I still have a Ken Griffey Jr. Rookie Card. To be honest, I don’t even know where the thing is, but I hope it is it worth a ton of money at this point (although I doubt it). So disclaimer up front: I dabbled in baseball card trading back in the day. And for all of you out there who used to trade baseball cards, you’ll enjoy this recent research paper from Joey Engelberg, Linh Le, and Jared Williams. h.t. Quantpedia

Stock Market Anomalies and Baseball Cards

We show that the market for baseball cards exhibits anomalies that are analogous to those that have been documented in financial markets, namely, momentum, price drift in the direction of past fundamental performance, and IPO under performance. Momentum profits are higher among active players than retired players, and among newer sets than older sets. Regarding IPO under performance, we find that newly issued rookie cards under perform newly issued cards of veteran players, and that newly issued sets under perform older sets. Our evidence is consistent with the predictions of Hong and Stein (1999) and Miller (1977).

Here are some key charts:

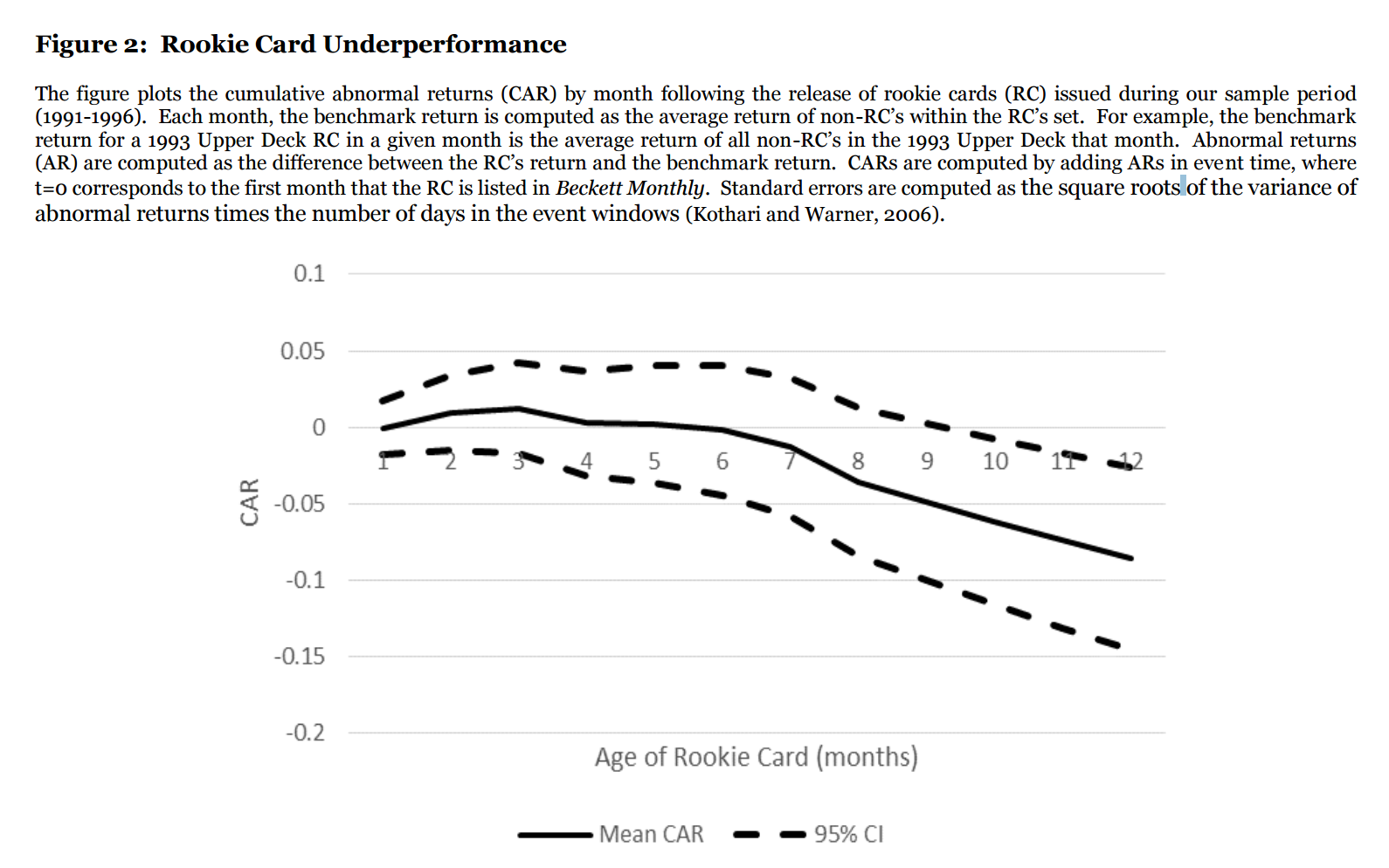

First, Rookie cards are like IPOs–start out great…and eventual fizzle out. (see Jay Ritter paper for background on IPO underperformance)

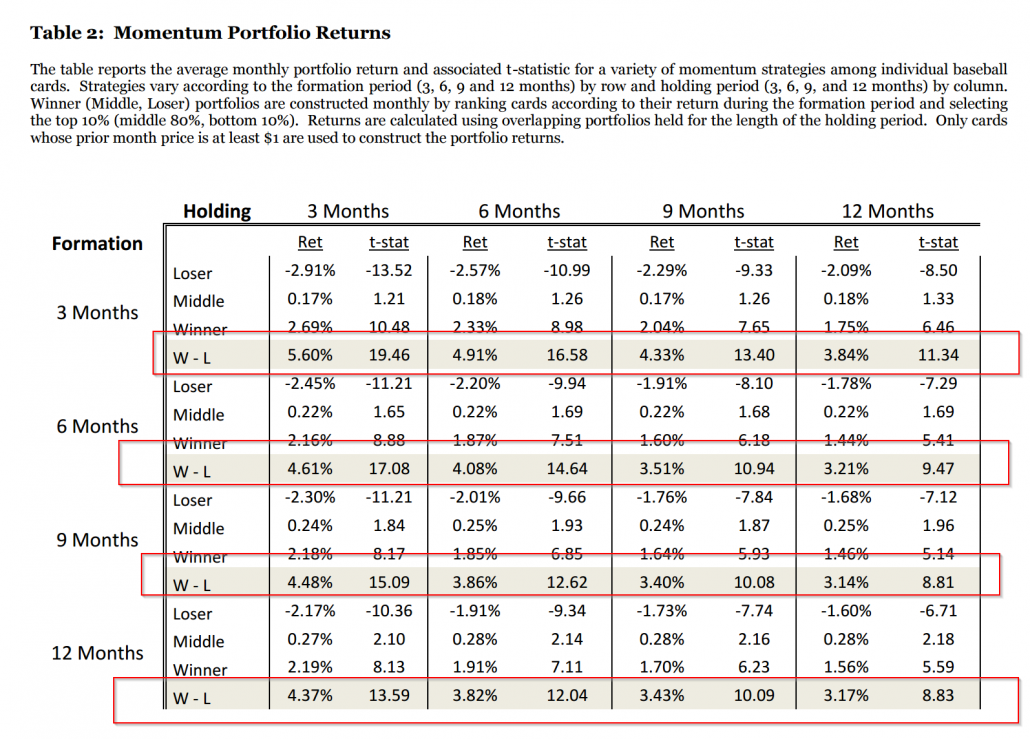

Second, momentum portfolios trading in baseball cards act a lot like momentum portfolios trading in stocks — but the momentum effect is way stronger!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.