Last night, China’s principal benchmark, the Shanghai Composite index, collapsed 7.4%. Ouch! Now that’s what we call a drawdown!

Hundreds of stocks hit their daily 10% drawdown limit (where selling is not allowed below the limit price for the rest of the day). Chinese market news is exploding across the internet and we’re seeing panicky keywords like “freakout,” “nosedive,” etc.

So how bad was it?

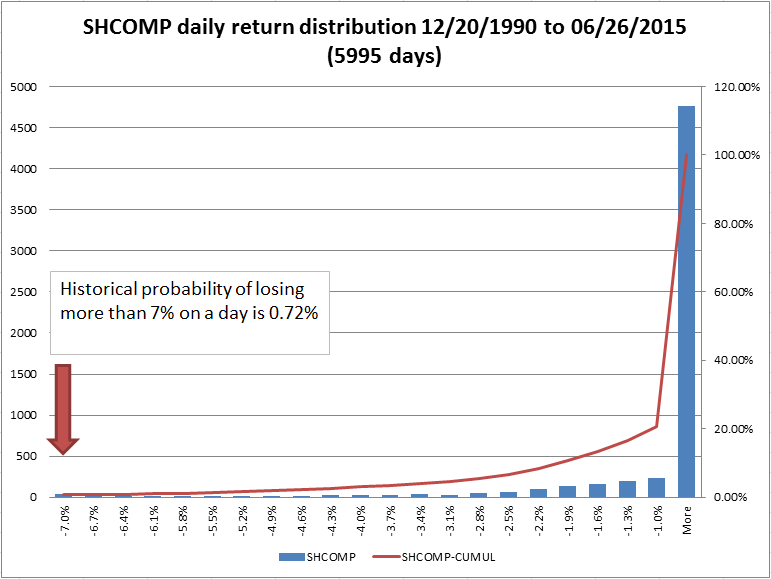

In order to evaluate this question, we ran a quick analysis based on the historical daily returns for the Shanghai Composite index. Between 12/20/1990 and 06/26/2015, the historical probability of losing more than 7% on a day is 0.72%! So was it pretty bad? Yes it certainly was, at least compared to fairly recent history.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

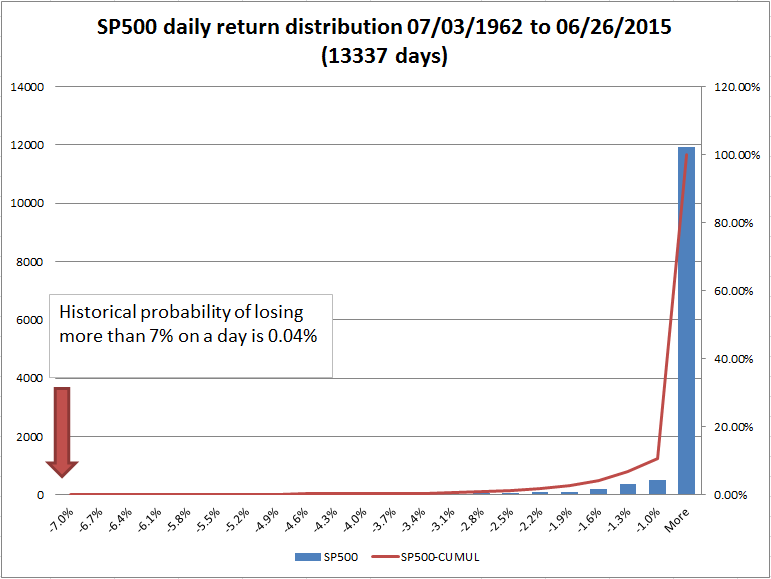

Next we looked at the S&P 500 daily return between 07/03/1962 to 06/26/2015. Note that this sample covers a significantly longer time frame. What if we saw a similar drawdown for the S&P 500? The historical probability of losing more than 7% in a day for the S&P 500 over this period is only 0.04%! A very rare event indeed.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Clearly, the carnage we observed yesterday in the Chinese markets would have even fewer precedents when viewed through the lens of US markets.

So this is a rare event by almost any standard, yet we are seeing this outcome in China today. So how concerned should we be?

One of the reasons that the market blow up we are seeing in China is so terrifying, is that 1) the market has already surged a lot (the Shanghai Composite had surged ~40% year to date, prior to last night’s pullback), and 2) a key driver behind the rally was the use of leverage. As the Shanghai rallied earlier this year, many individual investors had increasingly used leverage to finance additional purchases of securities.

So what can a 7.4% daily drawdown do to a leveraged portfolio? Assuming you have $1 million, and you use 6X leverage (which is in line with some leverage ratios we are seeing for Chinese individuals), your gross market exposure is $6 million. When you hit a 7.4% drawdown, you will lose $444K — basically half of your initial $1 million capital is gone. Poof! According to some reports, there are investors with upwards of 10X leverage. For those investors, that story will certainly not have a happy ending.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.