- Title: MONONATIONALS: THE DIVERSIFICATION BENEFITS OF INVESTING IN COMPANIES WITH NO FOREIGN SALES

- Authors: CORMAC MULLEN AND JENNY BERRILL

- Publication: FINANCIAL ANALYST JOURNAL, II Q 2017 (version here)

What are the research questions?

Market globalization is said to be the culprit of decreased benefits of international diversification. In 1995, a US investor investing in Vodafone had exposure to 99% of UK based sales. The same investor in 2012 is exposed to UK sales only for 8% while at the same time he is exposed to 30% of US sales, his home country. Vodafone is an example of a multinational corporation (MNCs).

- What are the diversification benefits of domestic and multinational corporations with varying degrees of internationalization, including foreign companies with sales only in their domestic market, companies with sales concentrated in their home region, companies with sales concentrated in other regions and global companies?

What are the Academic Insights?

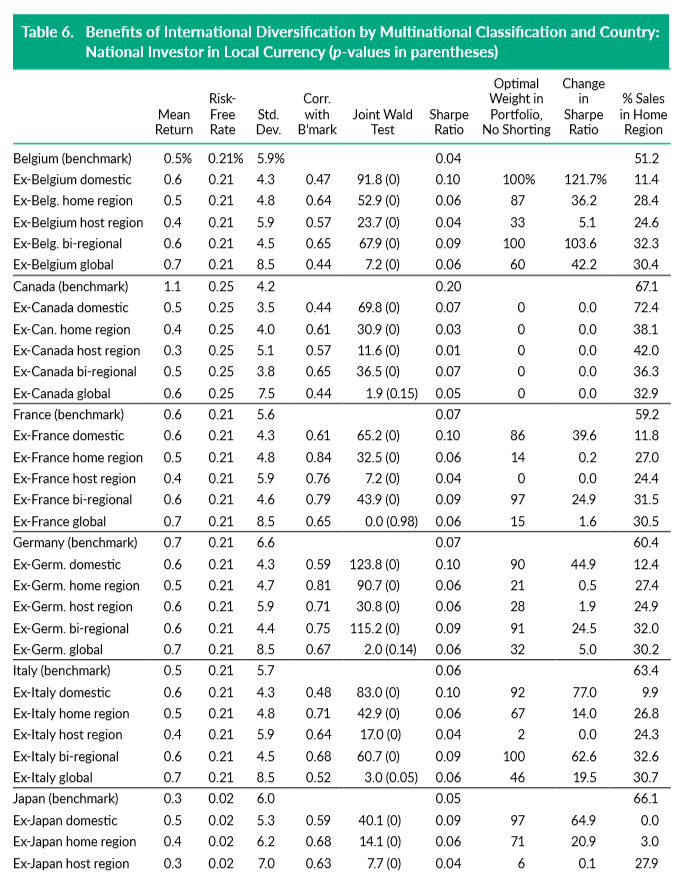

By using a modified version of Bragman and Brain’s (2003) multinational classification system to categorize 1,276 stocks from 10 countries (domestic, home region, host region, bi-region and global), they find that:

- Adding international stocks to a local portfolio offers statistically significant diversification benefits to investors in Canada, Europe and Japan, but not the US or the UK.

- When looking at varying degrees of internationalization, global stocks offer diversification benefits only to Belgian investors. Differently, for the remaining eurozone countries, Canada and Japan all but global stocks classification add diversification benefits. Finally, for the UK and the US only foreign domestic stocks offer statistically significant diversification.

- Generally, the greatest improvement in Sharpe ratios comes from adding foreign domestic stocks.

Why does it matter?

International diversification is not dead yet! It is a matter of finding the right stocks. The suggestion for both investors and fund managers is to perform an “end-market” sales analysis to increase the potential diversification benefits of an international stock portfolio.

The Most Important Chart from the Paper:

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.