The Deposits Channel of Monetary Policy

- Drechsler, Savov and Schnabl

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract

We propose and test a new channel for the transmission of monetary policy. We show that when the Fed funds rate increases, banks widen the interest spreads they charge on deposits, and deposits flow out of the banking system. We present a model in which imperfect competition among banks gives rise to these relationships. An increase in the nominal interest rate increases banks’ market power, inducing them to increase deposit spreads and hence restrict deposit supply. Households respond to the increase in deposit prices by substituting from deposits into less liquid, but higher-yielding assets. Using branch-level data on the universe of U.S. banks, we show that following an increase in the Fed funds rate, deposit spreads increase by more, and supply falls more, in areas with less deposit competition. We control for changes in banks’ lending opportunities by comparing branches of the same bank in the same state. We control for changes in macroeconomic conditions by showing that deposit spreads widen immediately after a rate change and even if this change is fully anticipated. Our results imply that monetary policy has a significant impact on how the financial system is funded, on the quantity of safe and liquid assets it produces, and on its provision of loans to the real economy.

Alpha Highlight

A lot of retirees love the prospect that the Federal Reserve may raise interest rates. With higher rates, there is less of an urge to reach out on the risk curve to achieve a desired nominal return bogie (we won’t discuss why this might be a good/bad idea, it simply is what it is), since a simple savings account should offer higher deposit interest rates. But do higher interest rates actually lead to higher returns on savings? One of my academic buddies, Professor Alexi Savov, co-authored an interesting paper that answers this question. He finds that for every 1.00% increase in interest rates, the rate banks pay on a typical savings deposit rises by just 0.34%. So even a 2.00% increase in rates would translate into a relatively paltry 0.68% bump in what consumers would receive from the bank. Not exactly a silver bullet for retirement planning.

Let’s review the paper’s two main results in a bit more detail.

1. Increase in the Fed funds rate leads to higher deposit spreads

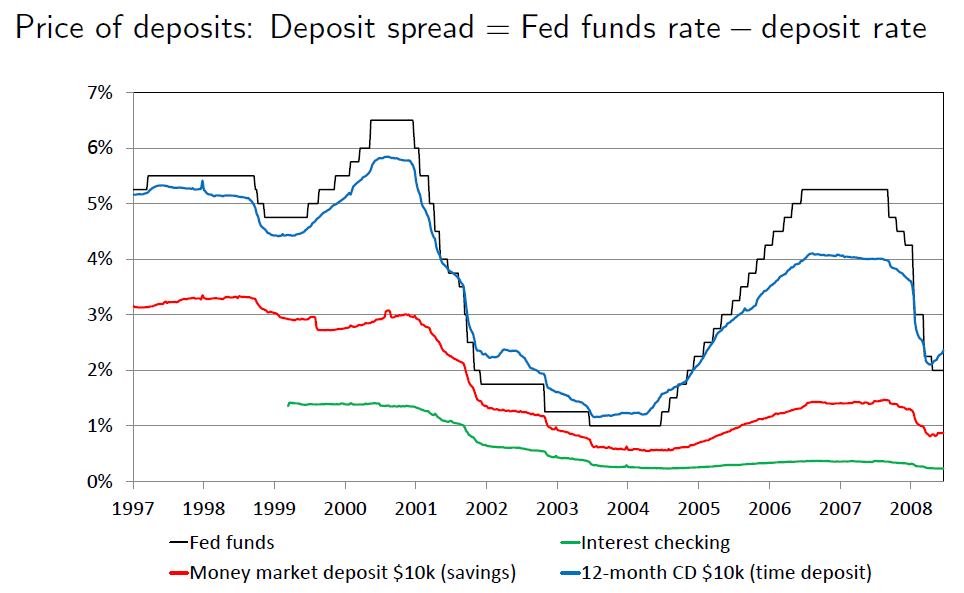

The figure below shows that when the federal funds rate increases, banks increase deposit rates as well, but less than one-for-one. In this way, deposit spreads widen. Especially for checking (green) and savings deposits (red), the deposit spreads are greater than 2% on average.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

2. Increase in the Fed funds rate leads to less total deposits

The chart below shows that changes in the federal funds rate are negatively related to the growth rate in savings deposits. In other words, when the Fed raises benchmark rates, depositors reduce their deposits. Interesting.

Here’s how the paper explains this weird phenomenon:

- When rates are low, banks face face competition from cash. So they must charge low spreads to attract deposits.

- However, when rates increase, cash becomes more expensive as an alternative, and thus banks have more market power. Banks are then able to charge their depositors more by keeping their deposit rates low. That’s why a Fed funds rate increase may facilitate deposit flows out of the banking system.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Going Forward

The results highlighted above suggest a few potential paths for banks. Banks with a lot of retail deposits stand to make a lot more money after liftoff (Liftoff refers to the situation when the Fed raises interest rates to more normalized levels). So if you’re a stock-picker, look for banks with branches in noncompetitive places like some of the regional banks in the Midwest. Second, to maximize profits, banks are likely to contract their balance sheets, making credit tighter. Third, from a personal standpoint it might be a good time to think about moving your money to a money market fund or an internet bank to avoid becoming “a profit center” for a bank. Of course, as others do the same you can expect Treasury bills and other safe liquid assets to become more expensive, impacting liquidity in financial markets more broadly.

Of course, this is all predicated on the idea that a “liftoff” will actually occur. Now that the world is seeing negative interest rates, there is a possibility that Liftoff will never be seen…

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.