The NFL is back!!!

Unfortunately, the Eagles may need a new kicker…and now we have to listen to Wes talk trash about the Cowboys victory around the office. Tragic!

In the spirit of the new NFL season, I figured it was a good time to highlight a newer paper titled “Corporate Sport Sponsorship and Stock Returns: Evidence from the NFL” written by Assaf Eisdorfer and Elizabeth Kohl. Versions of the paper can be found here and here.

Here is the abstract:

Most of the home stadiums/arenas of major-sport teams in the U.S. are sponsored by large publicly traded companies. Using NFL data we find that stock returns to the sponsoring firms are affected by the outcomes of games played in their stadiums. For example, the mean difference between next-day abnormal returns after a win and after a loss of the home team is 50 basis points for Monday night games and 82 basis points for post-season elimination games. Evidence suggests that this effect is partially driven by investor sentiment. The next-day abnormal return is further carried to subsequent days, providing profitable trading strategies.

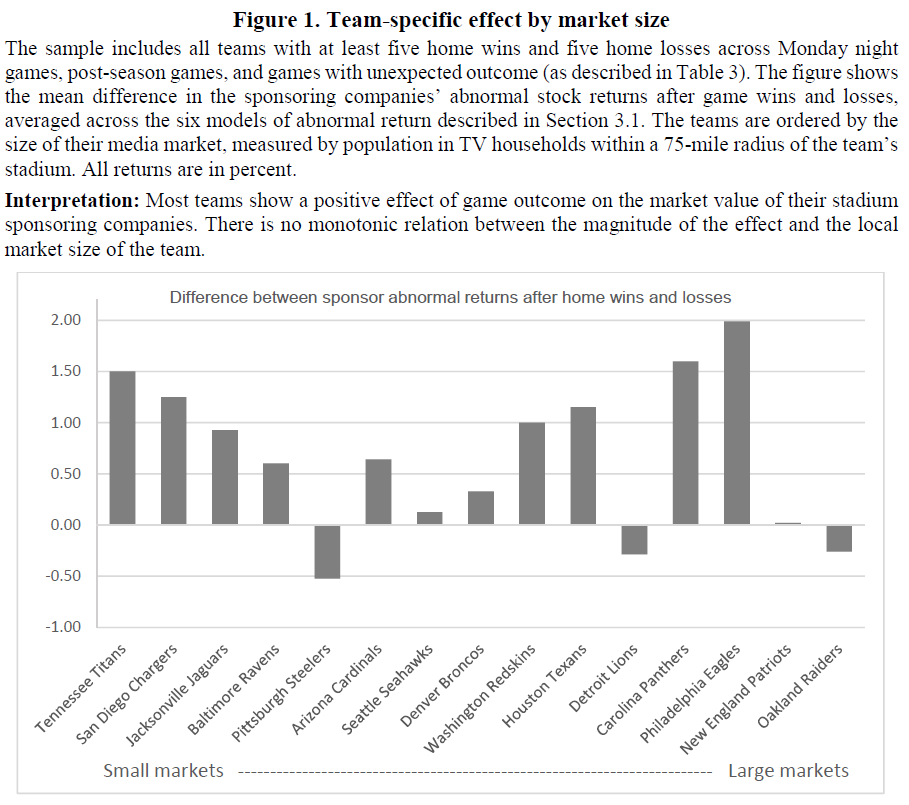

Here is an interesting table from the paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Is this a tradeable strategy?

Possibly, but I would not want to bet my own capital based on the outcome of a previous football game.

However, I am happy football is back!!!

About the Author: Jack Vogel, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.