The Agency Costs of Managerial Indiscretions: Sex, Lies, and Firm Value

- Cline, Walkling, and Yore

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

We examine a sample of executives accused of indiscretions in their personal lives for actions explicitly unrelated to the operations of their firm. These include accusations of violence, substance abuse, dishonesty, and sexual misadventure. While these actions are personal in nature, we find that they signal substantial agency costs for the firm. Companies of accused executives experience significant short-term and long-term wealth losses, and reduced operating performance in the period surrounding the alleged indiscretion. These firms are also more likely to be involved in shareholder-initiated lawsuits, DOJ/SEC investigations, and are significantly more likely to manage their earnings. While a large proportion of our executives keep their jobs after an alleged indiscretion, we do find that CEOs are significantly more likely to be fired for their missteps.

Alpha Highlight:

“Everything a CEO says and does is no longer personal. It is attributed to the company,” said by Shelly Lazarus, CEO (Gordon, 2007). This statement is especially true in a world with a 24/7 media presence.

This paper examines the impacts of indiscretions in management’s personal lives on firm values and operational performance. These managerial indiscretions include allegations of sexual misadventure, substance abuse, violence, and dishonesty. While having no direct link to the business operations or financial decisions of the firm, these personal misconducts might put a corporation at risk.

Why? Personal indiscretions are signals to the market relating to an executive’s utility function (e.g., an executive may not highly value his reputation) the market is often responsive to such signals.

Improprieties can be a big distraction as well, diverting management’s attention from the business both during an indiscretion, and when it is revealed. Another concern is whether such questionable activities may predict behavior in a corporate or financial setting. If a married executive is clandestinely dating a subordinate, is he also perhaps manipulating earnings?

To test the hypothesis that indiscretions affect corporations, the authors collect a sample of 301 indiscretions from 1978 to 2011. The improprieties studied were intentionally selected to be personal matters, and unconnected to firm operations.

Key Findings:

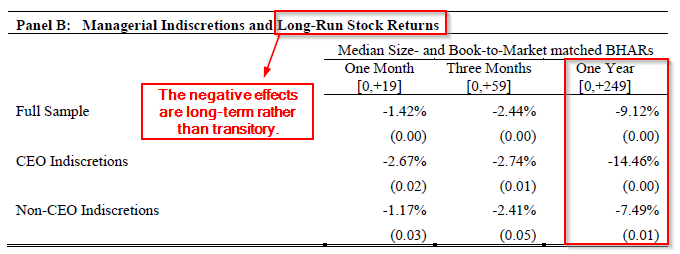

- Firm value and operating performance decrease significantly around the disclosure of an indiscretion. An immediate 3.8% loss in shareholder value occurs at the revelation of an indiscretion committed by CEO. This translates to an average loss of $320 million in market capitalization.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

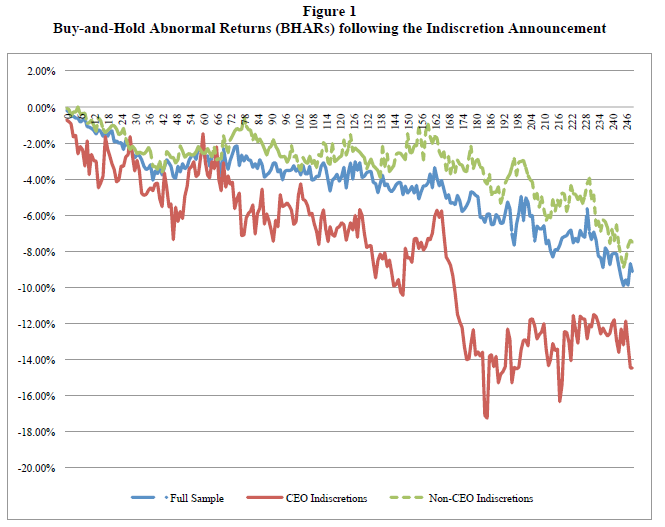

- The negative effects are long-term rather than transitory. Sample firms experience a long-run decline in value of 9% to 12% during the year in which an indiscretion is announced.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

- A significant abnormal decline of 1.5% in operating performance (ROA) in the fiscal year in which an indiscretion implicating the CEO is disclosed.

Charlie Munger is right:

The right culture, the highest and best culture, is a seamless web of deserved trust…Good character is very efficient. If you can trust people, your system can be way simpler. There’s enormous efficiency in good character and dis-efficiency in bad character.

Warren Buffett is also right:

Passion is the number one thing that I look for in a manager. IQ is not really that important…I’d say intelligence, energy, integrity. If you don’t have the last one, the first two will kill you. All you have is a crook who works hard.”

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.