Quick question: What’s the difference between an “advisor,” a “financial advisor,” an “investment advisor,” an “independent advisor,” and a “registered investment advisor?”

Answer: Uhh…just stop…I’m already confused.

Confused? You should be…that’s the point. Large components of the financial services industry don’t want the investing public to be informed; they’d rather have “disclosure” that can be buried on page 1,000 of a disclaimer page.

The word “advisor” implies that this financial pro is going to help you — the consumer of financial services — make a good decision and look out for your best interests. But “advisors” can act in different capacities, depending on what it is they are actually doing. Fortunately, the definition of what “advisor” should mean in certain contexts goes to the heart of the The Department of Labor’s rule to codify the legal obligation advisors have to retirees. We haven’t powered through every page of the new document, but Michael Kitces has a good summary of the details that are most relevant. There are many other commentators more qualified to discuss the details.

We hope this piece is different.

This article is an educational piece that highlights the difference between advisors who can act in a broker-dealer capacity (sometimes referred to as “advisors,” “financial advisors,” or “FAs”) and registered investment advisors (sometimes referred to as “investment advisors,” or “independent advisors”) who act in a fiduciary capacity.

The difference between these various labels can be mapped back to legal obligations to the client: suitability versus fiduciary standards. In non-legal jargon, fiduciary is the “do what’s right” obligation, whereas “suitability” is the “do what seems reasonable” obligation.

Can you spot the broker-affiliate among the “advisors”?

Why is the suitability versus fiduciary distinction underlying the nebulous “advisor” label such an important aspect of financial advice? Primarily because there are huge conflicts of interest and an entire ecosystem dedicated to making sure that the word “advisor” is confusing and vague. For example, we present some case studies below and ask the reader a simple question — when is an “advisor” legally obligated to put your interests above theirs?

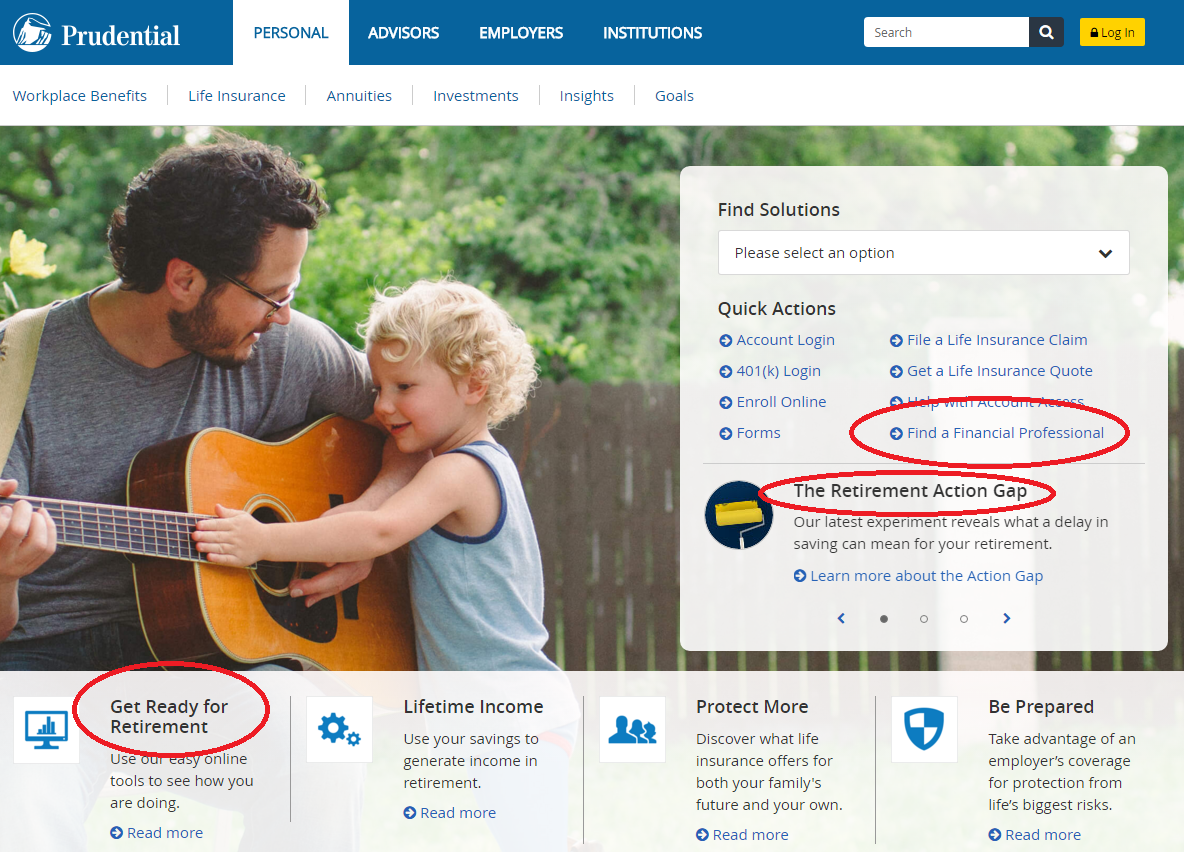

Example 1: Below is a site with a couple of references to “retirement,” and a link to “Find a Financial Professional.” So is this a fiduciary?

