Hot off the press and haven’t had time to reverse engineer and verify, but this is pretty interesting stuff at first glance.

The Enduring Effect of Time-Series Momentum on Stock Returns Over Nearly 100-Years

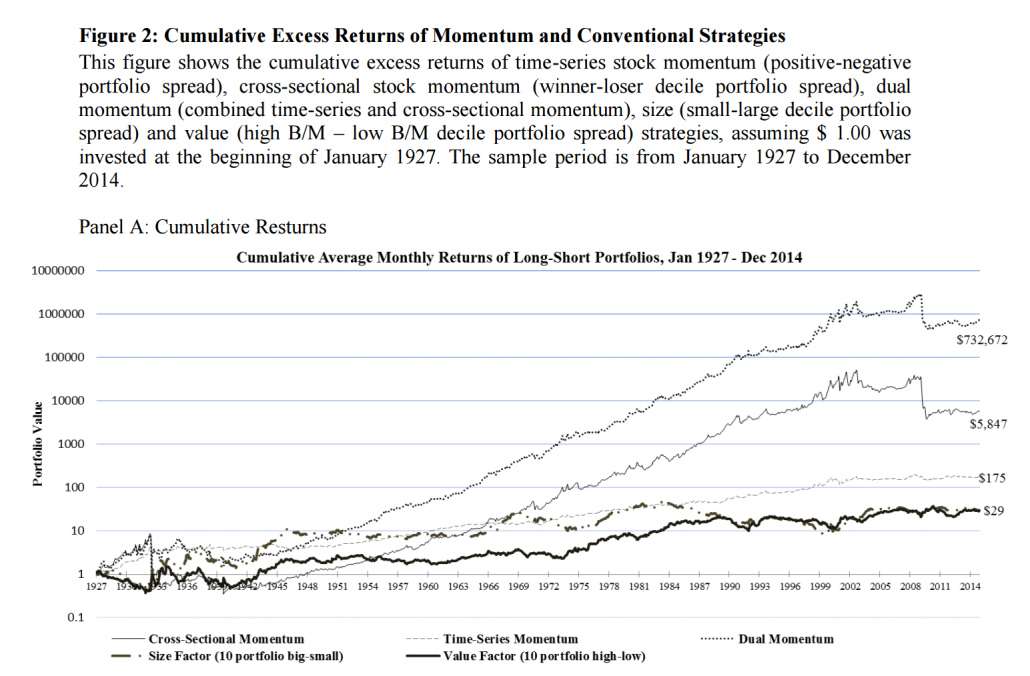

This study documents the significant profitability of “time-series momentum” strategies in individual stocks in the US markets from 1927 to 2014 and in international markets since 1975. Unlike cross-sectional momentum, time-series stock momentum performs well following both up- and down-market states, and it does not suffer from January losses and market crashes. An easily formed dual-momentum strategy, combining time-series and cross-sectional momentum, generates striking returns of 1.88% per month. We test both risk based and behavioral models for the existence and durability of time-series momentum and suggest the latter offers unique insights into its continuing factor dominance.

A picture is worth a 1,000 words:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

h.t., A. Miller @ http://www.miller-financial.com/ for sending our way!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.