As my co-author Andrew Berkin, the director of research for Bridgeway Capital Management, and I explain in our new book, “Your Complete Guide to Factor-Based Investing,” there is considerable evidence of cross-sectional return predictability. Citing more than 100 academic papers, we present the evidence of predictability for both equity and bond factors. And since the research is well known, one would think that sophisticated professional investors would be betting on the factors that show predictability, while the less-informed retail money would be on the other side of the trade.

But is that the case?

Joseph Engelberg, R. David McLean and Jeffrey Pontiff contribute to the literature on investor behavior with their March 2017 paper, “Analysts and Anomalies.” They began by calculating each stock’s net exposure (Net) to 96 stock return anomaly variables (from accounting, economics and finance journals over the past 40 years) as the number of long-anomaly portfolio memberships minus the number of short-anomaly portfolio memberships.

They also created four anomaly-group variables:

- Event anomalies are based on events within the firm, external events that affect the firm, and changes in firm performance. Examples of event anomalies include share issues, earnings surprises and unexpected increases in R&D spending.

- Market anomalies are anomalies that can be constructed using only financial data, such as volume, prices, returns and shares outstanding. Momentum, long-term reversal and market value of equity are included in the sample of market anomalies.

- Valuation anomalies are ratios in which one number reflects a market value and the other reflects fundamentals. Examples of valuation anomalies include sales-to-price and market-to-book.

- Fundamental anomalies are constructed with financial statement data and nothing else. Leverage, taxes and accruals are fundamental anomalies.

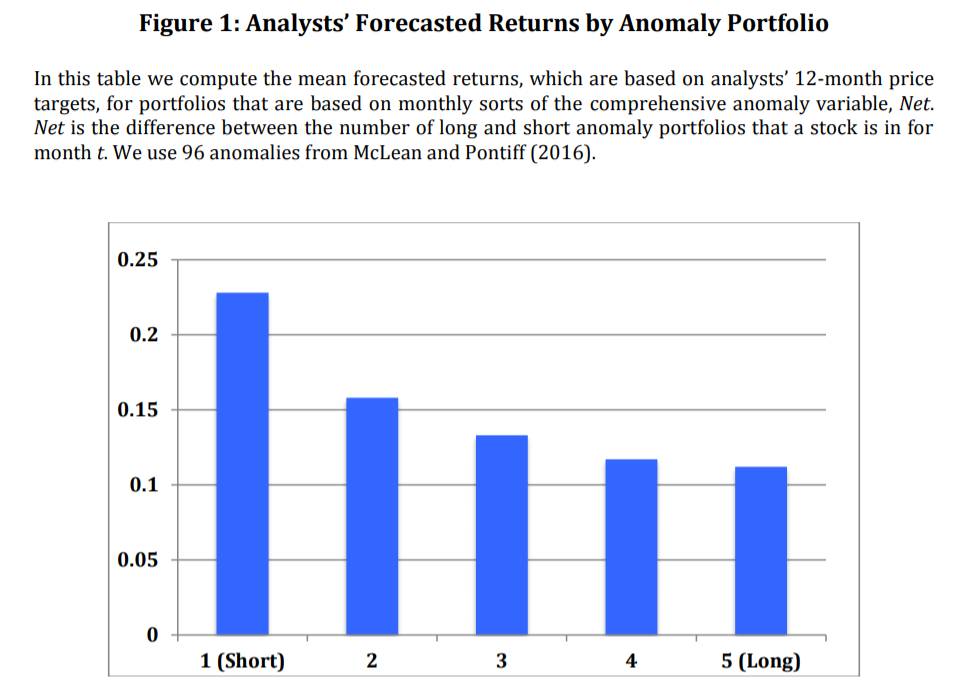

Engelberg, McLean and Pontiff’s sample period was from 1994 through 2014. They then used the one-year median price target to estimate a one-year analyst-forecasted stock return. The chart below looks at analysts’ forecasted returns and how they stack up against the anomaly factors (96 are used in this case). The “long” portfolio represents those stocks expected to the best based on factors, and the “short” portfolio reflects those stocks expected to do the worst based on the factors. Analysts’ predictions go in the opposite direction of the academic evidence!

The following is a summary of the authors’ overall findings:

- Anomaly-longs (stocks with high Net values) have lower recommendations than anomaly-shorts (stocks with low Net values) — analyst recommendations conflict with anomaly variables. The results were statistically significant.