When we clicked on the “Find a Financial Professional” button and entered our location, we were directed to a local broker. We noticed that neither the home page nor the link actually uses the word “advisor.”

Example 2: Below is a site that gives you two helpful options: “find an advisor,” and “find a financial advisor,” and the site also refers to how you can “Explore the New Retirement.” If you’re looking for advice regarding your retirement assets, this sounds good, right? So what do you think? If you clicked the button, would you get to a fiduciary-based advisor?

Answer: It’s a trick question! The answer is…both.

Huh?

When we clicked on the “Find an Advisor” button, this site directed us to a nearby Merrill Lynch office. There was a nice advisor picture and bio. But then we noticed something strange. There was no mention of the licenses the advisor held, which would have helped, and no way to tell whether the advisor was a broker, or a fiduciary. Strange.

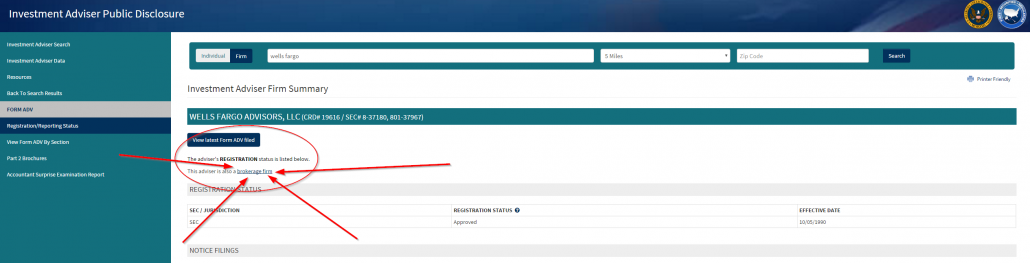

Luckily for us, the SEC can give us the answers we’re looking for, so we headed over to their web site at sec.gov, and entered the name we saw into the SEC’s database (You can do this too by going to sec.gov, clicking on “Education,” and choose “Check out a Broker or Advisor” in the pulldown).

It turns out this advisor is “dual-licensed,” both as a broker, and also as an “investment advisor rep.”

Boy that was hard to figure that out, right?! But if you’re like us, you will still be confused. Why? Because this “advisor” is BOTH a broker and a fiduciary.

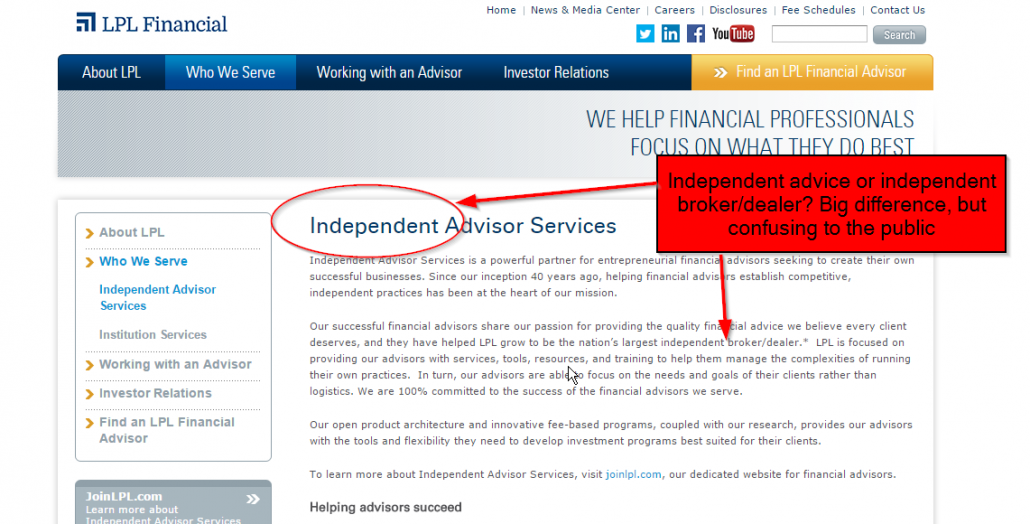

Example 3: Below is another site, again with references to how you can find a Financial Advisor. So is this a fiduciary-based advisor?

Answer: Another trick question! Again, it’s both. LPL offers a “hybrid” approach–where LPL Financial is a registered investment advisor and a broker-dealer–in which you can work with an “LPL Financial Advisor” but you have a choice between “Advisory Services,” and “Brokerage Services.”

Note the use of the word “independent,” but then also the reference to the broker-dealer. Tricky.

