Can Losing Lead to Winning

- Berger and Pope

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

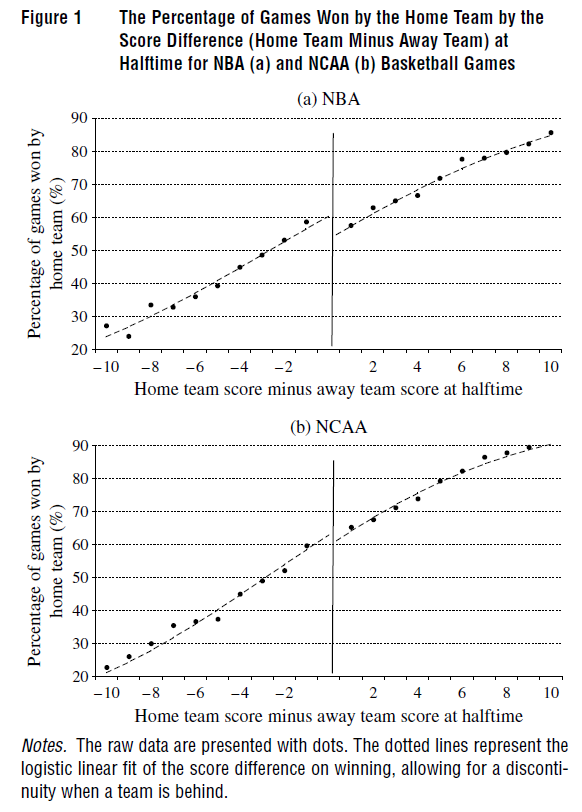

Individuals, groups, and teams who are behind their opponents in competition tend to be more likely to lose. In contrast, we show that through increasing motivation, being slightly behind can actually increase success. Analysis of more than 18,000 professional basketball games illustrates that being slightly behind at halftime leads to a discontinuous increase in winning percentage. Teams behind by a point at halftime, for example, actually win more often than teams ahead by one, or approximately six percentage points more often than expected. This psychological effect is roughly half the size of the proverbial home-team advantage. Analysis of more than 45,000 collegiate basketball games finds consistent, though smaller, results. Experiments corroborate the field data and generalize their findings, providing direct causal evidence that being slightly behind increases effort and casting doubt on alternative explanations for the results. Taken together, these findings illustrate that losing can sometimes lead to winning.

Highlight:

This paper highlights that being behind at halftime (in basketball) actually increases the probability of a team winning. The figure below from the paper, shows the simple probability of winning the game based on one’s halftime score.

“Our findings also speak to the ongoing debate about whether psychological biases persist in market settings… These findings have important implications for incentive design and motivating employees and others. Rather than giving people the full distribution (i.e., how they did relative to everyone else), telling them about their performance relative to the person directly in front of them should encourage everyone to work harder.”

Whether this applies outside of basketball is unclear.

Let us know what you think.

About the Author: Jack Vogel, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.