Nobody can deny a simple empirical fact: higher fees are associated with lower returns, on average (Here is a great paper by Ken French on the costs of active investing). This finding, logically, leads investors to focus on low-cost solutions as opposed to high-cost solutions, all else equal.

But do the rules apply to large professional investors?

As the story goes, the large endowments and pensions have an edge due to their scale and access to talent. David Swensen is the classic example. The Swensen story concludes that some large institutional investors should not invest in passive low-cost solutions because they’d be missing out on the “opportunities” that scale and access can provide. Great story, and Swensen is a wonderful anecdote of this working in practice, but the plural of anecdote is data. And what does the data say?

A new working paper from the Maryland Public Policy Institute gives us a brief glimpse at the evidence and find that fees STILL matter, on average.

However, there are some serious caveats to this study, and the results are merely suggestive, and not conclusive.

- 5-year sample–hard to say much about anything with 5-years of data

- Bullish marketplace–alternatives and other low-beta asset classes will underperform–by construction–in a bullish market.

Bottomline: On average, fees have mattered over the past 5 years for the sample studied, but because of the inherent limits in the study, the debate of passive vs. active will rage on…

Wall Street Fees and Investment Returns for 33 State Pension Funds

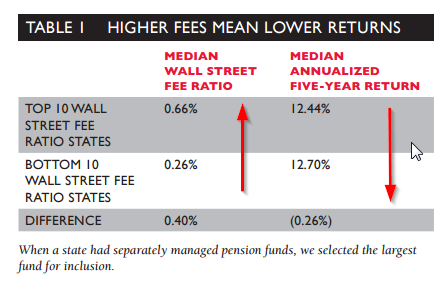

The study outlines fees and investment returns for state pension funds. The study concludes that states with the highest fees, as a percent of assets, had the lowest returns. The study shows a passive index mimicking state fund asset allocations provides higher returns. Private equity funds and hedge funds in which the states invested under performed relevant benchmark returns. The study provides some rationales for why the situation continues even though it costs states billions each year in foregone income.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.