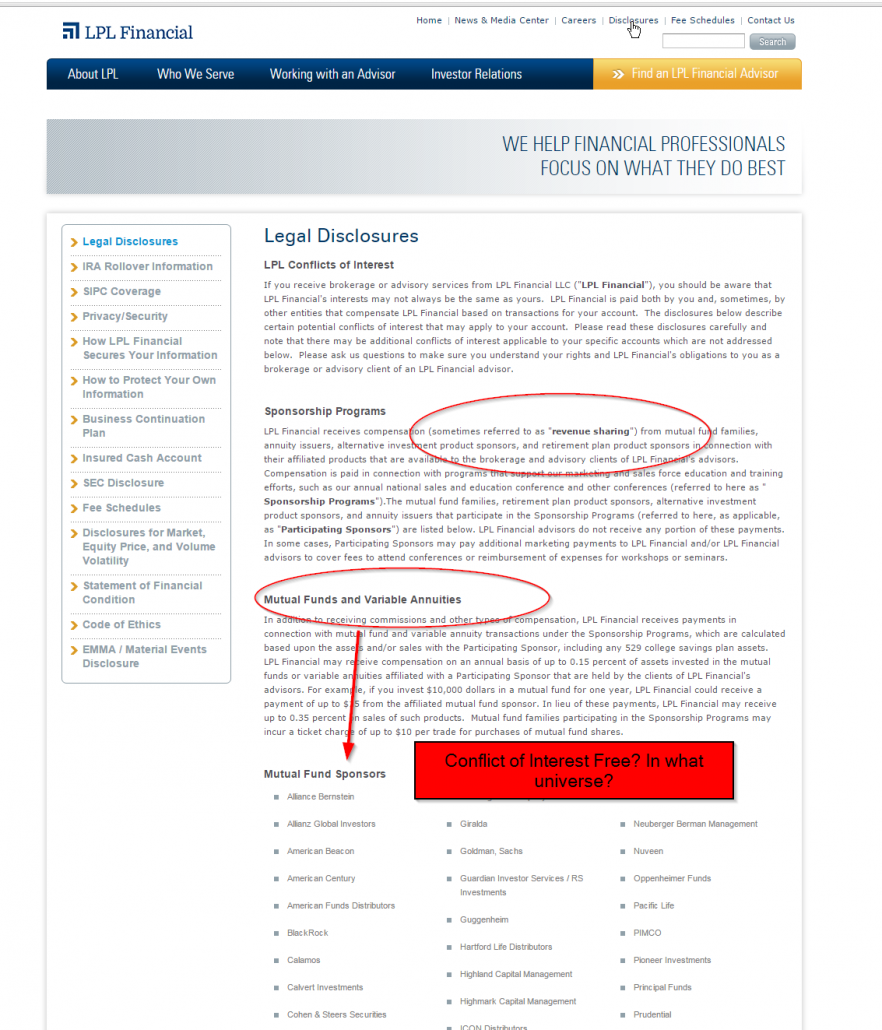

Or note how on the page below how they use the word “objective.” Does this imply they are looking out for our best interests? Not necessarily, if they are acting in a broker capacity.

It kind of sounds like an “independent advisor,” but let’s read the disclosure…

All this is not meant to pick on the firms identified above — these firms are merely examples of a common theme. Firms who muddy the waters, play semantic games, and occasionally semi-masquerade as “advisors.” Here are some links to common “advisor” shops that are also affiliated with brokerage firms with revenue sharing disclosure agreements with limited obligations to put a client’s interest above their own.

- Edward Jones

- Morgan Stanley

- Deutsche Bank

- Wells Fargo

- Pershing

- Goldman Sachs

- JP Morgan

- LPL Financial

The list goes on and on and on…FieldPoint Private has a nice summary of the conflict here.

So how can an investor on the market for financial services investigate these issues on their own?

- Ask the “advisor” salesmen about their legal status in connection with their interaction with you. Heck, they may not even know, but you should at least ask them. A fiduciary will immediately say, “Yes, I am a fiduciary.”

- Google “XXX revenue share disclosure” where XXX = the big brand pitching you the product. You’ll probably find something. Some firms are better at hiding this information.

- Again, one can read more about any so-called “advisor” on the SEC advisor search website. If the “advisor” also has a license with a “brokerage firm,” you should question their legal obligation to put your interests above their own.

Bottomline?

We can hardly understand what is going on in the financial advice business and we are formally registered as an independent investment advisor. How can a prospective client understand the opaque landscape? The reality is that this isn’t easy. At a minimum a client needs to do some snooping around on the SEC’s website and they need to ask their prospective advisor some basic questions.

Ideally a client finds an advisor that genuinely wants to help them out. Unfortunately, just because someone has a fiduciary obligation to serve a client’s interests above their own, that does not prevent stupidity, ignorance, and other conflicts of interests. Similarly, just because someone works for a broker-dealer, with more obvious conflicts of interests, doesn’t mean these people are “evil.” There can be good reasons to work with a broker. No person or firm can be perfect and in the end firms have to make money to maintain viability (save Vanguard, but they got their own issues with that business model).

In the end, a firm — regardless of the legal mumbo jumbo — either has a culture with long-term orientation, integrity at all costs, and a focus on doing the right thing for a client, or a culture focused on maximizing short-term profits and figuring out how to “monetize” clients. One can be a broker-affiliated firm and build a great client-friendly business or one can be a 100% independent fiduciary-focused firm and build a terrible non-client-friendly business. But the key first step to ascertaining the appropriate costs and benefits associated with the purchase of financial advice requires an informed consumer. Hopefully this post is a step in the right direction.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.