- Sorting stocks into quintiles based on Net, there is a negative, monotonic relationship between Net and forecasted returns.

- Stocks in the bottom quintile of Net (anomaly-sells) have a mean forecasted one-year return of 24 percent, while stocks in the top quintile of Net (anomaly-buys) have a mean forecasted one-year return of 14 percent.

- Buy recommendations do not predict returns, while sell recommendations predict lower returns.

They also found that Net forecasts changes in analysts’ price targets. “Stocks for which Net forecasts higher returns subsequently have increases in price targets. We find this effect for lags of up to 18 months, i.e., Net today can predict increases in price targets over the next month and continuing on for the next 18 months. This suggests that the ‘mistakes’ analysts make today by being at odds with anomaly variables are eventually and predictably corrected over the following year and a half.” However, this finding was not statistically significant.

The exception to the authors’ findings was among the group of “market” anomalies (e.g., momentum and idiosyncratic risk), which are based only on stock return, price and volume data. Among these, they found that “analysts produce more favorable recommendations and forecast higher returns among the stocks that are stronger buys according to market anomalies. This is perhaps surprising, as analysts are supposed to be experts in firms’ fundamentals, yet they perform best with anomalies that are not based on accounting data.”

The bottom line is that, in general, analysts offer price targets and recommendations in the opposite direction as anomalies. Engelberg, McLean and Pontiff note: “Analysts forecast higher (lower) stock returns and offer more (less) favorable recommendations to stocks that anomaly variables suggest should be sold (bought).” The results showed strong statistically significance. Their evidence suggests that predictability stemming from these 96 predictors is, at least partially, the result of mispricing and that investors who invest in accordance with analysts’ suggestions contribute to this mispricing.

There was some good news. Engelberg, McLean and Pontiff found that over time, as anomaly variables have become widely known, analysts have incorporated more of this information into their recommendations and price targets — the negative correlation between Net and analysts’ views weakened over their sample period. However, even during the later years of their sample there was still a negative or, at best, neutral relationship. In addition, with market and fundamental anomalies, the results show the opposite — analysts have gotten worse with respect to market anomalies over time. They concluded: “Analysts today are still overlooking a good deal of valuable, anomaly-related information.” They also added this interesting observation: “Stocks with low expected returns based on the Valuation anomaly variable are also the stocks that are likely to provide the most investment banking business” — mostly likely to raise new capital. In other words, there was a conflict of interest.

Summary

Given that security analysts are supposed to be sophisticated investors, and all the anomalies analyzed were in the publicly available literature, it is surprising to find that while analysts’ return forecasts predict stock returns, they do so in the wrong direction. It’s particularly puzzling given the finding from prior research that short sellers (typically thought of as sophisticated institutional investors, such as hedge funds) tend to target stocks in anomaly-short portfolios, and that this effect increases after a paper has been published. It’s also puzzling in light of the fact that Paul Calluzzo, Fabio Moneta and Selim Topaloglu, authors of the 2015 study “Institutional Trading and Anomalies,” found that institutions do follow anomaly strategies, although only after the anomaly is highlighted in an academic publication. .

Other papers, such as “Smart Money, Dumb Money, and Capital Market Anomalies” by Akbas, Armstrong, Sorescu and Subrahmanyam (covered here by Alpha Architect), show that mutual funds exacerbate pricing, but hedge funds decrease mispricing, which raises a natural hypothesis based on this paper’s findings: Are mutual funds relying on sell-side analyst information, while hedge funds do their own work?

The bottom line is that investors who follow target forecasted returns exacerbate mispricing and pay the price in terms of lower returns. This also helps to explain the persistence of anomalies. Keep these findings in mind the next time you’re tempted to act on some analyst’s recommendation (and beware of that deadly condition known as confirmation bias).

Analysts and Anomalies

- Joey Engelberg, David McLean, and Jeff Pontiff

- Copy available here

Analysts’ price targets and recommendations contradict stock return anomaly variables. Forecasted returns based on price targets are higher (lower) among stocks that anomaly variables suggest will have lower (higher) returns. Analysts’ one-year forecasted returns are 14% for anomaly-longs and 24% for anomaly-shorts. Similarly, analysts issue more favorable recommendations for anomaly-shorts than anomaly-longs. Analysts’ ex-post mistakes, which we calculate as the forecasted return less the realized return, can be predicted with anomaly variables. Our findings show that investors who follow analysts may contribute to mispricing.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.