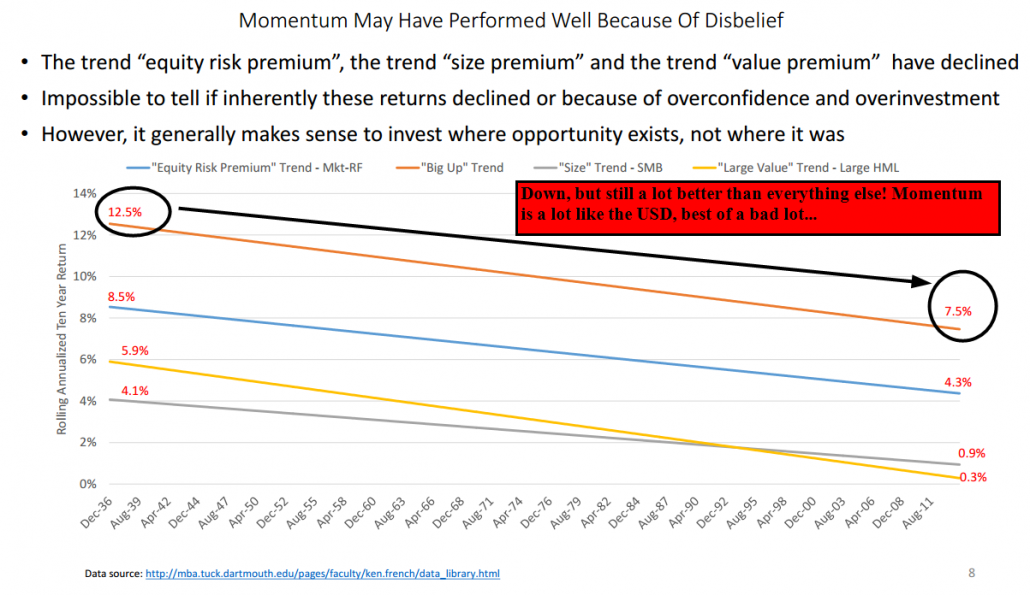

The return to “momentum” does not seem to be the victim of “overgrazing”. Conceptually, overgrazing occurs when too much capital chases too few investment opportunities which in turn leads to low returns. The “equity risk premium”, the “size premium” and the “value premium” seem to be getting close to a no-man’s land of return-free risk. A high degree of belief in “the kindness of strangers” could be driving the low equity risk premium, size premium and value premium. A high degree of disbelief in momentum could be driving what appears to be a trend large cap momentum excess return of about 7%.

Alpha Highlight:

Momentum still has the mojo!

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.