Like many advisors, I often find myself reviewing accounts and historical performance for clients and prospects with investments at other firms. Of course I see all the usual suspects like annuities, mutual funds with loads, 12B-1 fees, etc. Financial professionals who work on a commission basis regularly tuck these products into their clients’ portfolios – whether or not they are the best option (they just have to be suitable). These issues are nothing new and there are already many efforts devoted to educating clients around these potential conflicts of interest (e.g., FINRA).

This note focuses on a different issue I regularly come across that gets under my skin. In particular, many financial professionals build portfolios with various mutual funds, ETFs, and third-party managers.

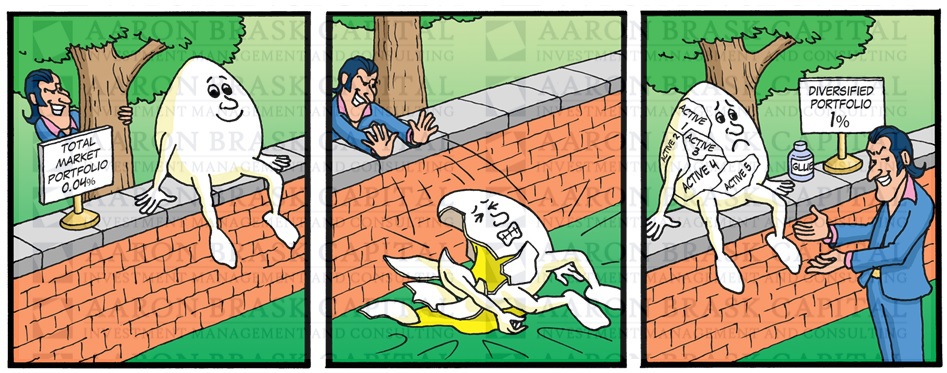

However, these portfolios, in aggregate, often strongly resemble the total market portfolio.

For example, many of the large wire houses use a variety of different active managers and funds. While each may employ a different strategy, their strategies often diversify themselves away. One manager over-weights what another under-weights and so forth. This observation is really just a statistical version of William Sharpe’s mathematical argument regarding active management in aggregate (a notion Jack Bogle has often repeated in marketing Vanguard’s index products).

The end result can be a portfolio that is very similar to the total market. Unfortunately, all of the expertise and effort to build this portfolio wind up costing significantly more than just purchasing a total market index fund. Indeed, both the advisor who constructed the portfolio and the funds themselves typically levy fees that can add up to as much as 1-2% per year.

Source: Aaron Brask

This begs the question of why bother?

I can think of at least two reasons. The first is that advisors want to have the appearance of adding value. When a client looks at their statement and sees all of the different holdings, they likely assume they were strategically chosen based on the extensive experience of the advisor and/or advisor’s firm. The second reason is that many of the larger firms operate pay-to-play schemes whereby they also get fees from the fund companies. In my view, this is really just a lesser known version of the 12B-1 fee.

Active funds and managers are not the only way to play this game. Indeed, I have seen independent firms play the same game with index funds while touting their ultra-low fees (I difficult pitch to resist for many investors). I cannot count the number of times I have seen portfolios diversified between growth and value, large and small, etc. In my mind, this is not much different than charging a fee to break the market into smaller pieces and glue them back together.

I acknowledge some advisors may argue the granularity provides them with the opportunity for strategic rebalancing. In my experience, however, this is often not the case. The portfolios are built for the appearance of diversification but end up paying unnecessary fees.

About the Author: Aaron Brask

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.