Chipping Away at Financial Reporting Quality

- Biggerstaff, Cicero, Goldie, and Reid.

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

Chief financial officers are responsible for managing the financial reporting process. We test whether the quality of a firm’s financial reports is a function of the effort expended by the CFO. Using golfing records to measure leisure consumption, we first show that CFOs consume more leisure when they have lower economic incentives to work. We show further that higher levels of CFO leisure are negatively associated with a number of indicators of financial reporting quality. The use of firm fixed effects and an instrumental variable analysis suggest that the observed relations are causal. Further tests indicate that higher leisure consumption is associated with shorter conference calls with a more uncertain tone. Finally, the effects of lower quality reporting are demonstrated by results linking CFO leisure with analysts’ forecast dispersion and weaker earnings response coefficients.

Alpha Highlight:

Biggerstaff, Cicero and Puckett (2014) show that a CEOs’ golfing frequency is negatively correlated with firms’ operating performance and firm value. In this paper, the authors look at the relationship between a CFO’s golfing frequency and a firms’ financial reporting quality. The punchline: CFO behavior matters.

The sample consists of 385 CFOs from 2008 to 2012, and the authors collect the golfing data from the United States Golf Association (USGA).

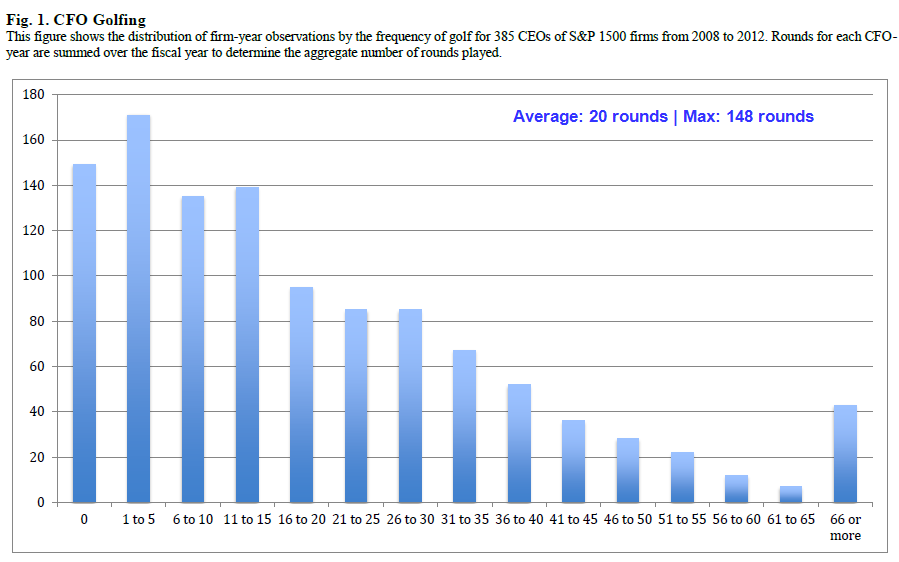

The chart below shows the distribution of the 385 CFOs’ golf playing rounds from 2008 to 2012. The average rounds that CFOs play per year are 20. Assuming an average round takes 5 hours and the average working hours/week is 40, this is roughly equivalent to 2.5 weeks of work. The maximum rounds that a CFO played in this sample is 148 rounds (4.6 months of work, wow!)

Key findings from the paper:

- The paper finds positive correlations between CFOs’ golfing frequency and accrual errors, discretionary accruals, and unexplained audit fees.

- Higher CFO leisure consumption is associated with a decreased quality and quantity of information provided during the earnings conference call.

- Higher CFO leisure consumption is associated with higher analyst forecast dispersion and lower earnings responses.

Watch out for firms where the CFO and the CEO are always golfing!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.