We all hear about the massive move away from active to passive in the US market. We also hear arguments that passive may eat the world and that active management is a zero sum game (seems like a reasonable hypothesis, but I’m not so sure).

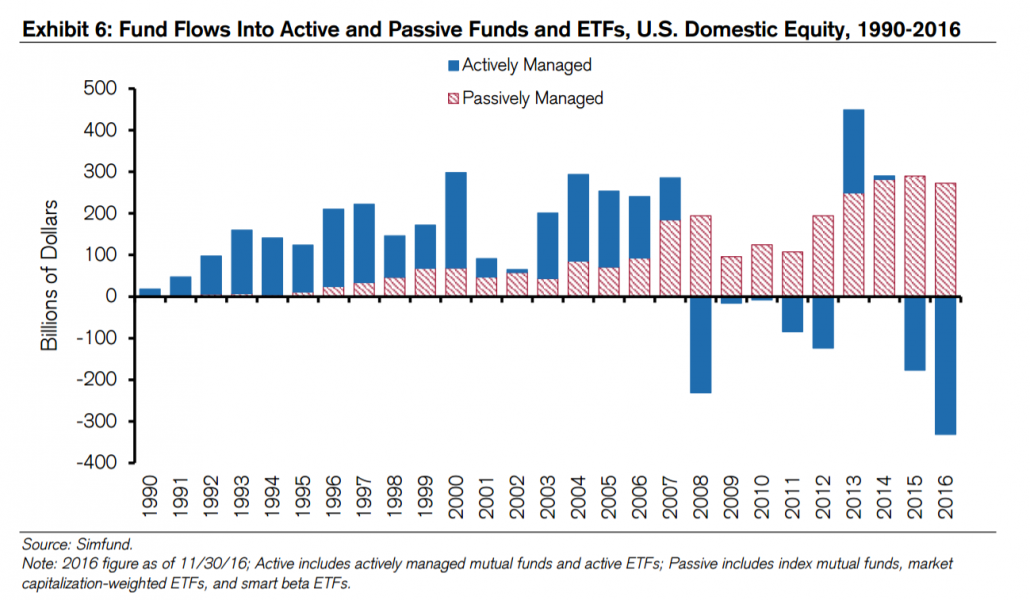

Here is a figure from a recent CS report that highlights the US activity and the clear move away from active and into passive:

All of this chatter seems viable from a US-based perspective.

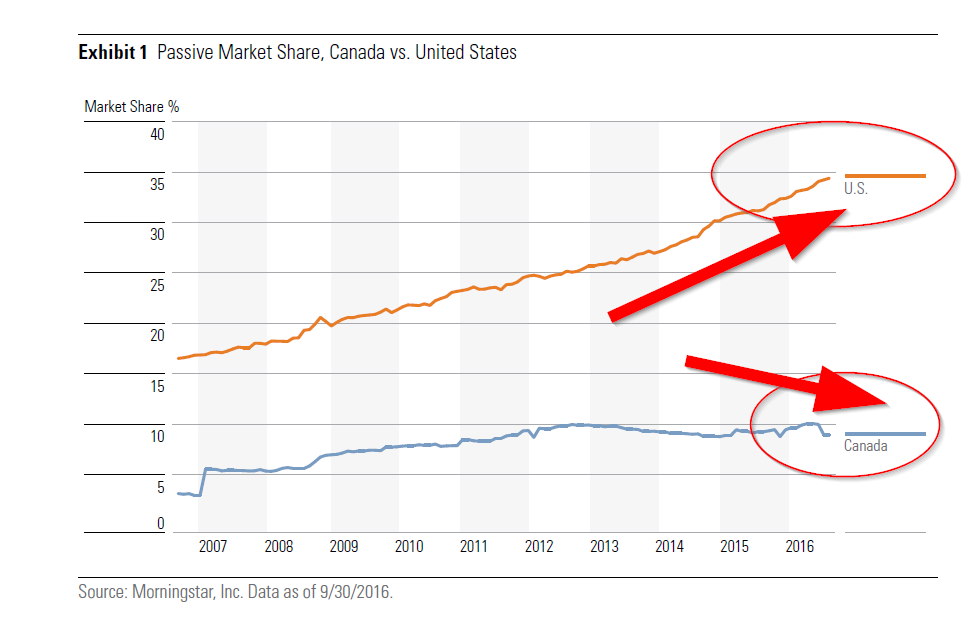

Interestingly enough, you don’t have to look that far to see a completely different narrative playing out. When we look North to Canada and we see an entirely different game playing out:

Source: Morningstar. Thanks to Ben Johnson for highlighting this research report and thanks to Art Johnson for bringing this to our attention!

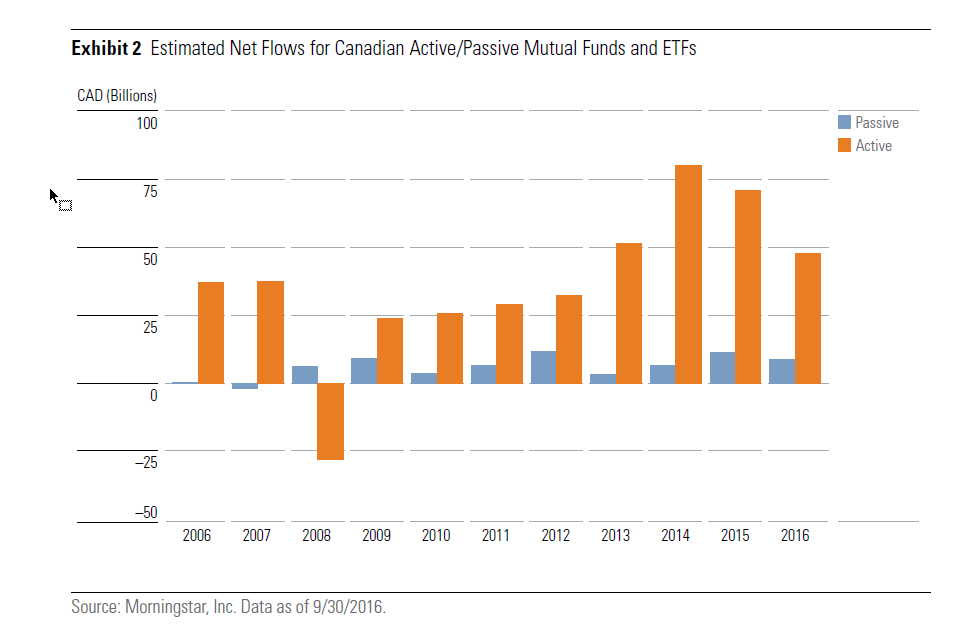

The Canadian market highlights a completely different story — a move towards more active and a move away from the tiny amount of passive already in place.

Wild!

Here is a comparison chart of the move to passive between the US and Canadian markets:

What is going on?

The real answer is “who knows,” but the Morningstar Canadian crew has an answer:

Big banks, incentives, and backward self-regulation are to blame.

Incentives certainly play a role. Perhaps recent past performance also plays role? Maybe even culture?

My takeaway is that the narrative claiming that passive is going to destroy and/or eat the financial world is too simplistic. There are a lot of mechanisms at work in the financial marketplace and their interaction effects are extremely hard to predict. I don’t have the answers and I can’t predict the future, but it will sure be fun to see how it all plays out!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.