We sat down and did a quick and dirty analysis of the S&P sector ETFs on a YTD basis and over the past 2 months.

Here are the sector portfolios we used for our analysis:

- XLE Energy

- XLF Financials

- XLU Utilities

- XLK Technology

- XLB Materials

- XLP Consumer Staples

- XLI Industrials

- XLV Health Care

- Results are net of management fees and transaction costs. All returns are total returns and include the reinvestment of distributions (e.g., dividends). Data is from Bloomberg.

In Q1, healthcare and energy were cheap on a relative basis, but a value investor needed to be prepared for short-term volatility: healthcare’s future was/is unclear and oil prices were on a roller coaster ride!

Well, sure enough, the short-run volatility showed up!

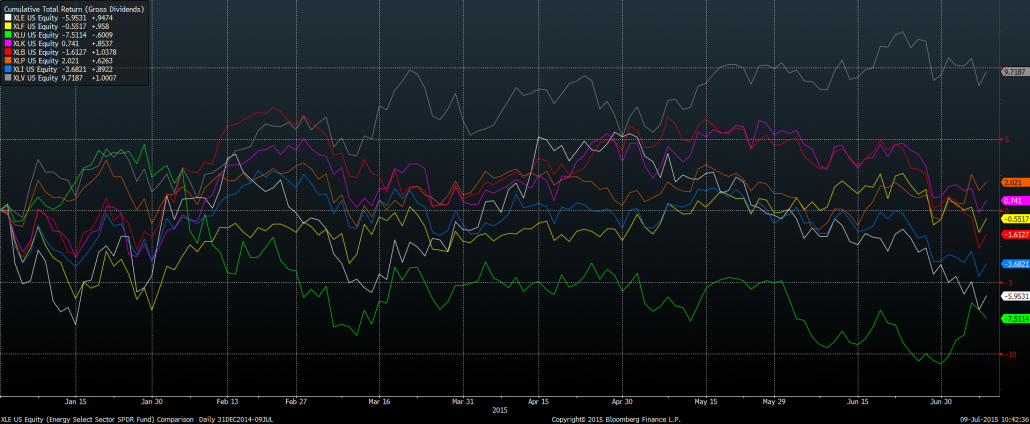

Here are the YTD charts for the sector SPDR ETFs:

- Health Care did the best by generating a total return of 9.7%

- Utilites did the worst by losing 7.5% YTD

- Energy has been on a whipsaw rollercoaster!

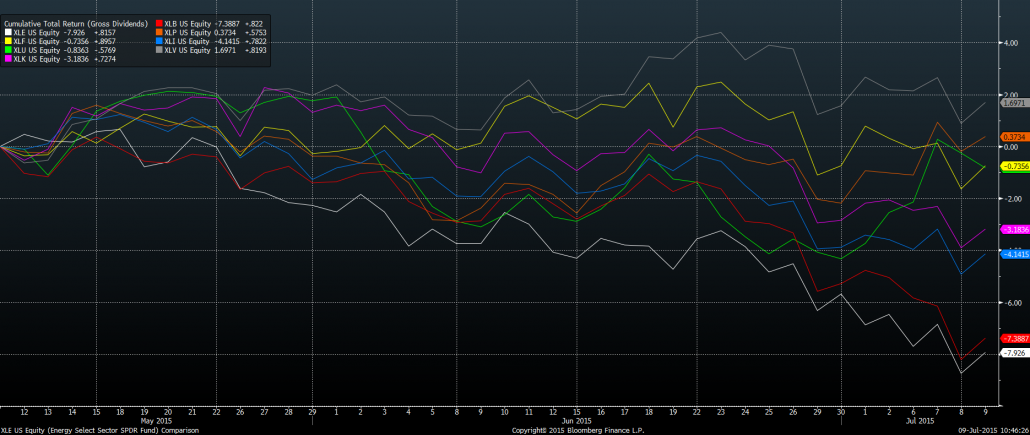

Here are the performance figures over the past 2 months–a volatile time in the market:

- Health Care maintained strong relative performance

- Energy did the worst by losing 7.9% over the past 2 months!

Value investors managed to catch a breather with healthcare, but energy investing has tried the patient of investors focused on the short-term!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.