Clinical intuition and test scores as a basis for diagnosis

- Klehr, R.

- Journal of Consulting Psychology, 13, 34-38

- An online version of the paper can be found here

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

The present study has compared the ability of a group of 15 experienced clinicians to diagnose mental defectives and schizophrenics on the basis of purely qualitative interpretation of test responses, with the diagnostic results of applying an objective scoring technique to the same material. The material evaluated consisted of the CVS test responses of 36 subjects: 12 schizophrenics, 12 mental defectives, and 12 normals. The results indicate that the performance of the clinicians under these circumstances is comparable to the use of an objective scoring technique, both performances being significantly better than chance. A control group of graduate students did not differ significantly from chance.

Prediction:

In this experiment 36 subjects were chosen. The subjects were broken into 3 categories:

- Schizophrenics

- Mental defectives

- Normal

15 advanced level psychologists who had long experience in clinical testing were selected to evaluate these subjects’ “normality.” As a control, 15 inexperienced graduate students were also asked to evaluate the 36 subjects. There are two data sources:

- Results from a standardized intelligence test shown to predict mental defects (CVS)

- Experience and intuition.

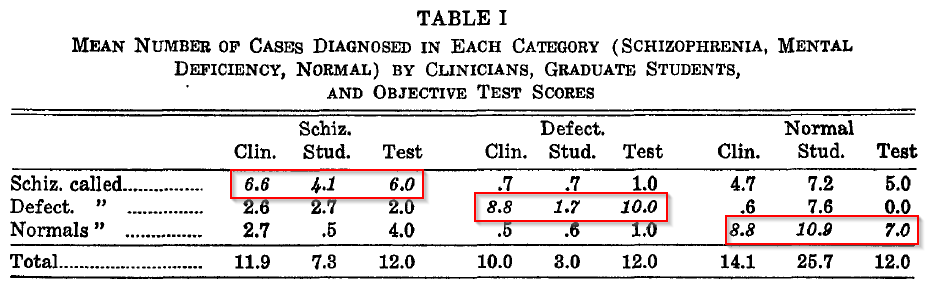

The results for the experiment are in Table I. On the left axis we have the actual diagnosis and then we have the performance of the different groups (clinical experts, grad students, and the systematic approach (test)).

How does this work?

Take line 1. As a benchmark, any group should get 4/12 correct identifications because the 3 categories are spread evenly among each group of 12. Of the 12 Schizophrenics, experts (labeled Clin.) called 6.6/12, the system got 6/12. Experts said .7/12 Schiz. were defectives; 4.7/12 were normals. The system said 1/12 were defectives; 5/12 were normal. The students were no better than chance. For calling mental defectives, the experts got 8.8/12 and the machine got 10/12. For normals, experts hit 8.8/12, the machine called 7/12.

- Experienced experts and the model have similar performance.

- Inexperienced experts have poor performance.

Thoughts?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.