Aaron Seager, a portfolio manager at Arbor Hill Advisors, offered up the following charts showing alpha over the past 15 years for Warren Buffett and an index of Hedge Funds.

Humbling to say the least…

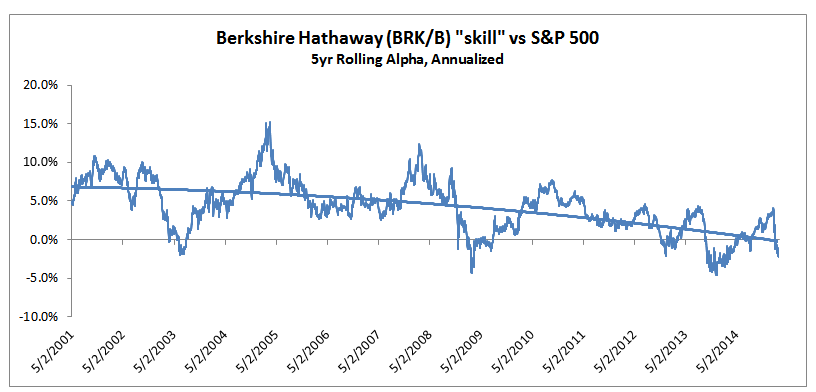

Warren Buffett’s Alpha

Warren Buffett arguably runs the most famous “value investing fund” in the world. His performance record over the past 50 years is extraordinary. But how has he performed over the last 15 years?

Below we highlight the 5-year annualized rolling alpha estimates of Berkshire relative to the S&P 500 (daily data of BRK/B-RF on SPY).

The pattern over the past 15 years is not on a positive trend…

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

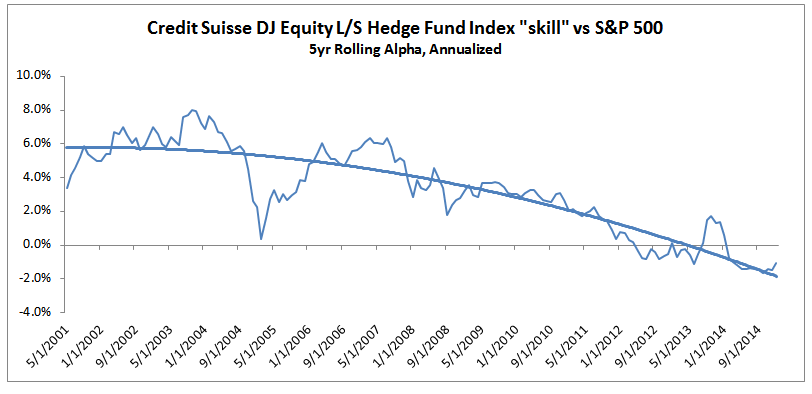

Hedge Fund Alpha

Hedge fund managers are considered the “masters of the universe” with their sophisticated organizations, slick marketing mechanisms, and extraordinary fees. How have the masters of the universe fared in recent memory?

Below we present the 5-year annualized rolling alpha estimates for hedge funds (monthly data on CS DJ Equity L/S HF Index on S&P 500 TR Index).

Again, the pattern over the past 15 years is not on a positive trend…

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Simple alpha estimates aren’t the end-all-be-all for performance assessment, and perhaps they are influenced by an underlying pattern in risk-free rates, but the trend to zero for some of the smartest people in the marketplace is not inspiring!

Question:

If Warren Buffett and the hordes of high IQ hedge fund managers can’t generate alpha, who can?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.