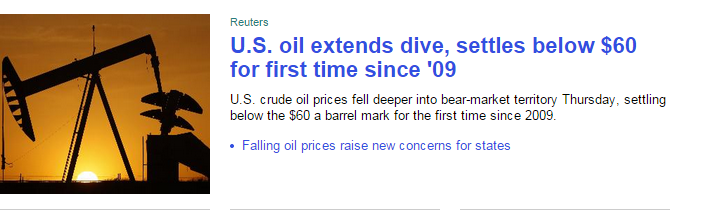

I just took a snapshot of the front page of Yahoo Finance, CNBC.com, and Bloomberg.com:

WHO WOULD EVER BUY AN OIL STOCK???

Apparently, nobody.

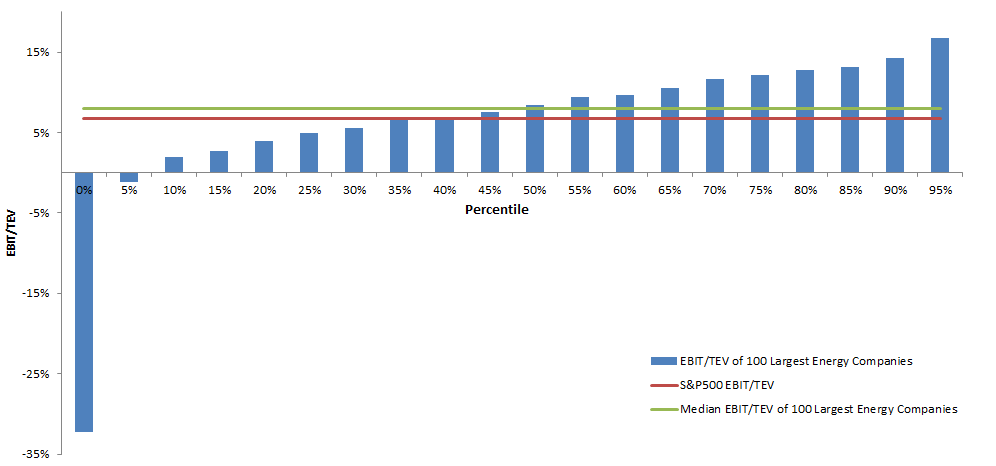

Energy companies as a whole have been blowing up left and right and now sell at a decent discount to the market.

Oil specific names are getting killed and they are also getting cheap (at least on an enterprise multiple basis).

Of course, cheap things can get a lot cheaper. Nonetheless, the long-term track record of buying cheap stuff is pretty clear (or here).

Here are the Top 10 cheapest energy names that are at least $2B in market cap (many have a large exposure to oil):

| Ticker | Name | EBIT/TEV Yield | Percentile Cheapness Rank |

| PBF US Equity | PBF ENERGY INC-CLASS A | 22.26% | 99.90% |

| VLO US Equity | VALERO ENERGY CORP | 20.98% | 99.80% |

| RIG US Equity | TRANSOCEAN LTD | 18.16% | 99.70% |

| SM US Equity | SM ENERGY CO | 17.22% | 99.50% |

| OIS US Equity | OIL STATES INTERNATIONAL INC | 16.72% | 99.40% |

| HP US Equity | HELMERICH & PAYNE | 16.29% | 99.20% |

| IOC US Equity | INTEROIL CORP | 15.61% | 98.70% |

| WNR US Equity | WESTERN REFINING INC | 14.85% | 98.10% |

| OXY US Equity | OCCIDENTAL PETROLEUM CORP | 14.17% | 97.70% |

| NOV US Equity | NATIONAL OILWELL VARCO INC | 14.13% | 97.70% |

If you’re a value investor, this should be exciting–not scary…

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.