Last year we highlighted what we deemed the “value investing pain train.”

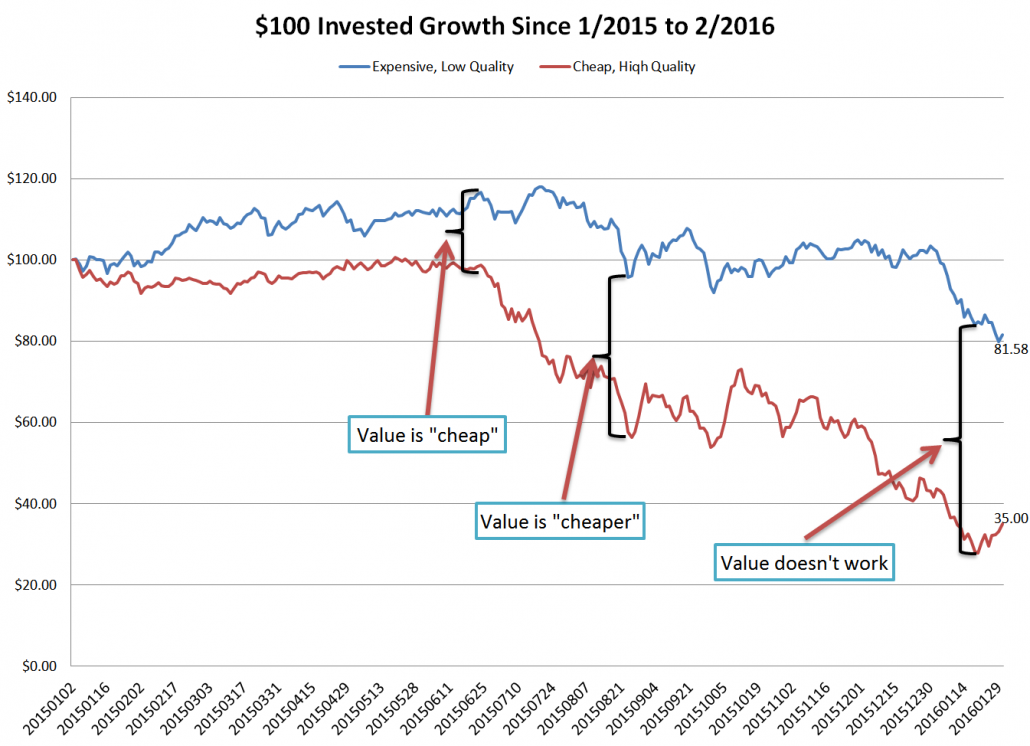

In 2015, cheap high-quality stocks started getting crushed by expensive junk stocks. Here is a recap of the carnage.

In many respects, value investing is a lot like Terry Tate — the huge “office” linebacker that would crush employees who made mistakes. His nickname: the “pain train.”

SAT answer: Terry Tate is to office employees, as value investing is to investors.

The value investing pain train: a visualization

Let’s look at the progression of the value investing pain train.

Here is a link to the source data: Price/Quality portfolio data. We examine value-weight returns for the cheap high-quality quintile and the expensive low-quality quintile. The daily returns run from 1/1/2015 to 1/31/2016. Results are gross of fees. All returns are total returns and include the reinvestment of distributions (e.g., dividends).

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

- Beginning of summer…value is getting cheap.

- End of summer…value is super cheap.

- End of the year…value is a stupid strategy.

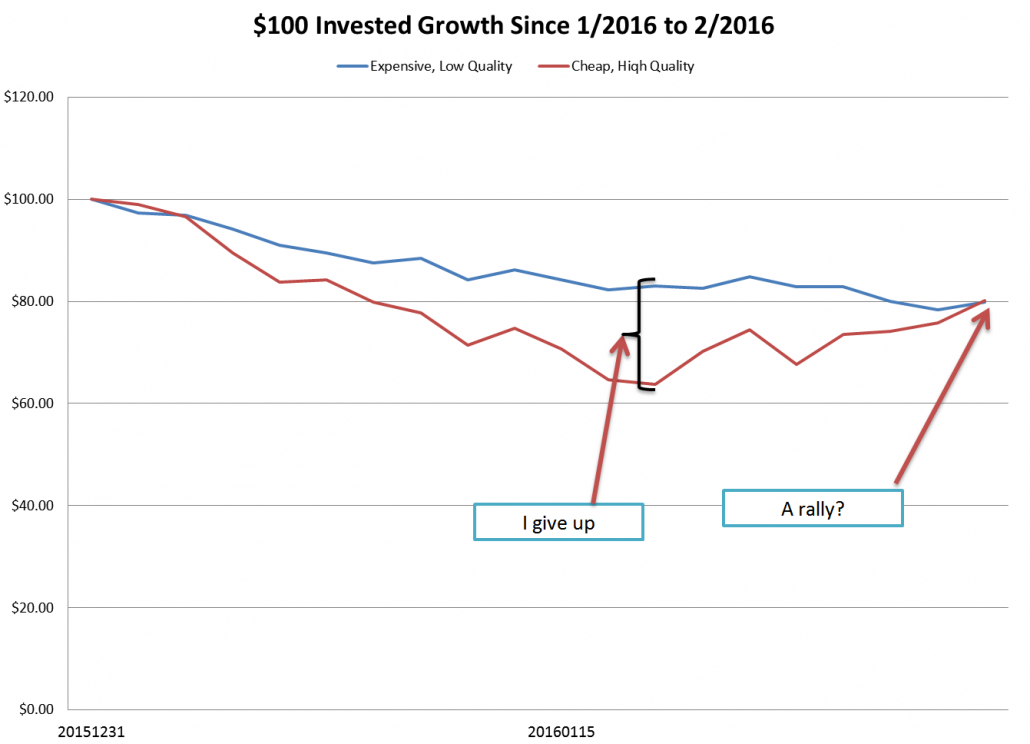

Fast forward to 2016. Below are the results for January from 1/1 to 1/31. Value started off on the wrong foot, possibly due to redemptions from 2015?

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Is value ready for a rally? Or is this a head fake?

The value investing propaganda starting coming out hot and heavy in February. Rob Arnott led the charge at Research Affiliates, with a piece with an amazing title, “How Can Smart Beta go Horribly Wrong.” A simple summary is that value investing has gotten destroyed and seems like a great opportunity. Buy RAFI products. Now. The public relations effort on behalf of value investing seems to have worked: February was an epic month for all things that buy cheap out-of-favor firms.

Great news for all of us who traffic in the stock market’s trash can.

A logical conclusion from the analysis and commentary above might be to buy value. After all, value has sucked wind for a long time and a lot of folks have given up on the strategy. However, we should be careful with “logical” conclusions. As we’ve said time and time again, active value investing has been digging manager graveyards since 1900 and this form of investing is simple, but not easy. The chart in 2015 highlights that relative performance can get a lot worse before they get better. And trust us, the chart from 2015 is not the exception, but the rule. Value investing is a long-term strategy that cannot be timed. You buy the exposure over time, sock it away in a lock box, and don’t touch it–no matter what.

The winners in the value trade are those who can hold the strategy when many other market participants have given up. The pain train seems to have subsided–and we hope that is the case–but the reality is that all value investors must be mentally prepared to do what others cannot. Or in the words of Cliff Asness, be prepared to see the grim reaper at your door!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.