Professors in the Boardroom and Their Impact on Corporate Governance and Firm Performance

- Bill Francis, Iftekhar Hasan, Qiang Wu

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

Directors from academia served on the boards of around 40% of S&P 1,500 firms over the 1998-2011 period. This paper investigates the effects of academic directors on corporate governance and firm performance. We find that companies with directors from academia are associated with higher performance and this relation is driven by professors without administrative jobs. We also find that academic directors play an important governance role through their advising and monitoring functions. Specifically, our results show that the presence of academic directors is associated with higher acquisition performance, higher number of patents and citations, higher stock price informativeness, lower discretionary accruals, lower CEO compensation, and higher CEO forced turnover-performance sensitivity. Overall, our results provide supportive evidence that academic directors are valuable advisors and effective monitors and that, in general, firms benefit from having academic directors.

Alpha Highlight:

Boards of directors play a pivotal role in corporate governance by establishing broad policies, deciding developing objectives and so on. A large percentage of directors in all kinds of firms are from academia. There are researchers who debate whether professors are helpful for board effectiveness and firm performance. This paper comprehensively investigates this issue and finds that academic directors are excellent directors, on average.

This paper examines a sample with all firms in the Investor Responsibility Research Center (IRRC) director database, which include 10,456 observations for 1,391 unique academic directors.

To capture the presence and the relative size of academic directors in the boardroom, the authors create the following:

- a dummy variable — Academic: this variable equals one if a firm has at least one academic director in the boardroom, and zero otherwise;

- a continuous variable — Academic Ratio: it captures the relative size of academic directors on the board by using the number of academic directors divided by total number of directors.

To measure firm performance the authors use two proxies:

- Tobin’s Q: the ratio of a firm’s market value to its book value;

- ROA: an accounting measure of operating performance.

Key Findings:

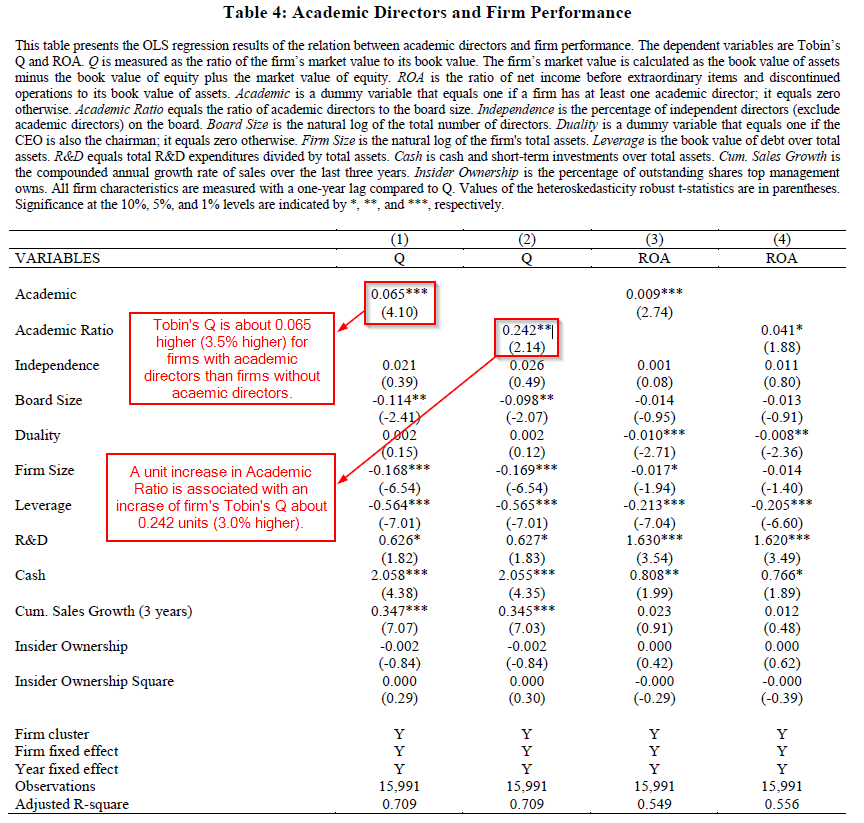

Table 4 from the paper presents the OLS regression results of the relation between academic directors and firm performance. The results shows both the presence and the relative size of academic directors on the board have a statistically significant and an economically meaningful impact on firm performance. Then paper further tests out that this relation is driven by professors without administrative jobs.

- Monitoring effectiveness: higher attendants to board meetings and more committee memberships;

- CEO compensation policy and CEO forced turnover: lower cash-based CEO compensation and higher CEO forced turnover-performance sensitivity;

- Financial reporting quality and stock price informativeness: less associate with discretionary accruals and higher stock price informativeness;

- Innovation: higher number of patents and patent citations;

- Acquisition performance: better acquisition performance.

Finally, the paper also notes that directors with business-related degrees have a positive impact on firm performance.

Okay, so who wants to pay Prof Gray a ton of money to work 1 day each quarter?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.