SEC rules allow companies to delay the public disclosure of significant corporate events for up to 4 business days. This information is reported on an 8-K.

This 4-day gap between an event and the disclosure creates an interesting situation. As an insider, if I know an 8-K is going to report news, I may want to try and trade in that 4 day window when the information is not available to the broader market. Harvard and Columbia professors, Cohen, Jackson and

Mitts, explore this situation in their paper,”The 8-K trading Gap“.

Their research finds that corporate insiders take advantages of insider information during the “8-K trading gap”, and enjoy systematic abnormal returns from insider tradings. Of course, unlike finance professors, law professors have a disclaimer on their results:

…we wish to emphasize that our evidence in no way establishes the existence of illegal or improper conduct…The mere occurrence of an insider’s transaction during the 8-K gap is insufficient to establish liability of any kind under the securities laws.

With the legal disclaimer out of the way, let’s dig into the actual research paper!

First, what is the 8-K trading gap? From the paper…

When a significant event occurs at a publicly traded company, federal law requires the firm to disclose this information to investors in a securities filing known as a Form 8-K. But the firm need not disclose immediately; instead, SEC rules give companies four business days after the event occurs within which to file an 8-K. These rules thus create a period during which market-moving information is known by those inside the firm but not most public-company investors—a period we call the “8-K trading gap.”

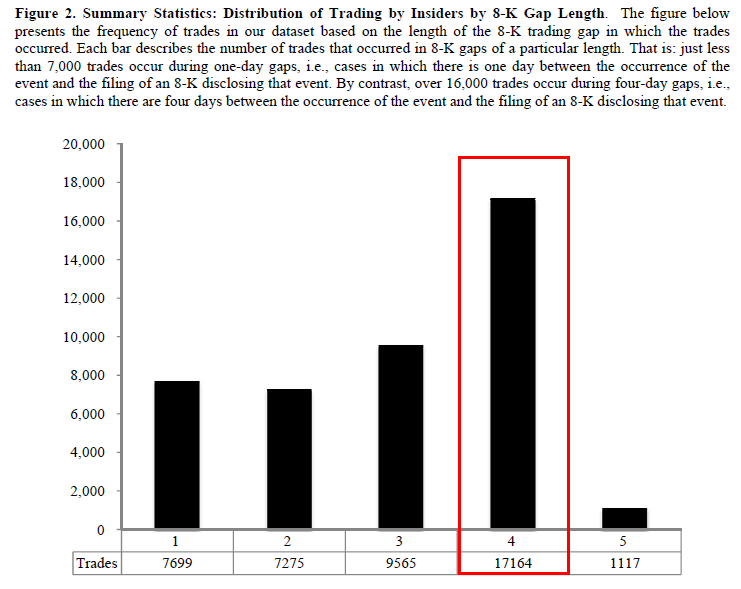

Figure 1 shows a histogram of the 8-K trading gap. Roughly 50% of firms exhibit a trading gap, which creates a unique insider trading opportunity. The sample contains 164,314 Form 8-Ks filed by 5,231 firms. Of that sample, there are 15,419 8-Ks that have associated insider transactions during the 8-k gap.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

But do insiders actually trade during the 8-K trading gap?

Yes.

Figure 2 shows the distribution of the insider transactions in the sample. Clearly, there is a lot of insider trading during the 8-K gap.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Okay, so it looks fishy. But are insiders profiting from this activity?

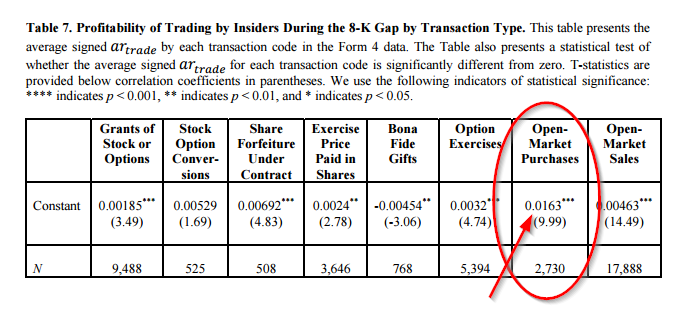

The paper finds that insiders enjoy systematic abnormal returns of 42.3 bps on average, per trade. These profits increases with the length of the gap. To be specific, adding one more day in a gap leads to a 13.3 bps increase in abnormal returns.

But it gets worse! Open market transactions earn an average abnormal return of 163bps…

Are these results believable?

This paper is almost unbelievable. How could a public company insider even consider this a legitimate transaction, even if it might be “legal” because of some esoteric loophole? Shouldn’t boards or compliance lawyers or someone be imposing some kind of blackout period covering this window of time? Seems too crazy.

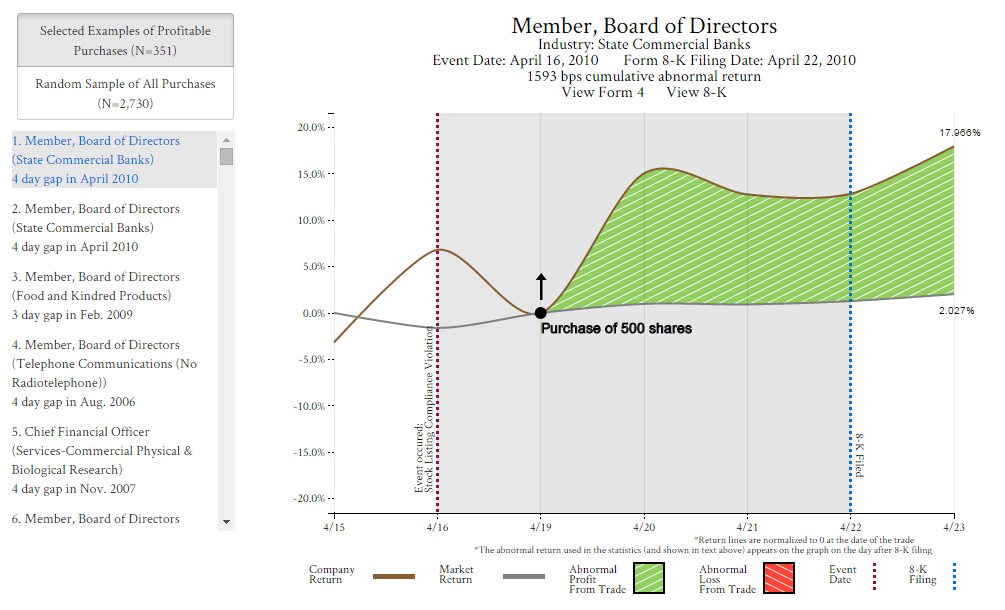

The authors recognized that their claims and evidence would be surprising. So they built a webpage, which presents hundreds of examples of insider tradings during 8-K trading gap. There is an example below:

Clearly some boards aren’t interested in imposing blackout periods, or even avoiding the appearance of impropriety through their shady trade timing. I encourage you to dig around on the site and review the transactions. Hopefully, the SEC investigates this situation and gets things squared away and/or gets to the bottom of this oddball insider trading opportunity.

Insider trading recaps from Alpha Architect:

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.